As global markets navigate mixed economic signals and fluctuating indices, Hong Kong's Hang Seng Index has shown resilience with a notable gain of 2.14%. This backdrop sets the stage for identifying promising small-cap stocks that might be overlooked by mainstream investors. In this environment, a good stock often exhibits strong fundamentals, growth potential, and the ability to navigate economic uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

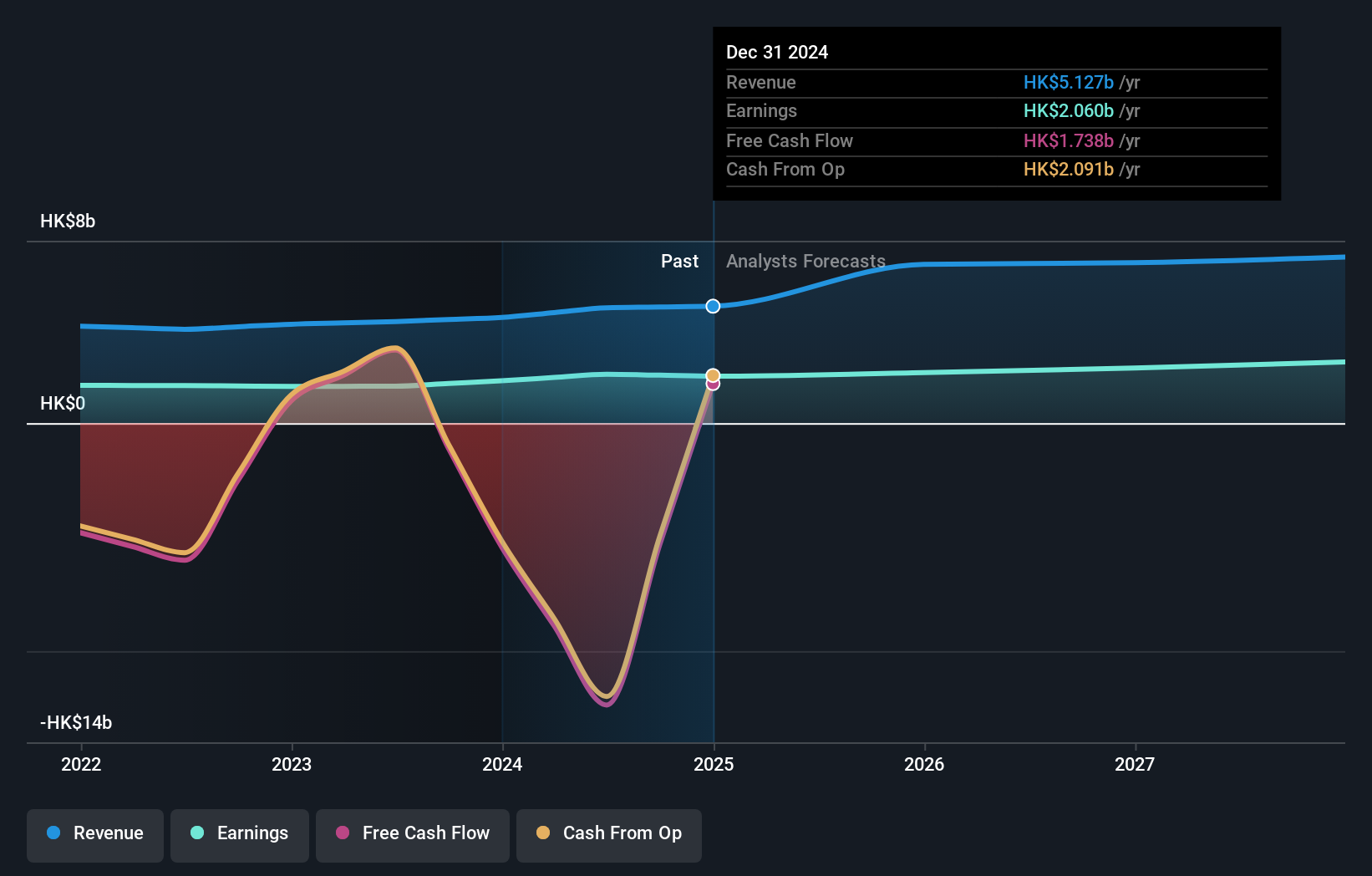

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited is an investment holding company that offers banking, financial, and related services across Hong Kong, Macau, and the People’s Republic of China with a market cap of approximately HK$9.53 billion.

Operations: Dah Sing Banking Group generates revenue primarily through its banking and financial services in Hong Kong, Macau, and the People’s Republic of China. The company has a market cap of approximately HK$9.53 billion.

Dah Sing Banking Group, with assets totaling HK$262.4B and equity of HK$33.6B, reported net interest income of HK$2.54B for the first half of 2024, up from HK$2.27B a year ago. Total deposits stand at HK$214.6B while total loans are HK$144.6B, earning a Net Interest Margin of 2%. The bank has an allowance for bad loans at 1.9% and announced an interim dividend of HKD 0.27 per share payable on September 26, 2024.

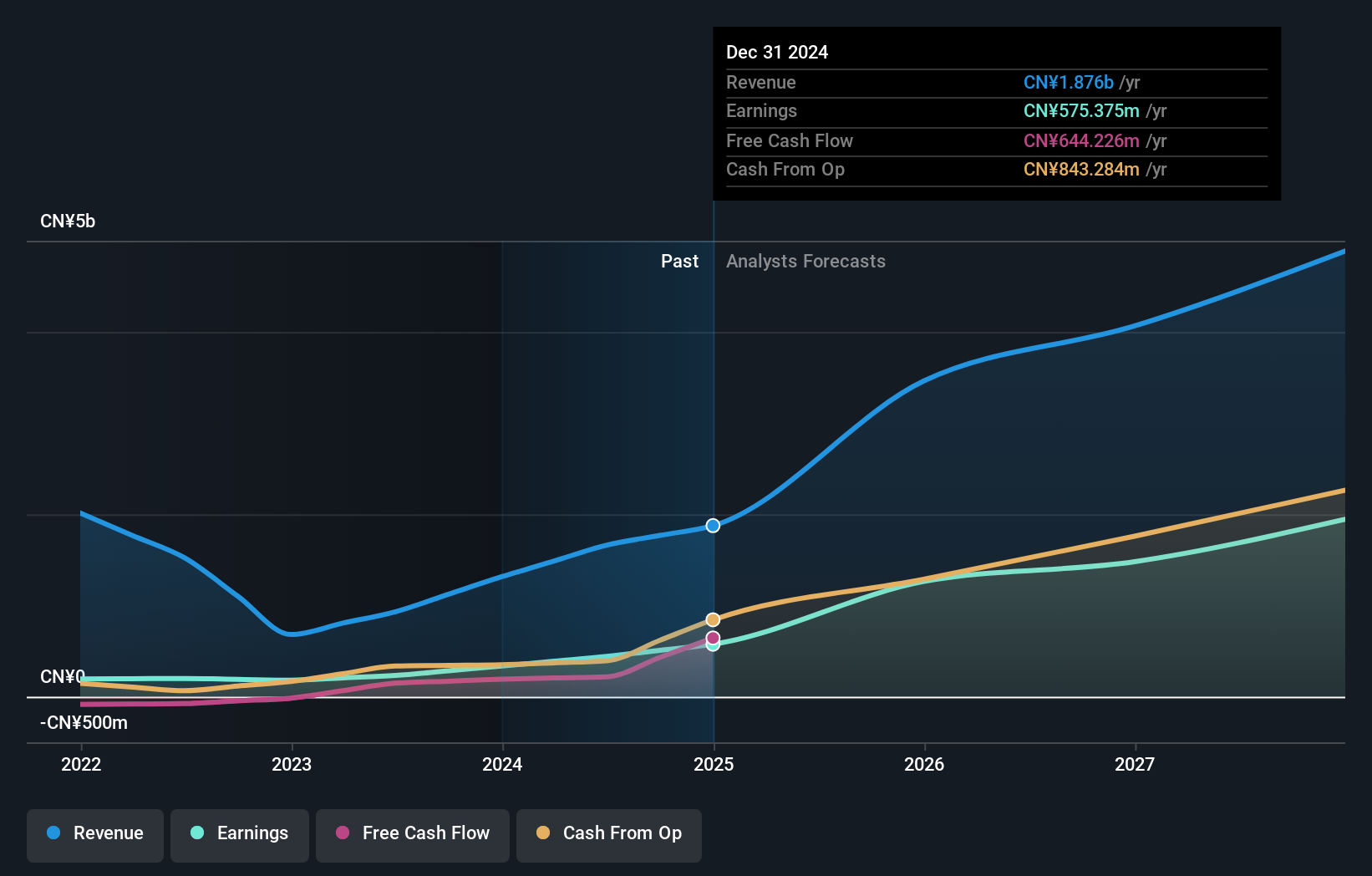

Wanguo International Mining Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo International Mining Group Limited, an investment holding company, engages in mining, ore processing, and sale of concentrate products in the People’s Republic of China and Solomon Islands with a market cap of HK$7.17 billion.

Operations: The company generates revenue primarily from two projects: Yifeng Project (CN¥749.25 million) and Solomon Project (CN¥912.63 million).

Wanguo Gold Group, formerly Wanguo International Mining, reported significant growth with sales reaching CNY 927.86 million for H1 2024, up from CNY 581.19 million last year. Net income also rose to CNY 254.27 million compared to CNY 147.11 million previously. The company announced an interim dividend of HKD 0.12 per share for the first half of the year and has appointed Mr. Li Feilong as an executive director effective August 2024, reflecting its expanding leadership team and strategic direction in gold mining operations.

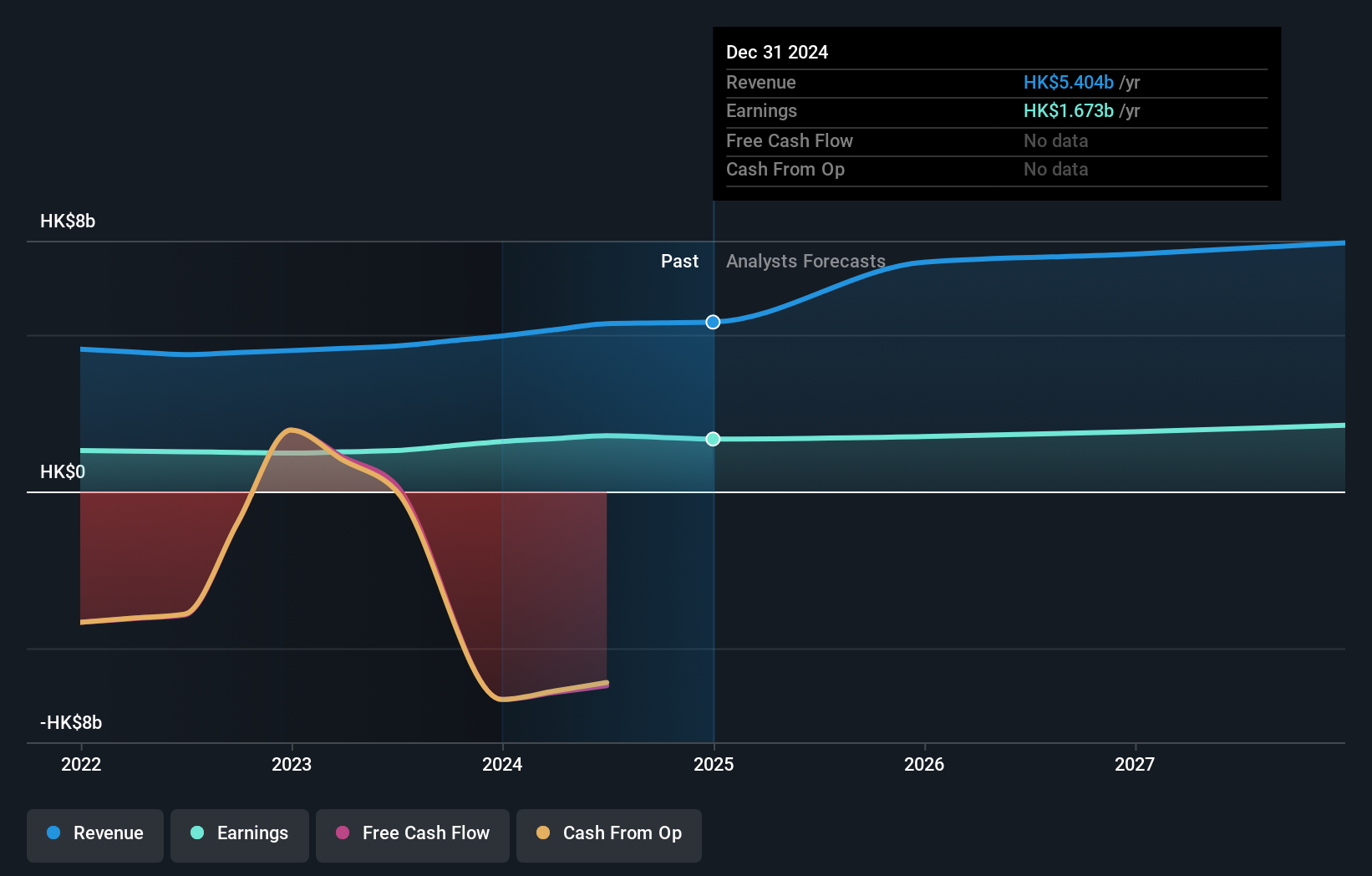

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited is an investment holding company that provides banking, insurance, financial, and other related services in Hong Kong, Macau, and the People’s Republic of China with a market cap of HK$7.37 billion.

Operations: The company generates revenue primarily from its banking and insurance services across Hong Kong, Macau, and the People’s Republic of China. With a market cap of HK$7.37 billion, it focuses on diversified financial offerings contributing to its overall income streams.

Dah Sing Financial Holdings, with total assets of HK$272.4B and equity of HK$42.4B, has shown strong performance recently. Total deposits stand at HK$214.2B against loans of HK$144.8B, highlighting its solid financial position. The company reported net income for the first half of 2024 at HK$1,112M, up from last year's HK$922M. Its earnings growth over the past year was 42%, outpacing the industry average significantly and trading at a notable discount to its estimated fair value by 43%.

- Click to explore a detailed breakdown of our findings in Dah Sing Financial Holdings' health report.

Understand Dah Sing Financial Holdings' track record by examining our Past report.

Turning Ideas Into Actions

- Take a closer look at our SEHK Undiscovered Gems With Strong Fundamentals list of 173 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2356

Dah Sing Banking Group

An investment holding company, provides banking, financial, and other related services in Hong Kong, Macau, and the People’s Republic of China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives