- United Arab Emirates

- /

- Capital Markets

- /

- ADX:WAHA

Discovering February 2025's Hidden Gems with Growth Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical uncertainties, small-cap stocks have shown mixed performance, with indices like the S&P 600 reflecting broader market volatility. Amidst this backdrop, identifying potential growth opportunities requires a keen eye for companies that exhibit strong fundamentals and resilience in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Ningbo Sinyuan Zm Technology | NA | 18.08% | 9.75% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm that manages assets in diverse sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate, and capital markets with a market capitalization of approximately AED2.91 billion.

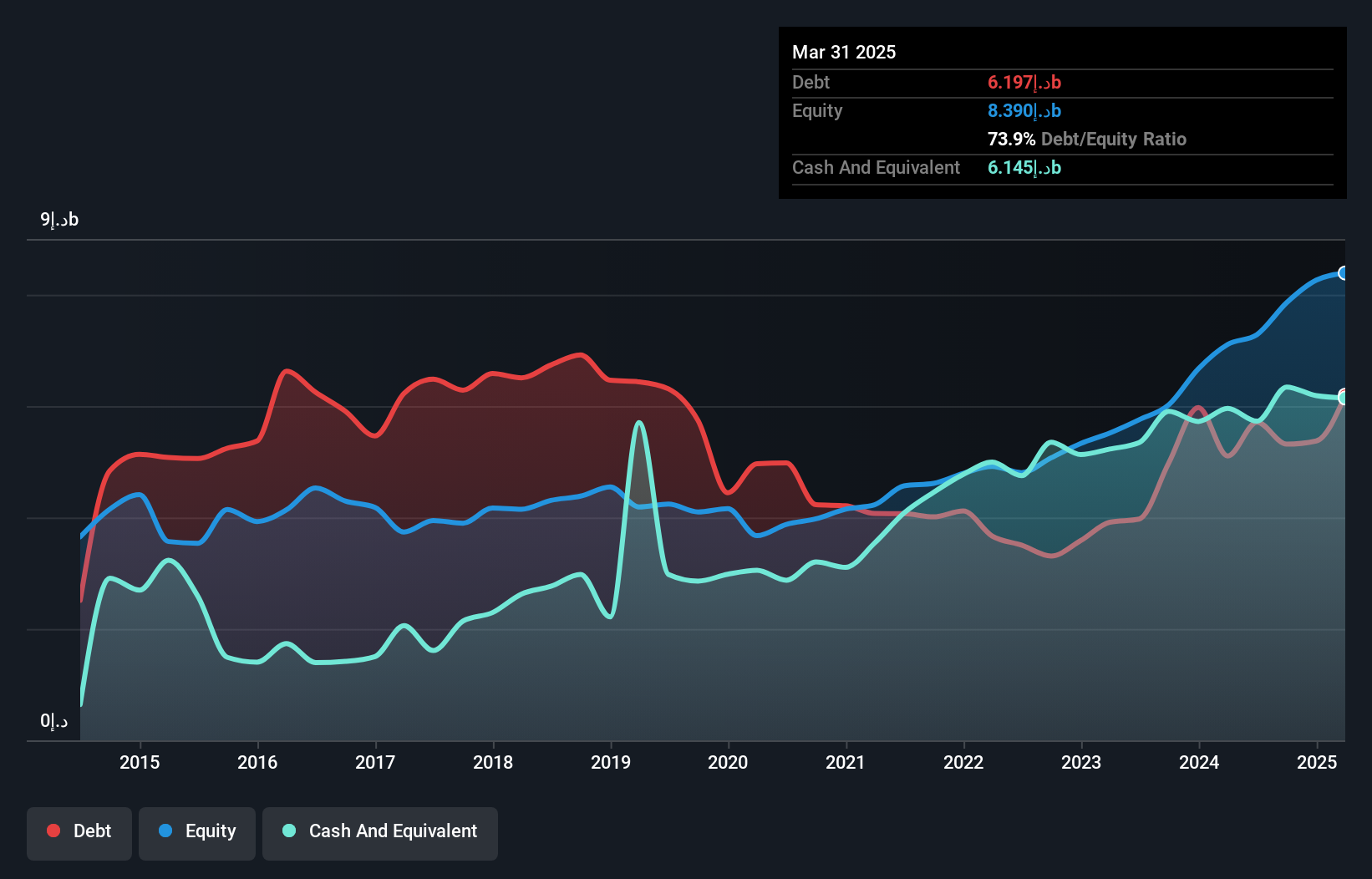

Operations: Revenue from private investments, excluding Waha Land, amounts to AED149.88 million.

Al Waha Capital PJSC has demonstrated robust earnings growth, outpacing the Capital Markets industry with a 31.6% increase over the past year. The company's debt to equity ratio has impressively decreased from 140% to 67.7% over five years, reflecting prudent financial management. Despite not being free cash flow positive, Al Waha's high-quality earnings and a price-to-earnings ratio of 5.9x—considerably lower than the AE market average of 13.3x—indicate potential undervaluation in its segment. Recent reports show net income for Q3 at AED 77.56 million, up from AED 53.63 million year-on-year, signaling continued profitability momentum.

- Take a closer look at Al Waha Capital PJSC's potential here in our health report.

Explore historical data to track Al Waha Capital PJSC's performance over time in our Past section.

YiChang HEC ChangJiang Pharmaceutical (SEHK:1558)

Simply Wall St Value Rating: ★★★★★★

Overview: YiChang HEC ChangJiang Pharmaceutical Co., Ltd. is a pharmaceutical company engaged in the research, development, manufacturing, and sales of pharmaceutical products with a market cap of approximately HK$8.19 billion.

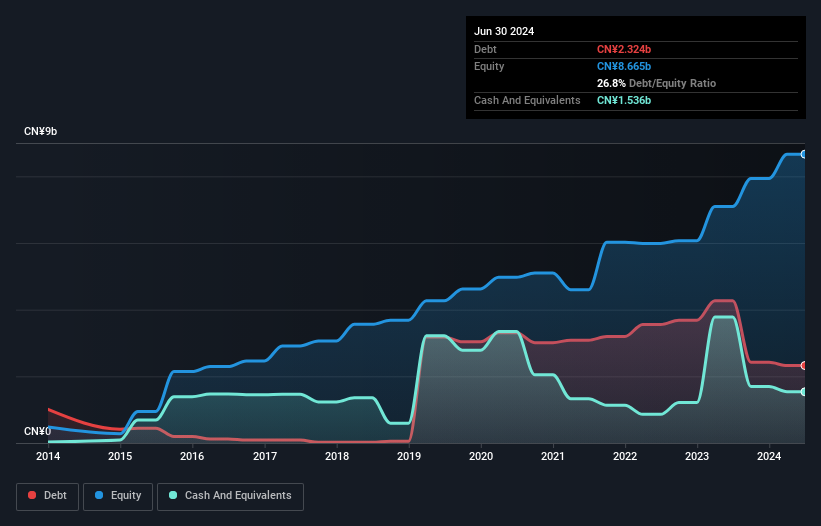

Operations: YiChang HEC generates revenue primarily from the sales of pharmaceutical products, amounting to CN¥5.54 billion.

YiChang HEC ChangJiang Pharmaceutical, a smaller player in the pharmaceutical space, has shown notable financial resilience. The company's earnings surged by 45% over the past year, significantly outpacing the industry's growth of 9%. With a debt-to-equity ratio dropping from 75% to 24% over five years and a net debt-to-equity ratio at a satisfactory 6%, it demonstrates prudent financial management. Trading at approximately 46% below estimated fair value suggests potential undervaluation. While non-cash earnings are high, providing quality insights into profitability, it's crucial to consider its consistent decline in annual earnings by about 2% over five years for future assessments.

- Unlock comprehensive insights into our analysis of YiChang HEC ChangJiang Pharmaceutical stock in this health report.

Understand YiChang HEC ChangJiang Pharmaceutical's track record by examining our Past report.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited is an investment holding company that offers banking and financial services in Hong Kong, Macau, and the People’s Republic of China with a market capitalization of approximately HK$11.29 billion.

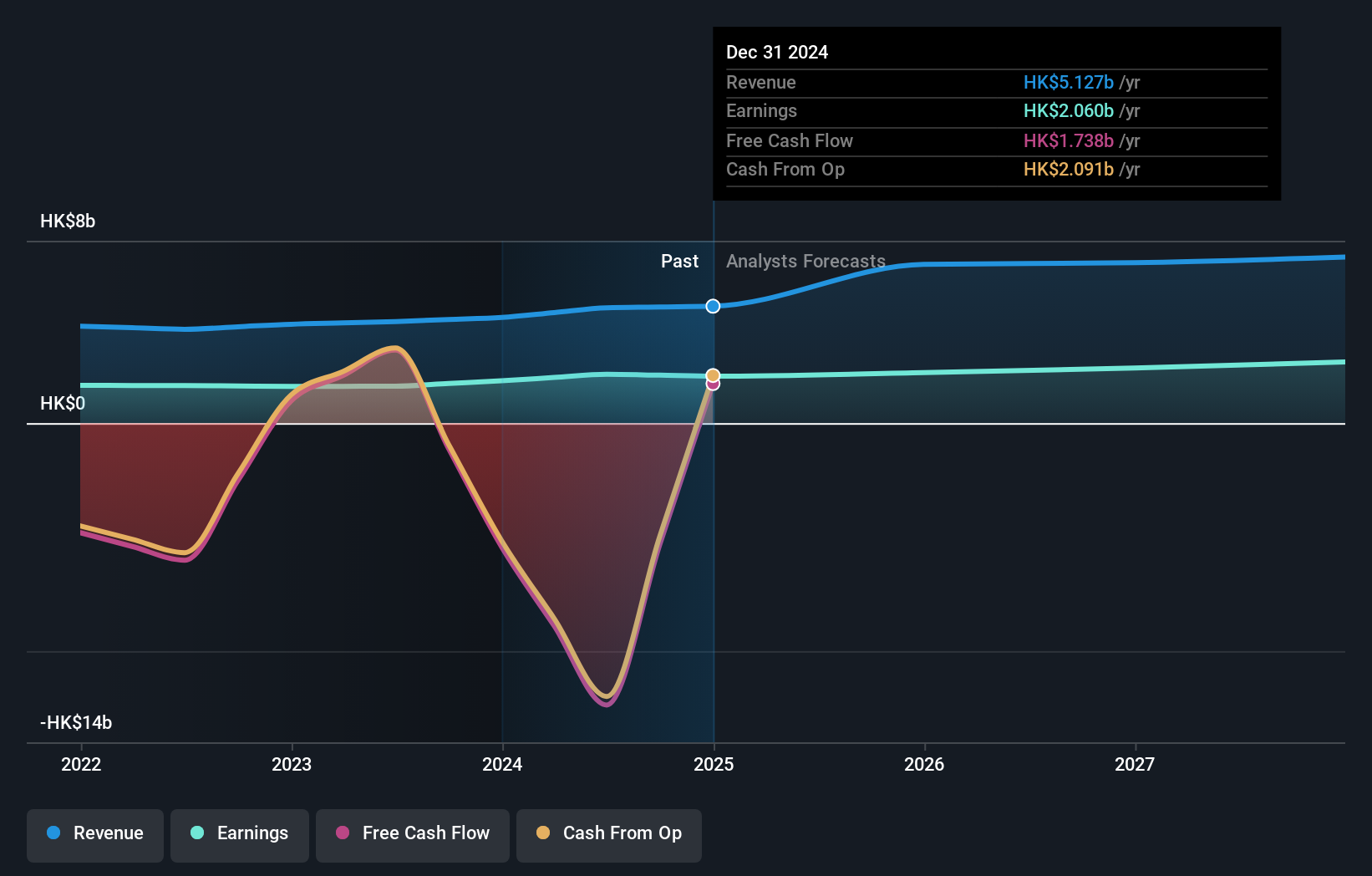

Operations: Dah Sing Banking Group derives its revenue primarily from Personal Banking (HK$2.68 billion), followed by Treasury and Global Markets (HK$1.34 billion) and Corporate Banking (HK$853.60 million). Mainland China and Macau Banking contribute HK$176.27 million to the overall revenue mix.

Dah Sing Banking Group, with HK$262.4 billion in total assets and HK$33.6 billion in equity, demonstrates a solid foundation within its sector. Its total deposits stand at HK$214.6 billion against loans of HK$141.9 billion, indicating a healthy deposit-to-loan ratio supported by a net interest margin of 2%. The bank's allowance for bad loans is 1.9% of total loans, which seems appropriate given industry standards but still leaves room for improvement. Despite trading at 35% below estimated fair value, the group's earnings surged by 32% last year, outpacing the industry growth rate significantly at just over 2%.

- Click here and access our complete health analysis report to understand the dynamics of Dah Sing Banking Group.

Gain insights into Dah Sing Banking Group's past trends and performance with our Past report.

Make It Happen

- Get an in-depth perspective on all 4668 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:WAHA

Al Waha Capital PJSC

A private equity firm which manages assets across several sectors, including financial services and fintech, healthcare, energy, infrastructure, industrial real estate and capital markets.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives