Do Bank of Communications's (HKG:3328) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Bank of Communications (HKG:3328), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Bank of Communications

How Fast Is Bank of Communications Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Bank of Communications has grown EPS by 5.1% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

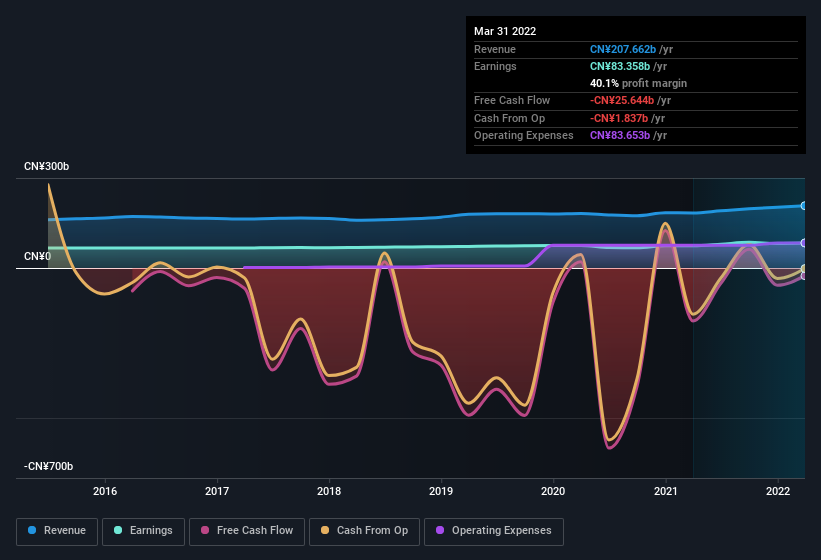

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Bank of Communications's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bank of Communications maintained stable EBIT margins over the last year, all while growing revenue 13% to CN¥208b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Bank of Communications's future profits.

Are Bank of Communications Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Bank of Communications top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Executive Chairman, Deqi Ren, paid CN¥443k to buy shares at an average price of CN¥4.43.

It's reassuring that Bank of Communications insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like Bank of Communications, with market caps over CN¥53b, is about CN¥6.9m.

The CEO of Bank of Communications only received CN¥826k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Bank of Communications To Your Watchlist?

As I already mentioned, Bank of Communications is a growing business, which is what I like to see. And that's not all, folks. We've also seen insiders buying stock, and noted modest executive pay. If that doesn't automatically earn it a spot on your watchlist then I'd posit it warrants a closer look at the very least. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Bank of Communications shapes up to industry peers, when it comes to ROE.

As a growth investor I do like to see insider buying. But Bank of Communications isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3328

Bank of Communications

Provides commercial banking products and services in China.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives