As global markets react to interest rate cuts and economic data, the Hong Kong market has shown resilience amidst a backdrop of fluctuating inflation and trade dynamics. With this in mind, investors may find dividend stocks particularly appealing for their potential to provide steady income regardless of market volatility. A good dividend stock often combines strong fundamentals with a consistent payout history, making it an attractive option for those seeking stability in uncertain times.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.69% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.61% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 9.05% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.77% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.50% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.63% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.80% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.83% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 8.20% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.63% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top SEHK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

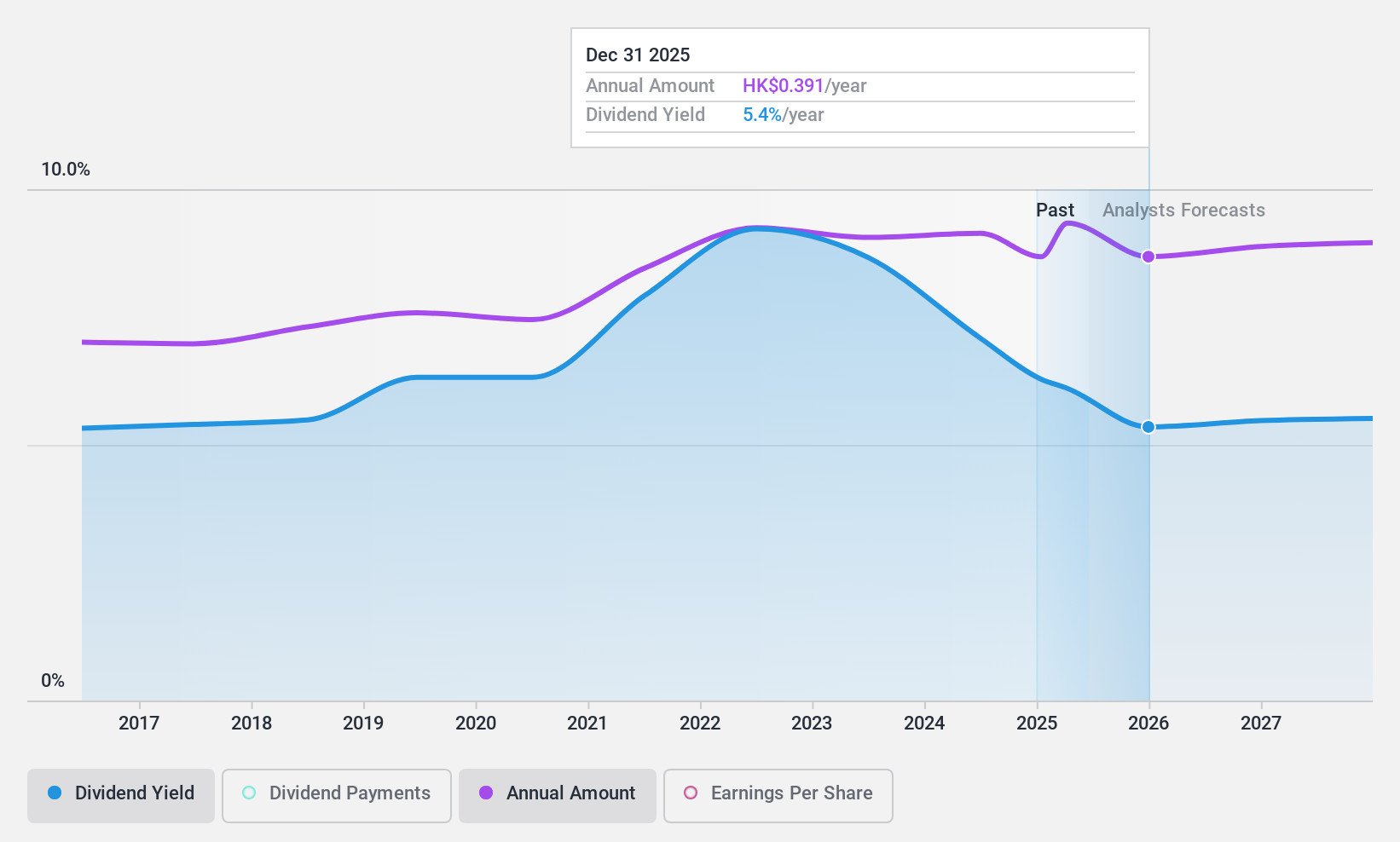

Bank of Communications (SEHK:3328)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Communications Co., Ltd. provides commercial banking products and services in China and has a market cap of HK$468.89 billion.

Operations: Bank of Communications Co., Ltd. generates revenue from several segments, including Personal Banking (CN¥76.86 billion), Treasury Business (CN¥23.21 billion), and Corporate Banking Business (CN¥98.09 billion).

Dividend Yield: 7.4%

Bank of Communications offers a reliable dividend yield of 7.39%, though it falls short compared to the top 25% in Hong Kong. The company maintains a sustainable payout ratio of 49%, with dividends well covered by earnings and forecasted to remain so at 31.1% in three years. Recent board changes and fixed-income offerings, along with consistent dividend growth over the past decade, underscore its stability as a dividend stock.

- Take a closer look at Bank of Communications' potential here in our dividend report.

- Our valuation report unveils the possibility Bank of Communications' shares may be trading at a discount.

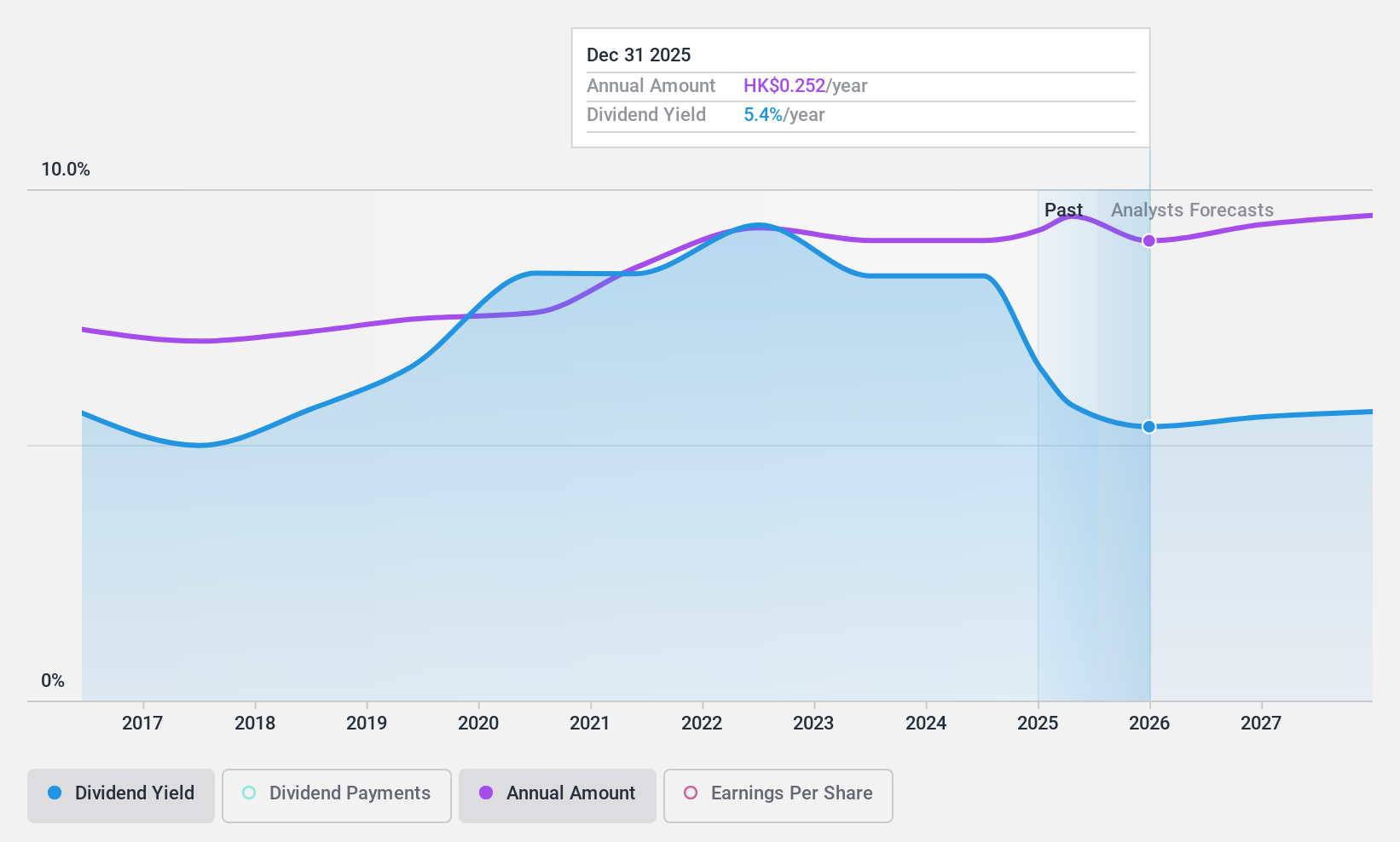

Bank of China (SEHK:3988)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of China Limited, with a market cap of HK$13.50 billion, offers a range of banking and financial services across Chinese Mainland, Hong Kong, Macao, Taiwan, and internationally through its subsidiaries.

Operations: Bank of China Limited generates revenue from several segments, including Personal Banking (CN¥197.23 billion), Corporate Banking (CN¥205.79 billion), Investment Banking (CN¥7.23 billion), Treasury Operations (CN¥60.20 billion), and Insurance (CN¥22.86 billion).

Dividend Yield: 7.5%

Bank of China has maintained stable dividend payments over the past decade, with a current yield of 7.5%. Its payout ratio is low at 32.5%, ensuring dividends are well covered by earnings and forecasted to remain sustainable at 29.5% in three years. Recent news includes the appointment of Ms. Zhao Rong as Chief Risk Officer and an interim dividend recommendation for 2024, highlighting ongoing management stability and commitment to shareholder returns.

- Dive into the specifics of Bank of China here with our thorough dividend report.

- According our valuation report, there's an indication that Bank of China's share price might be on the cheaper side.

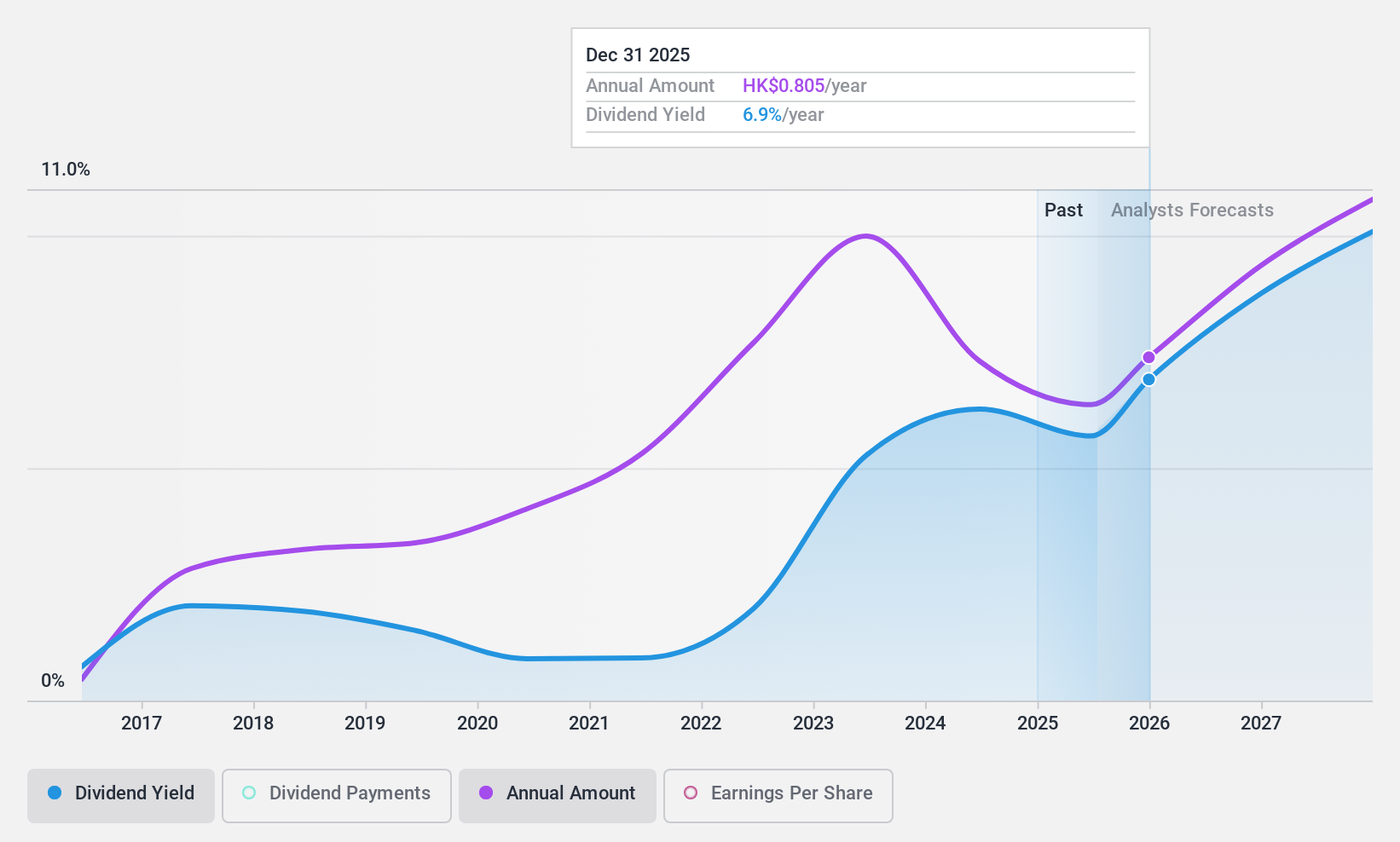

Zhongsheng Group Holdings (SEHK:881)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhongsheng Group Holdings Limited, an investment holding company with a market cap of HK$21.41 billion, engages in the sale and service of motor vehicles in the People’s Republic of China.

Operations: The company's revenue primarily comes from the sale of motor vehicles and the provision of related services, amounting to CN¥179.81 billion.

Dividend Yield: 8.8%

Zhongsheng Group Holdings has a mixed dividend history, with payments being volatile over the past decade. However, its current payout ratio of 49% and cash payout ratio of 52% indicate dividends are well covered by earnings and cash flows. Despite a recent decrease in net income, the company maintains an attractive yield of 8.8%, placing it in the top quartile among Hong Kong dividend payers. Recent financial restructuring efforts aim to reduce borrowing costs and enhance long-term growth prospects.

- Navigate through the intricacies of Zhongsheng Group Holdings with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Zhongsheng Group Holdings' current price could be quite moderate.

Make It Happen

- Get an in-depth perspective on all 75 Top SEHK Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3988

Bank of China

Provides various banking and financial services in Chinese Mainland, Hong Kong, Macao, Taiwan, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives