Intervacc Leads The Pack With These 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets react to the latest political developments and economic indicators, investors are navigating a landscape marked by volatility and sector-specific movements. Amidst these shifts, penny stocks continue to capture attention as potential opportunities for those seeking value in smaller or emerging companies. Despite being an older term, penny stocks remain relevant for investors who focus on firms with robust financials and clear growth trajectories. This article explores three such promising penny stocks that stand out due to their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.775 | MYR134.24M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.97 | THB1.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

Click here to see the full list of 5,818 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Intervacc (OM:IVACC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Intervacc AB (publ) focuses on developing novel veterinary vaccines for animals in Sweden and has a market cap of SEK196.91 million.

Operations: Intervacc AB (publ) does not report specific revenue segments.

Market Cap: SEK196.91M

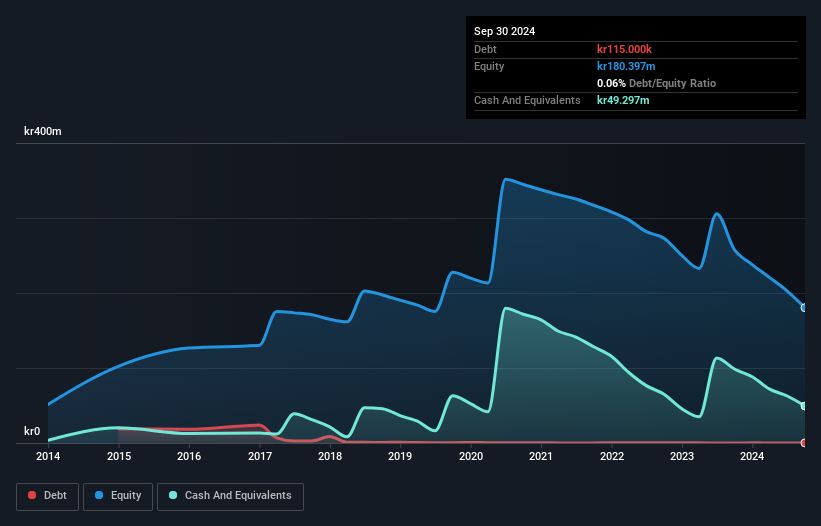

Intervacc AB (publ) is a pre-revenue company with a market cap of SEK196.91 million, focusing on veterinary vaccines. Despite its unprofitability and high share price volatility, the company has managed to reduce its debt-to-equity ratio over five years and maintains more cash than total debt. Recent earnings show modest revenue growth but continued net losses, though losses have decreased from previous periods. The management team is experienced with an average tenure of 4.6 years, yet the board lacks similar experience. Intervacc faces potential short-term stock shortages for its Strangvac vaccine due to manufacturing process updates awaiting regulatory approval.

- Click here to discover the nuances of Intervacc with our detailed analytical financial health report.

- Gain insights into Intervacc's future direction by reviewing our growth report.

Victorias Milling Company (PSE:VMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Victorias Milling Company, Inc. is an integrated sugar company operating in the Philippines and internationally, with a market cap of ₱11.13 billion.

Operations: The company's revenue is primarily derived from Sugar Milling at ₱7.76 billion and Distillery Operations at ₱2.81 billion, with additional income from Power Generation amounting to ₱5.82 million.

Market Cap: ₱11.13B

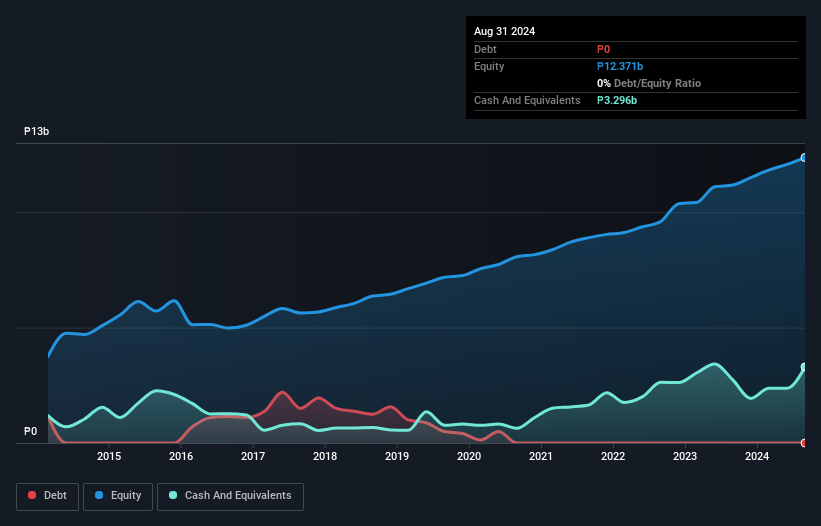

Victorias Milling Company, with a market cap of ₱11.13 billion, derives significant revenue from sugar milling and distillery operations. The company is debt-free, marking an improvement from a 12.6% debt-to-equity ratio five years ago, and its short-term assets comfortably cover both short- and long-term liabilities. Despite these strengths, the company faced negative earnings growth over the past year (-42.8%) compared to industry averages and has experienced high share price volatility recently. Additionally, its dividend yield of 2.96% is not well covered by free cash flows, though shareholders have not faced dilution in the past year.

- Dive into the specifics of Victorias Milling Company here with our thorough balance sheet health report.

- Assess Victorias Milling Company's previous results with our detailed historical performance reports.

Newton Resources (SEHK:1231)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Newton Resources Ltd is an investment holding company involved in the sourcing and supply of iron ores and other commodities both in Mainland China and internationally, with a market cap of HK$1.36 billion.

Operations: The company's revenue segment is primarily from its Resources Business, generating $485.41 million.

Market Cap: HK$1.36B

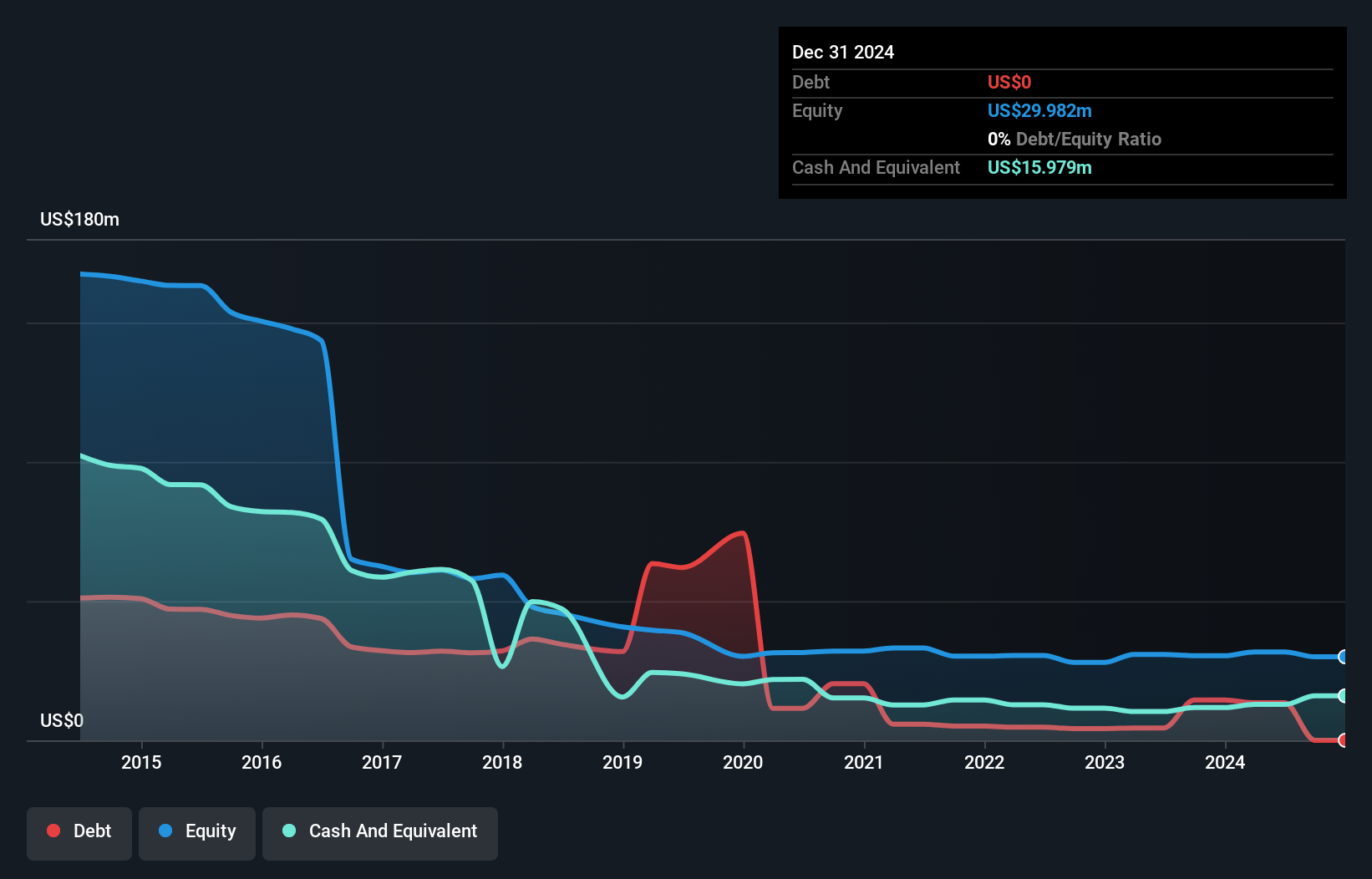

Newton Resources Ltd, with a market cap of HK$1.36 billion, has shown mixed financial performance recently. The company reported half-year sales of US$174.76 million, down from the previous year, yet it achieved a net income of US$1.42 million. Despite low return on equity at 2.9%, earnings have grown significantly by 103% over the past year compared to its five-year average decline, outperforming industry growth rates. The company's debt management is satisfactory with a reduced debt-to-equity ratio and strong interest coverage at 6.9 times EBIT; however, negative operating cash flow remains a concern for covering debts effectively.

- Get an in-depth perspective on Newton Resources' performance by reading our balance sheet health report here.

- Evaluate Newton Resources' historical performance by accessing our past performance report.

Where To Now?

- Gain an insight into the universe of 5,818 Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Intervacc, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IVACC

Flawless balance sheet slight.

Market Insights

Community Narratives