Does CITIC Bank’s Strong 2025 Rally Signal More Room for Growth?

Reviewed by Bailey Pemberton

If you're eyeing China CITIC Bank's stock and wondering if now is the right time to make a move, you're not alone. Many investors are trying to size up what’s driving this bank’s surprising momentum, especially in the midst of shifting market sentiment. Despite some recent softness, with a drop of 1.8% over the past week and a 5.7% slip over the last month, the longer-term numbers tell a different story. Year to date, China CITIC Bank’s stock is up a strong 26.5%, and if you zoom out further, the picture looks even brighter. Over the past three and five years, the returns are a remarkable 165.8% and 220.5% respectively.

This pattern of performance suggests more than just short-term swings. For many, these numbers signal growing confidence in China CITIC Bank's ability to adapt and succeed in a complex economic landscape. Recent market developments, such as the gradual loosening of financial regulations and ongoing support for key Chinese banks, have played a role in reshaping investor perception. The shifts seem to hint at both renewed growth potential and a recalibration of risk, fueling optimism for future results.

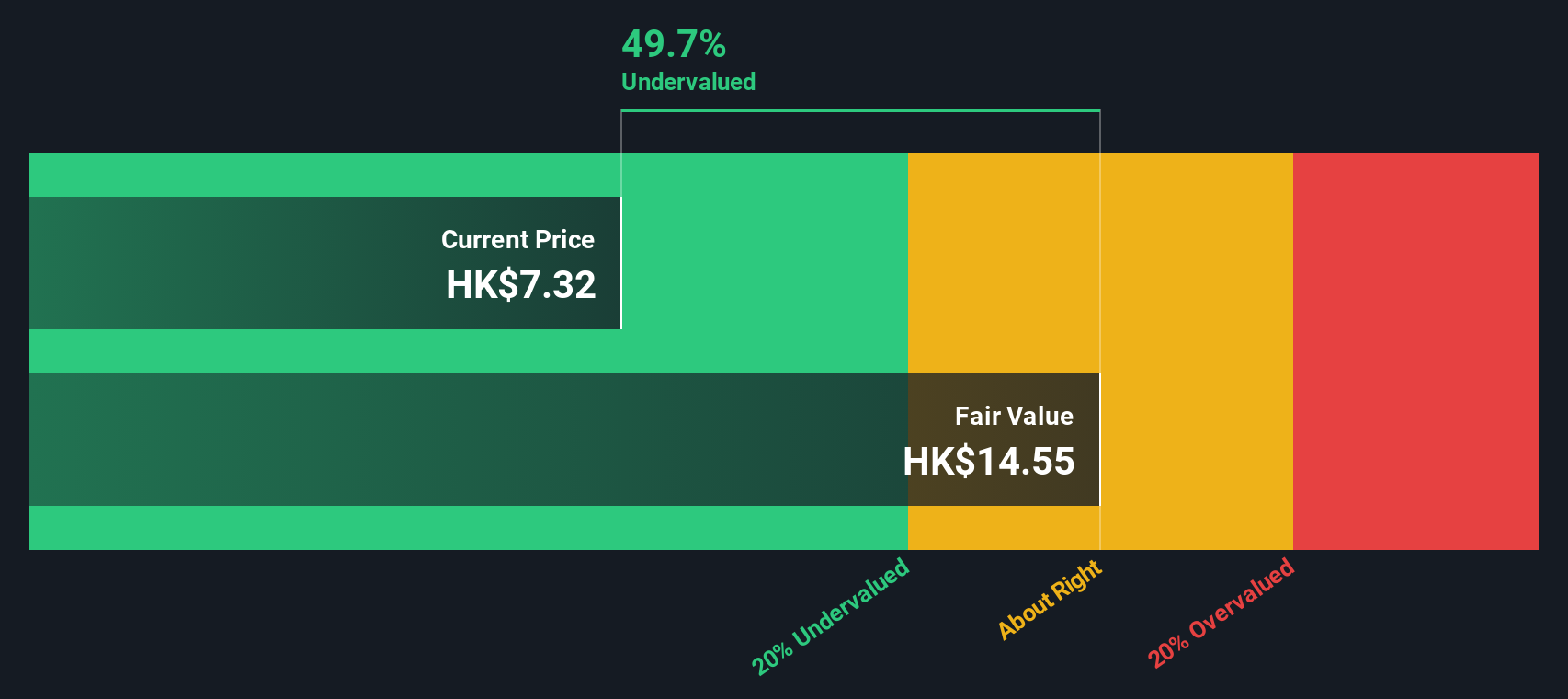

So, is China CITIC Bank still undervalued after such impressive gains? According to our multi-check valuation score, the company passes five out of six criteria, landing a valuation score of 5. That is an encouraging sign, but knowing whether a stock truly offers great value requires a closer look at the methods behind those numbers. Next, let's break down the key approaches for assessing valuation, and stay tuned for an even smarter perspective at the end of our analysis.

Approach 1: China CITIC Bank Excess Returns Analysis

The Excess Returns model measures how effectively a company generates profits on its equity above the required cost of capital. This approach focuses on the difference between the return generated for shareholders and the cost of that equity, providing a straightforward estimate of value driven by profitability and growth in book value.

For China CITIC Bank, the numbers tell a compelling story. The current Book Value is HK$12.75 per share, with a Stable EPS of HK$1.28 per share. These forecasts are underpinned by weighted future Return on Equity estimates from 10 analysts. The bank's Cost of Equity is HK$1.22 per share, which means the Excess Return stands at HK$0.06 per share. This math translates to an average Return on Equity of 8.93%. Over the longer term, the Stable Book Value is projected to grow to HK$14.37 per share, according to eight analysts.

This model produces an intrinsic value that is 60.6% above the current share price, signaling a strong undervaluation. For investors, it suggests that China CITIC Bank is not just profitable, but also delivering attractive returns that surpass its cost of equity. This is seen as a positive sign for value-seekers.

Result: UNDERVALUED

Our Excess Returns analysis suggests China CITIC Bank is undervalued by 60.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: China CITIC Bank Price vs Earnings

For profitable companies like China CITIC Bank, the Price-to-Earnings (PE) ratio is one of the most widely used metrics to evaluate value. The PE ratio quickly tells us how much investors are willing to pay for each unit of current earnings, making it especially relevant for banks and other established businesses with steady profits.

When assessing whether a PE ratio is low, high, or just right, you need to consider more than just the headline number. Growth expectations, business risks, and profit margins all influence what a “fair” PE should be. Faster-growing companies and those with lower perceived risk typically justify higher PE ratios, while slower growers or riskier stocks trade at lower multiples.

China CITIC Bank currently trades at a PE of 5.28x. To put this in context, the average for banks in the industry stands slightly higher at 5.57x, while the peer average sits at 9.64x. These basic comparisons suggest the stock is trading at a modest discount.

However, Simply Wall St's proprietary “Fair Ratio” offers a more personalized benchmark. The Fair Ratio, at 6.34x for China CITIC Bank, reflects critical details like projected earnings growth, risk profile, profitability, industry norms, and even the company’s size. This multi-factor approach provides a more nuanced view than simply matching to peers or broad industry averages.

Stacking it all together, China CITIC Bank’s actual PE (5.28x) remains below its Fair Ratio (6.34x), indicating the stock is still undervalued from this perspective.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your China CITIC Bank Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives let you go beyond numbers by telling the story behind a company, connecting your unique perspective to financial forecasts and fair value estimates. Instead of relying solely on static ratios or broad comparisons, a Narrative brings together your assumptions about China CITIC Bank’s future revenue, earnings, and margins with your view of what the company is really worth.

This dynamic approach is made simple and accessible on Simply Wall St’s platform, where millions of investors share their Narratives on the Community page. These narratives help you make smarter decisions by directly comparing Fair Value—your estimate or the community’s—to the current share price, providing a more personal and timely buy or sell signal. In addition, Narratives are updated automatically as new news, earnings, or data are released, so your story stays relevant.

For example, some investors forecast a higher fair value for China CITIC Bank, expecting rapid growth, while others are more cautious and set lower valuations based on different outlooks. Narratives make it easy to see both sides, empowering you to invest with confidence and insight.

Do you think there's more to the story for China CITIC Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:998

China CITIC Bank

Provides various banking products and services in the People’s Republic of China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives