- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Exploring Hidden Opportunities In Hong Kong With These 3 Promising Small Caps

Reviewed by Simply Wall St

As geopolitical tensions rise and economic indicators present mixed signals, the Hong Kong market has seen a notable uptick, with the Hang Seng Index climbing 10.2% recently. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking to capitalize on potential growth areas that may not yet be fully appreciated by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company focused on the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of HK$13.24 billion.

Operations: Kinetic Development Group generates revenue primarily through the extraction and sale of coal products in China. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its overall profitability.

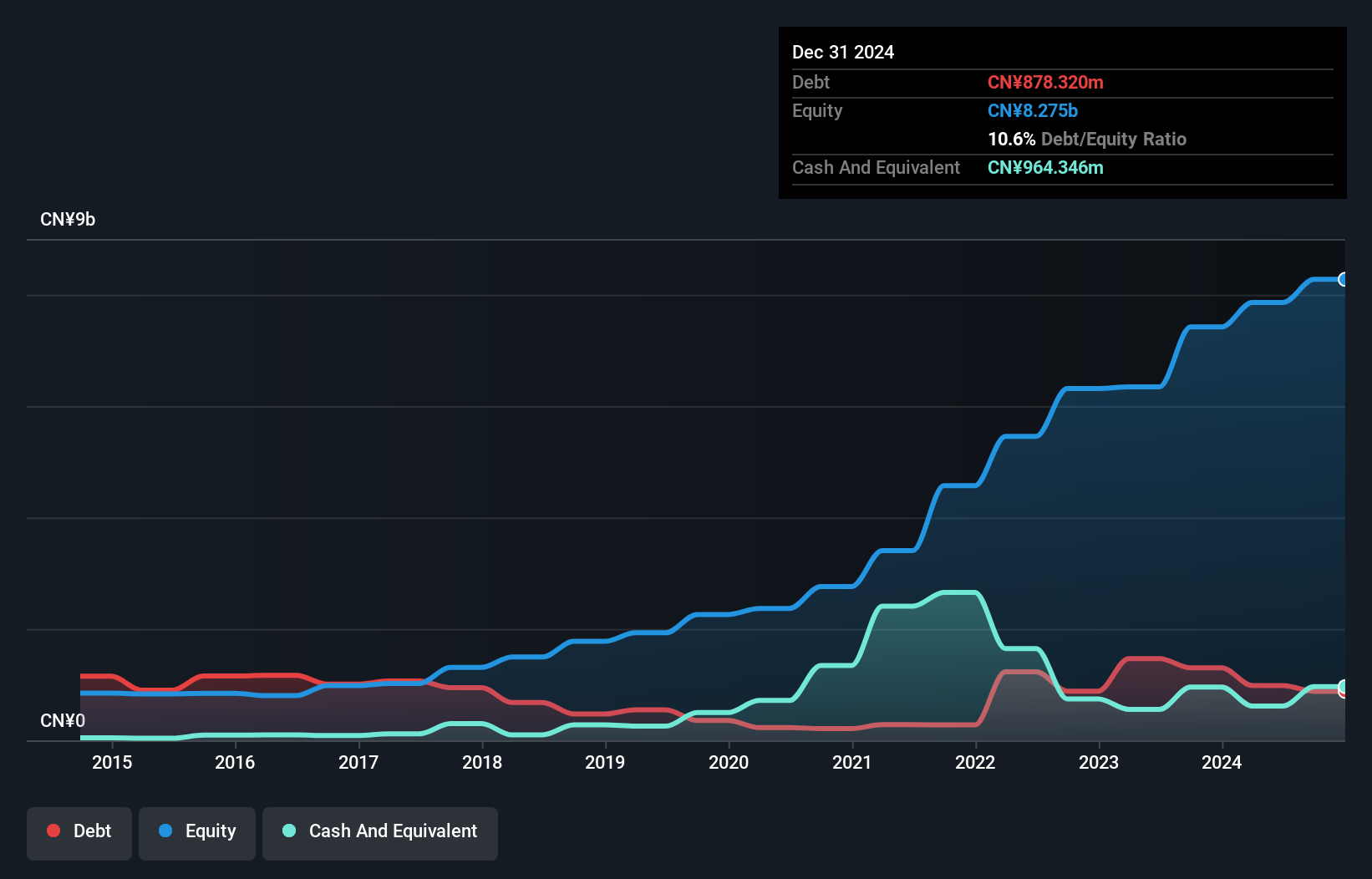

Kinetic Development Group, a smaller player in the market, has shown impressive financial health with its debt to equity ratio dropping from 28.4% to 12.5% over five years. The company reported earnings growth of 39%, outpacing the industry average of 4.6%. Additionally, net income for the first half of 2024 surged to CNY 1.10 billion from CNY 570 million last year, reflecting high-quality earnings and strong performance relative to peers in the oil and gas sector.

- Click here to discover the nuances of Kinetic Development Group with our detailed analytical health report.

Learn about Kinetic Development Group's historical performance.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. is a Chinese company specializing in home meal products with a market capitalization of HK$11.26 billion.

Operations: Guoquan Food generates revenue primarily from its retail segment, specifically grocery stores, amounting to CN¥5.998 billion.

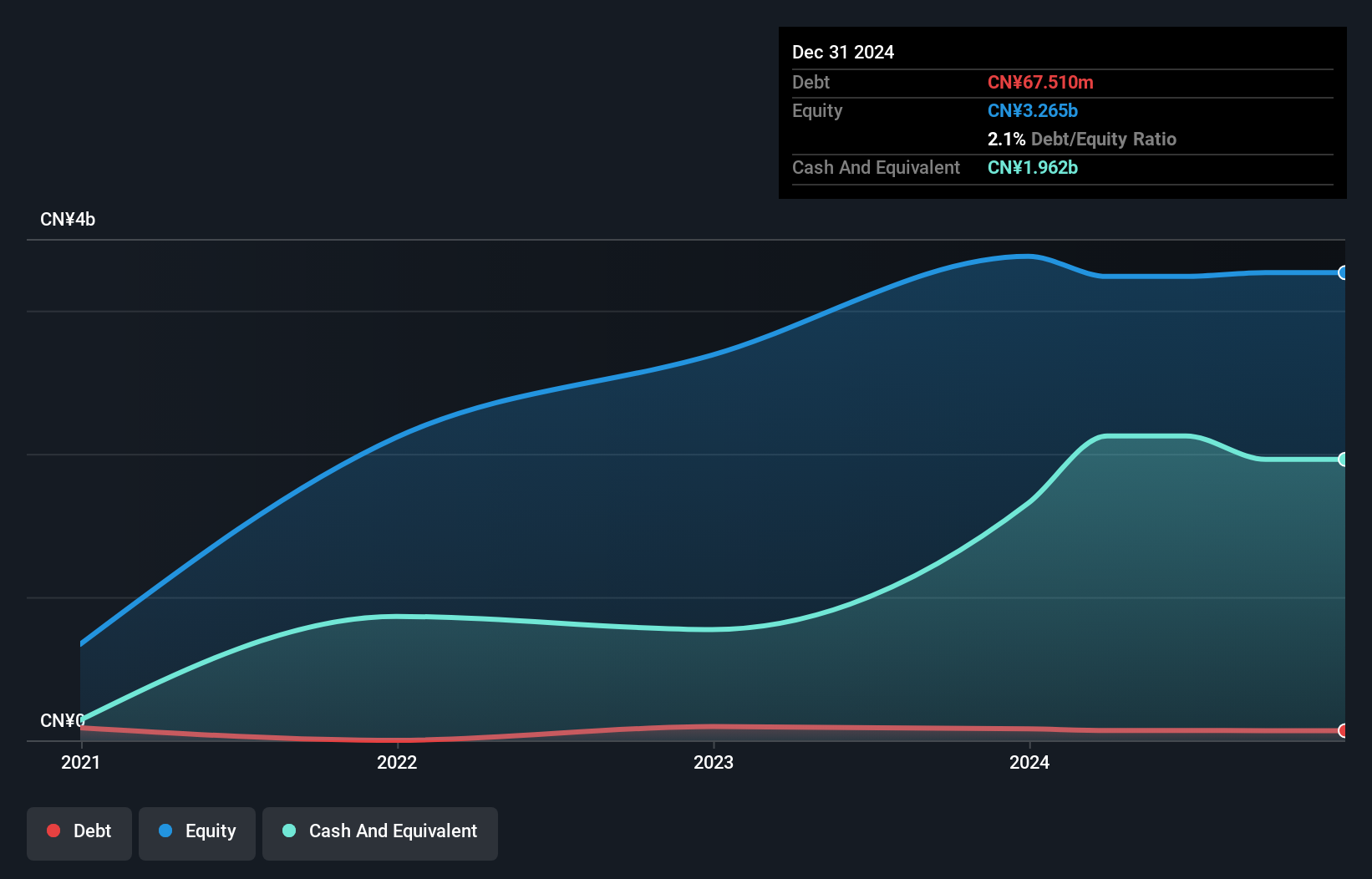

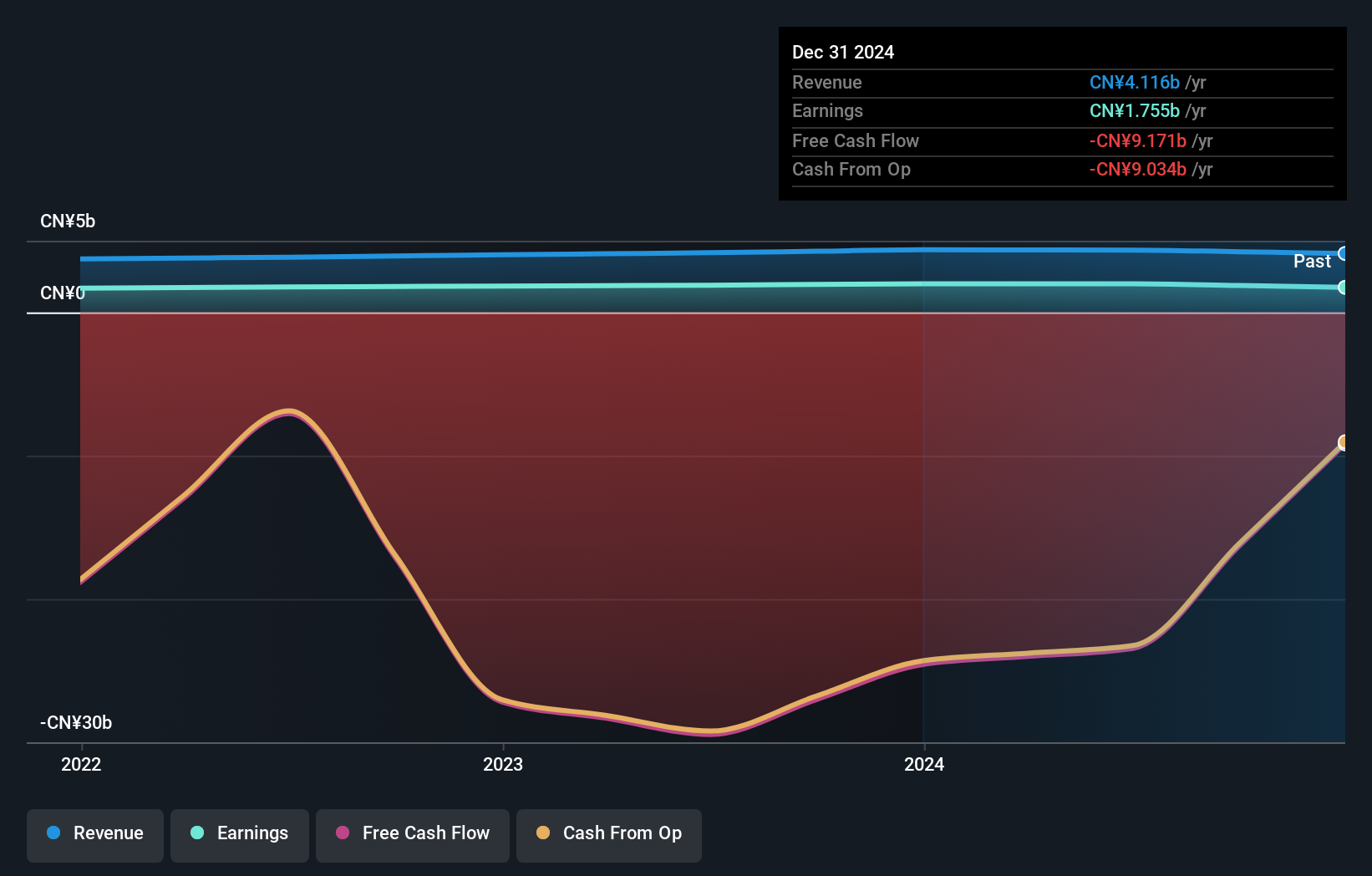

Guoquan Food, a small player in the market, recently reported half-year sales of CNY 2.67 billion, down from CNY 2.76 billion last year. Net income also slipped to CNY 85.98 million compared to CNY 107.7 million previously, with basic earnings per share at CNY 0.0313 versus last year's CNY 0.0403. Despite these numbers, the company trades at a significant discount of about 46% below estimated fair value and maintains high-quality earnings with more cash than total debt on its books.

- Navigate through the intricacies of Guoquan Food (Shanghai) with our comprehensive health report here.

Understand Guoquan Food (Shanghai)'s track record by examining our Past report.

Jinshang Bank (SEHK:2558)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinshang Bank Co., Ltd. offers a range of banking products and services in China, with a market cap of HK$9.17 billion.

Operations: The bank's primary revenue streams are derived from corporate banking (CN¥2.66 billion) and retail banking (CN¥1.10 billion), with a smaller contribution from treasury business (CN¥593.83 million).

Jinshang Bank, a small player in Hong Kong's financial scene, boasts total assets of CN¥370.9 billion and equity of CN¥25.3 billion. With customer deposits making up 84% of its liabilities, funding appears low-risk. The bank has a sufficient allowance for bad loans at 197%, while non-performing loans are kept at an appropriate level of 1.9%. Despite challenges, earnings grew by 5.2% last year, surpassing the industry average growth rate of 3.2%.

- Get an in-depth perspective on Jinshang Bank's performance by reading our health report here.

Examine Jinshang Bank's past performance report to understand how it has performed in the past.

Summing It All Up

- Gain an insight into the universe of 168 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinetic Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion