3 Undiscovered Gems In Hong Kong To Consider For Your Portfolio

Reviewed by Simply Wall St

The Hong Kong market has recently experienced a significant boost, with the Hang Seng Index climbing 13% following China's announcement of robust stimulus measures aimed at revitalizing its economy. This positive momentum presents an opportune moment for investors to explore potential opportunities among lesser-known stocks that may benefit from these economic developments. Identifying good stocks in this environment involves looking for companies that are poised to capitalize on increased demand and market sentiment shifts, making them potential hidden gems in a dynamic marketplace.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Uju Holding | 21.23% | -4.96% | -15.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Poly Property Group (SEHK:119)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Poly Property Group Co., Limited is an investment holding company involved in property investment, development, and management across Hong Kong, the People's Republic of China, and internationally, with a market capitalization of HK$7.60 billion.

Operations: Poly Property Group generates revenue primarily from its property development business, which accounts for CN¥35.59 billion, and its property investment and management segment, contributing CN¥1.87 billion. The company also earns from hotel operations with a revenue of CN¥377.21 million.

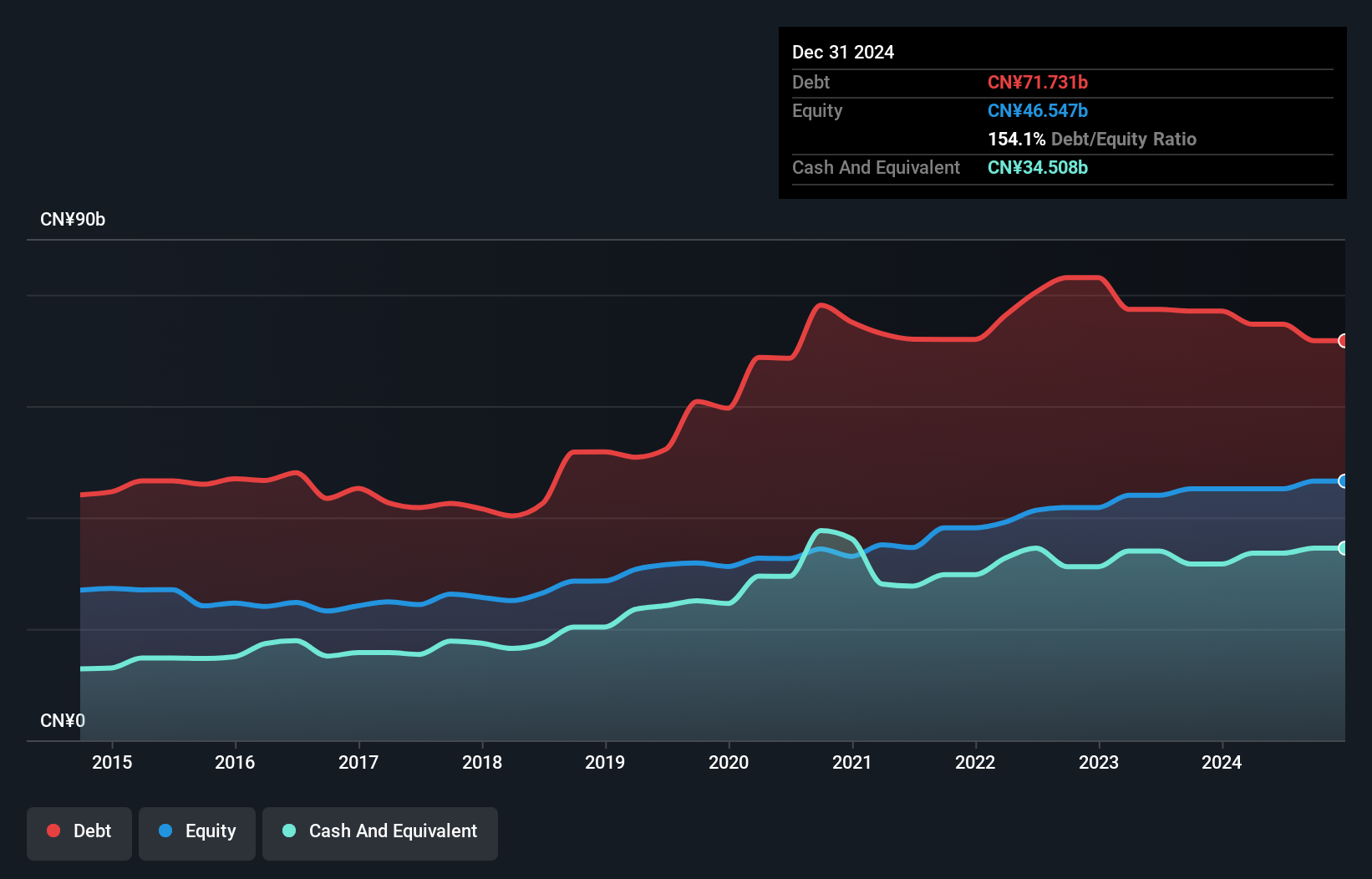

Poly Property Group, a smaller player in the Hong Kong real estate scene, reported a substantial 531% earnings growth over the past year, outpacing the industry's -11.2% performance. Despite this surge, its net debt to equity ratio remains high at 91.1%, indicating financial leverage concerns. The company achieved contracted sales of RMB 36.8 billion by August 2024 with an average selling price of RMB 25,628 per sq.m., suggesting robust market demand despite recent executive changes and profit forecasts indicating future challenges.

- Take a closer look at Poly Property Group's potential here in our health report.

Evaluate Poly Property Group's historical performance by accessing our past performance report.

Carote (SEHK:2549)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carote Ltd is an investment holding company that offers a variety of kitchenware products to brand-owners and retailers under the CAROTE brand, with a market capitalization of HK$4.82 billion.

Operations: Carote Ltd generates revenue primarily from its Branded Business, accounting for CN¥1.58 billion, and a smaller portion from its ODM Business at CN¥210.80 million.

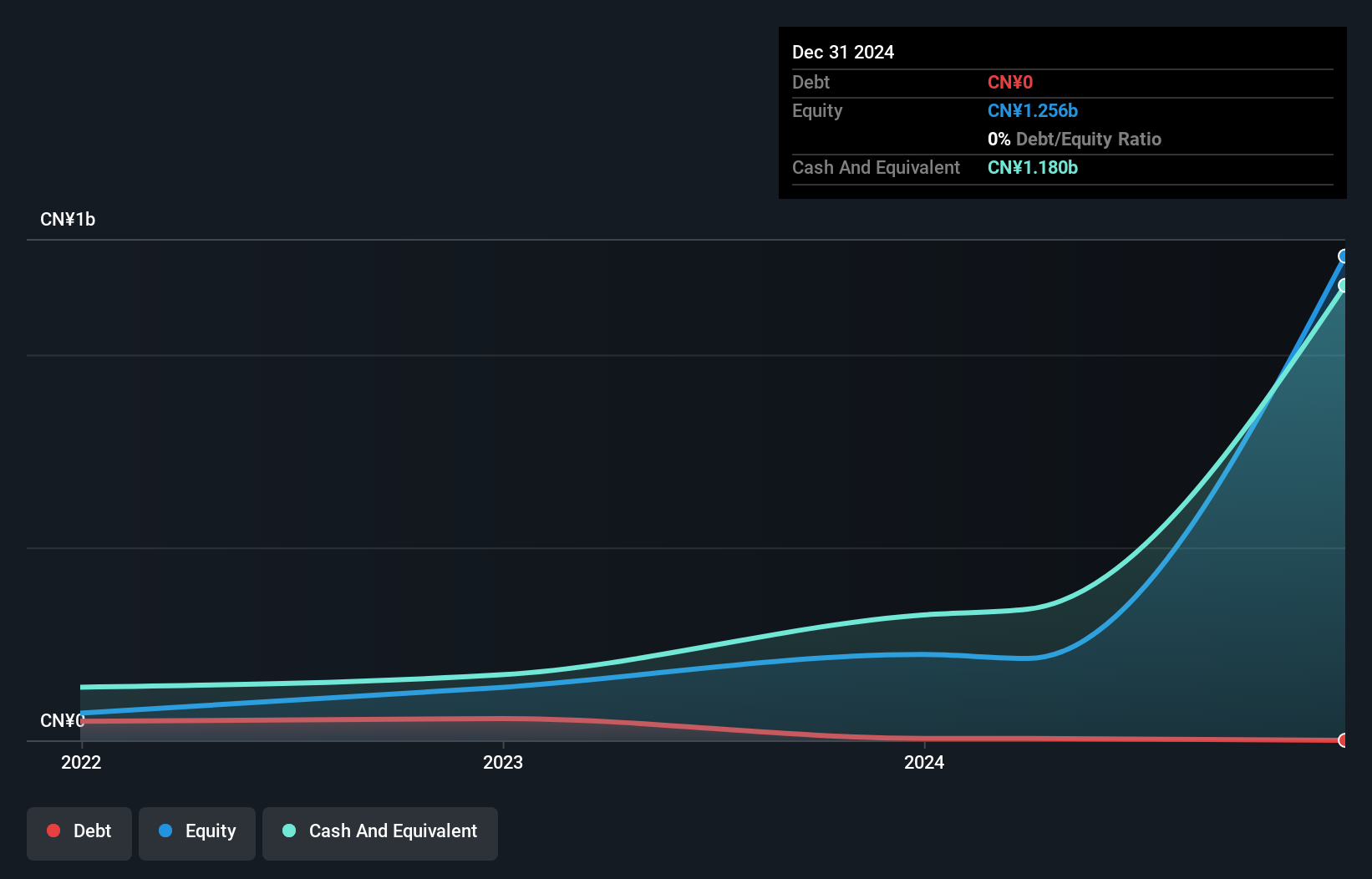

Carote, a relatively small player in the industry, recently completed an IPO raising HKD 750.62 million by offering shares at HKD 5.78 each with a slight discount of HKD 0.14 per share. The company's earnings have surged by 92% over the past year, significantly outpacing the Consumer Durables sector's growth of 20%. Trading at about 73% below its estimated fair value suggests potential undervaluation, while its high-quality earnings further bolster investor confidence.

- Click here and access our complete health analysis report to understand the dynamics of Carote.

Examine Carote's past performance report to understand how it has performed in the past.

Harbin Bank (SEHK:6138)

Simply Wall St Value Rating: ★★★★★☆

Overview: Harbin Bank Co., Ltd. offers a range of banking products and services mainly in China, with a market capitalization of HK$4.73 billion.

Operations: Harbin Bank generates revenue primarily from its Retail Financial Business, contributing CN¥2.99 billion, followed by the Corporate Financial Business and Interbank Financial Business segments.

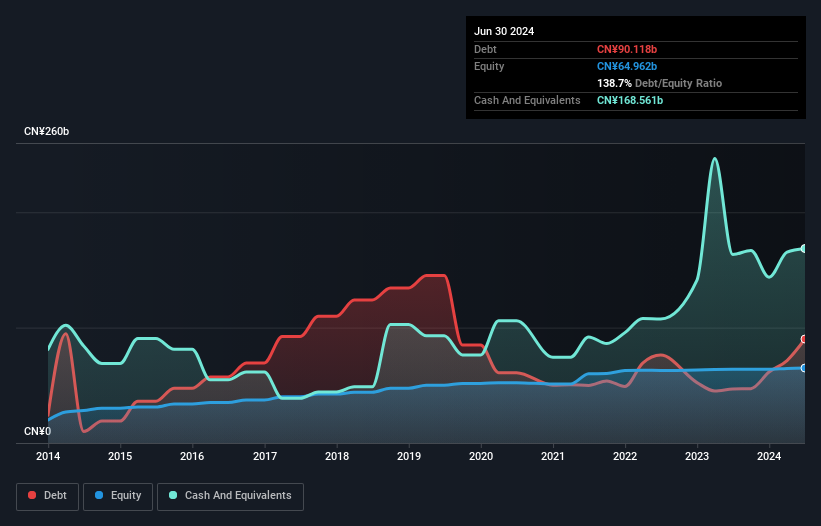

With assets totaling CN¥882.8 billion and equity of CN¥65 billion, Harbin Bank showcases a robust financial structure. Total deposits stand at CN¥704 billion, while total loans amount to CN¥358.1 billion. The bank has a sufficient allowance for bad loans at 2.7% of total loans, reflecting prudent risk management practices. Despite earnings declining by 69.5% annually over the past five years, recent growth in earnings by 202% suggests potential recovery momentum within the industry context.

Summing It All Up

- Unlock more gems! Our SEHK Undiscovered Gems With Strong Fundamentals screener has unearthed 165 more companies for you to explore.Click here to unveil our expertly curated list of 168 SEHK Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6138

Harbin Bank

Provides various banking products and services primarily in China.

Excellent balance sheet with proven track record.