Earnings Not Telling The Story For Impro Precision Industries Limited (HKG:1286) After Shares Rise 27%

Despite an already strong run, Impro Precision Industries Limited (HKG:1286) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

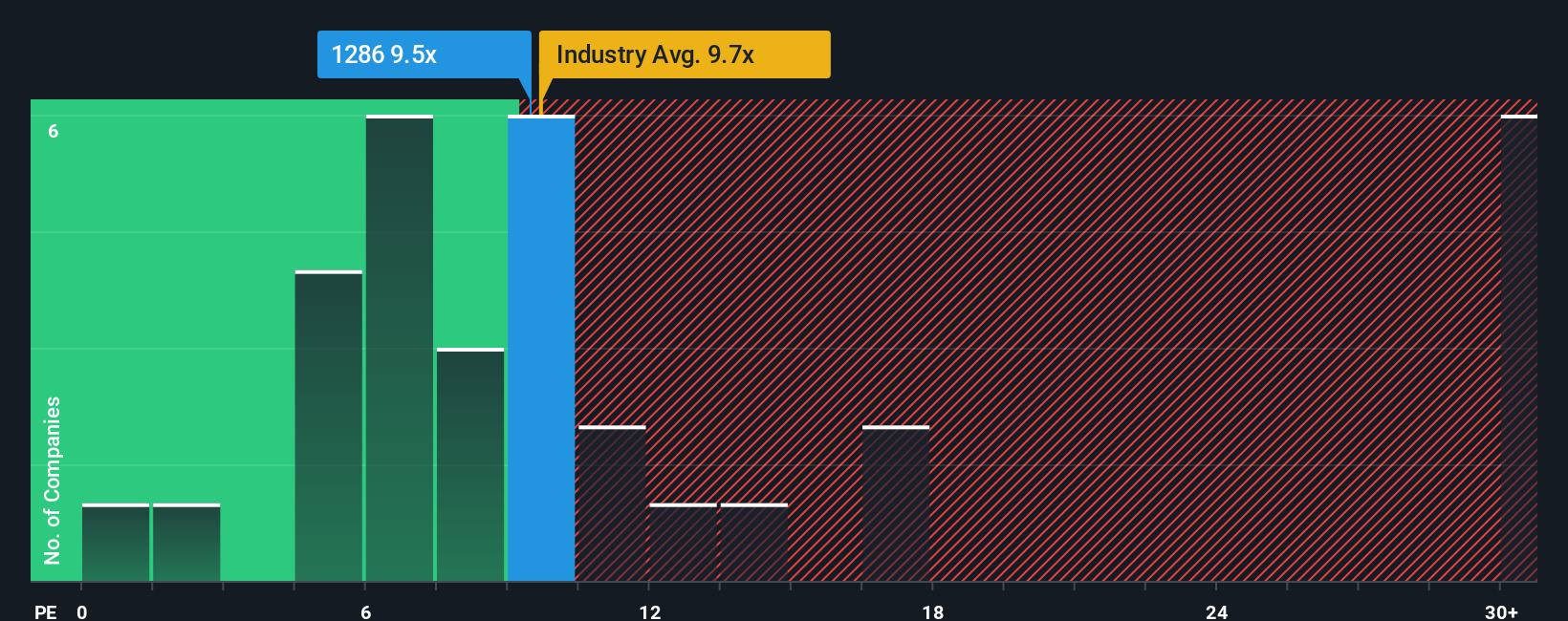

Even after such a large jump in price, it's still not a stretch to say that Impro Precision Industries' price-to-earnings (or "P/E") ratio of 9.5x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Impro Precision Industries certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Impro Precision Industries

Is There Some Growth For Impro Precision Industries?

There's an inherent assumption that a company should be matching the market for P/E ratios like Impro Precision Industries' to be considered reasonable.

Retrospectively, the last year delivered a decent 10% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 68% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 11% over the next year. Meanwhile, the rest of the market is forecast to expand by 19%, which is noticeably more attractive.

In light of this, it's curious that Impro Precision Industries' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Impro Precision Industries appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Impro Precision Industries currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Impro Precision Industries.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1286

Impro Precision Industries

Provides casting products and precision machining parts in the Americas, Europe, and Asia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives