- Hong Kong

- /

- Electrical

- /

- SEHK:1072

Investors Still Aren't Entirely Convinced By Dongfang Electric Corporation Limited's (HKG:1072) Earnings Despite 27% Price Jump

Dongfang Electric Corporation Limited (HKG:1072) shares have continued their recent momentum with a 27% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.4% in the last twelve months.

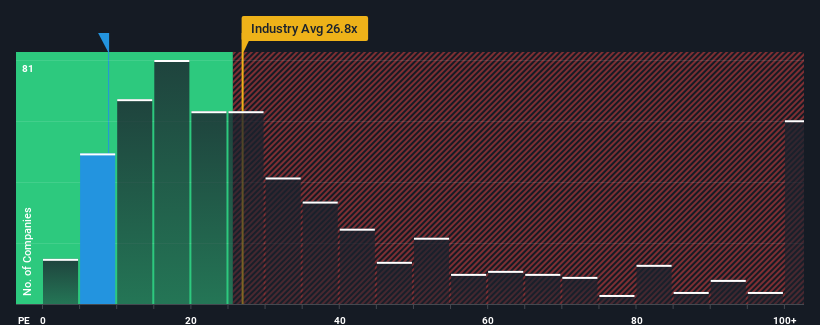

Although its price has surged higher, you could still be forgiven for feeling indifferent about Dongfang Electric's P/E ratio of 8.8x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Dongfang Electric as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Dongfang Electric

How Is Dongfang Electric's Growth Trending?

In order to justify its P/E ratio, Dongfang Electric would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. The latest three year period has also seen an excellent 91% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 30% over the next year. That's shaping up to be materially higher than the 20% growth forecast for the broader market.

In light of this, it's curious that Dongfang Electric's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Dongfang Electric's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Dongfang Electric currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Dongfang Electric (1 makes us a bit uncomfortable!) that you need to be mindful of.

You might be able to find a better investment than Dongfang Electric. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1072

Dongfang Electric

Engages in the design, develop, manufacture, and sale of power generation equipment in China and internationally.

Undervalued with adequate balance sheet and pays a dividend.