As global markets navigate a landscape of mixed economic signals and geopolitical tensions, Asian markets are drawing attention with their unique set of challenges and opportunities. In this environment, dividend stocks can offer a compelling blend of income and stability, making them particularly appealing for investors looking to balance risk with potential returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.53% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.29% | ★★★★★★ |

| NCD (TSE:4783) | 4.32% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.26% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.47% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.46% | ★★★★★★ |

| Daicel (TSE:4202) | 5.06% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

Click here to see the full list of 1232 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dah Sing Banking Group Limited is an investment holding company that offers banking and financial services in Hong Kong, Macau, and the People’s Republic of China, with a market cap of HK$12.69 billion.

Operations: Dah Sing Banking Group Limited generates revenue primarily through its Personal Banking (HK$2.98 billion), Treasury and Global Markets (HK$1.52 billion), Corporate Banking (HK$234.65 million), and Mainland China and Macau Banking (HK$425.64 million) segments.

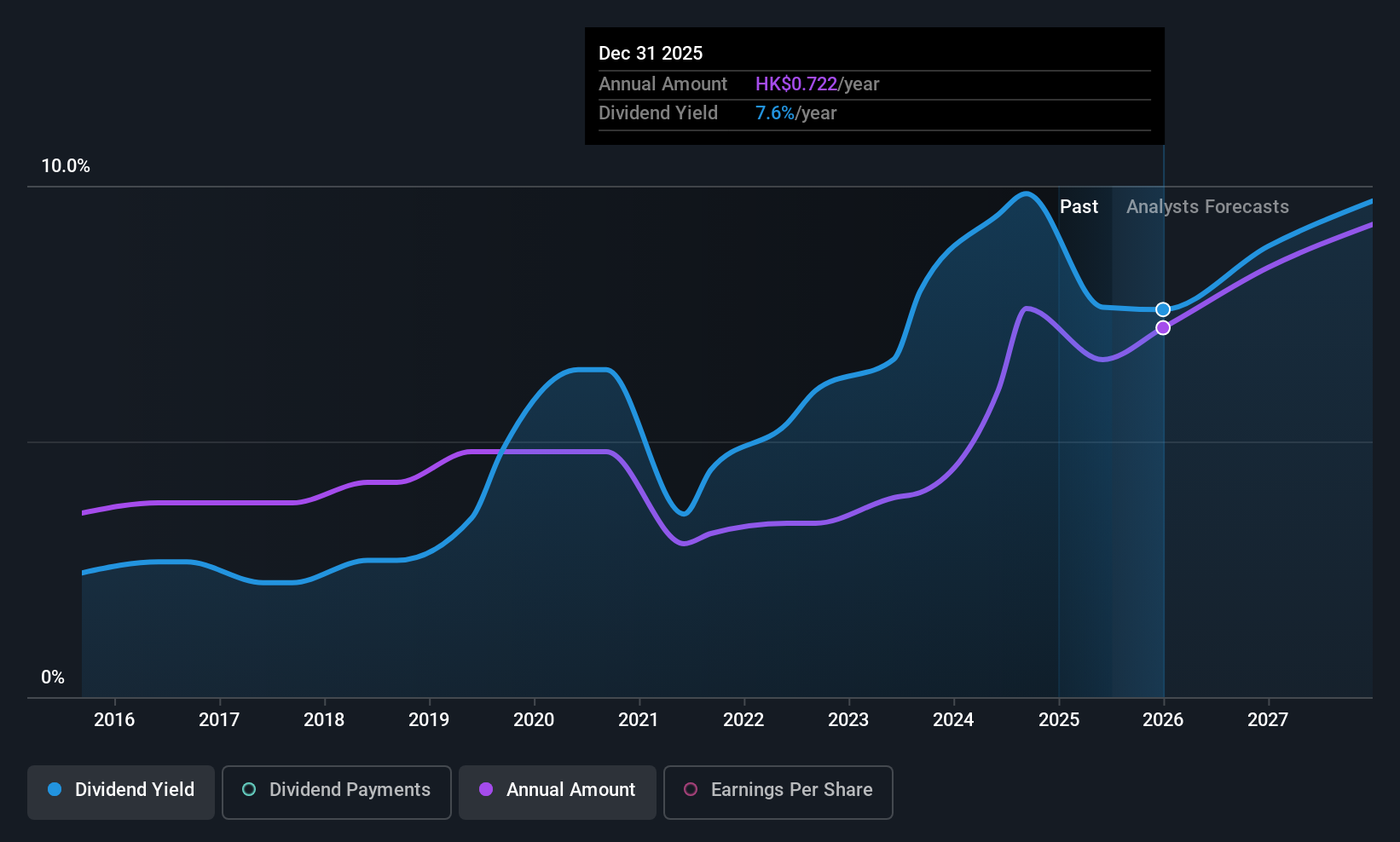

Dividend Yield: 7.3%

Dah Sing Banking Group's dividend situation presents a mixed picture. While the company's payout ratio is reasonably low at 45%, indicating dividends are well covered by earnings, its dividend track record has been volatile over the past decade. Recent financial results show net income growth to HK$2.06 billion, yet the proposed final dividend of HK$0.39 per share marks a decrease, reflecting potential instability in future payouts despite an expected earnings growth rate of 8.88% annually.

- Click here and access our complete dividend analysis report to understand the dynamics of Dah Sing Banking Group.

- Insights from our recent valuation report point to the potential overvaluation of Dah Sing Banking Group shares in the market.

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chongqing Rural Commercial Bank Co., Ltd. and its subsidiaries offer banking services in the People’s Republic of China, with a market capitalization of HK$90.78 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates its revenue primarily from banking services within the People’s Republic of China.

Dividend Yield: 3.4%

Chongqing Rural Commercial Bank's dividend profile is complex. Trading at 55.1% below its estimated fair value, it offers a low dividend yield of 3.44%, compared to the Hong Kong market's top tier of 7.4%. Despite earnings growing by 12.3% last year and being forecast to grow further, its dividends have been volatile over the past decade, with recent decreases in payouts totaling RMB 1.25 billion for 2024, reflecting ongoing instability in dividend reliability and sustainability despite a favorable payout ratio of around 30%.

- Unlock comprehensive insights into our analysis of Chongqing Rural Commercial Bank stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Chongqing Rural Commercial Bank shares in the market.

China Construction Bank (SEHK:939)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Construction Bank Corporation provides a range of banking and financial services to individual and corporate clients both in the People's Republic of China and internationally, with a market cap of approximately HK$2.17 trillion.

Operations: China Construction Bank Corporation generates revenue through its diverse banking and financial services offered to individual and corporate clients within China and abroad.

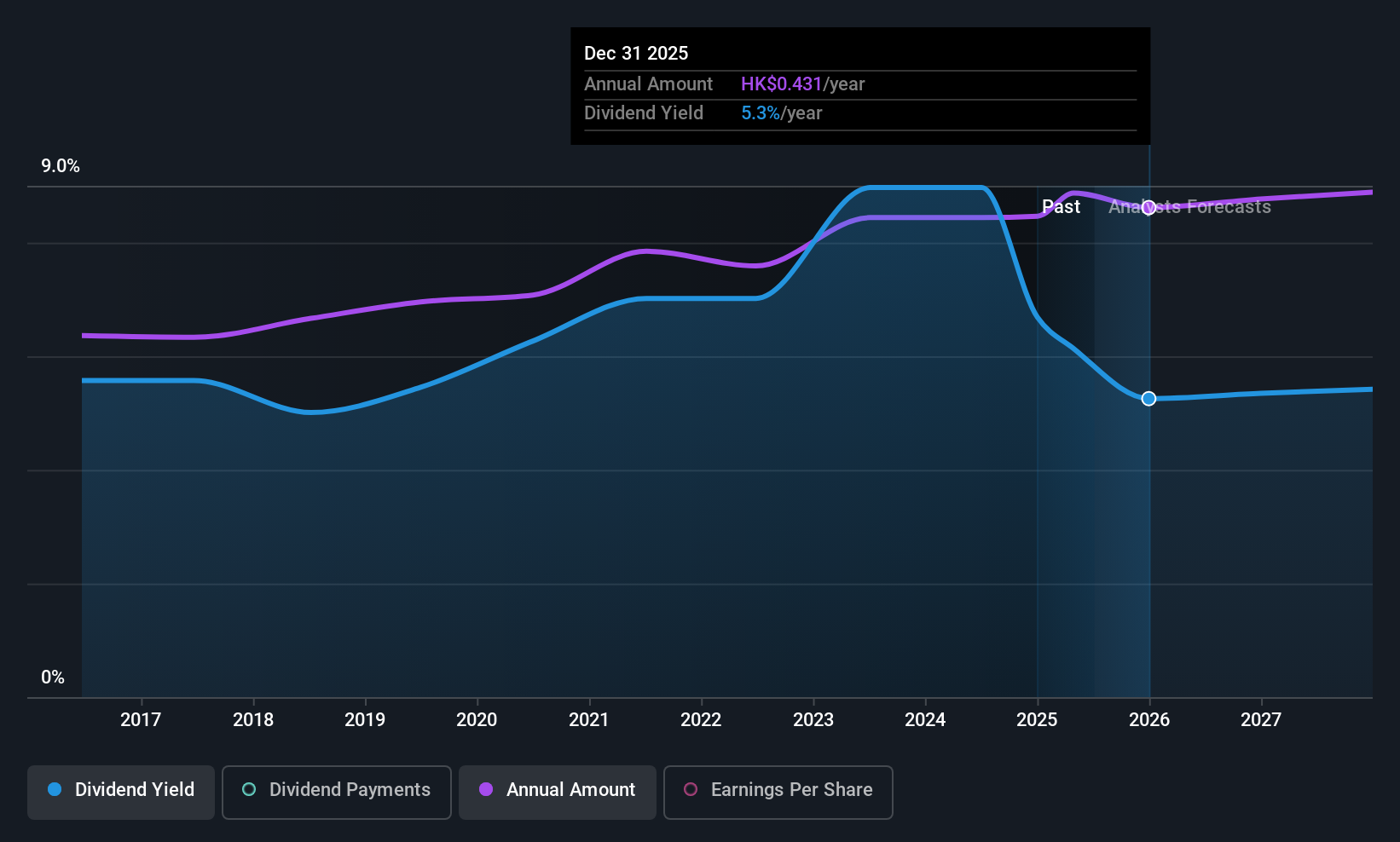

Dividend Yield: 5.5%

China Construction Bank offers a reliable dividend yield of 5.46%, though it trails the top 25% in Hong Kong's market. The bank's dividends are well-covered by earnings with a current payout ratio of 31.1%, and this coverage is expected to remain strong at 29.8% in three years. Recent leadership changes and strategic projects, like the Xiongan Financial Science and Technology Innovation Center, may influence future growth, but its dividend stability over the past decade remains noteworthy.

- Dive into the specifics of China Construction Bank here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that China Construction Bank is trading behind its estimated value.

Taking Advantage

- Click this link to deep-dive into the 1232 companies within our Top Asian Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2356

Dah Sing Banking Group

An investment holding company, provides banking, financial, and other related services in Hong Kong, Macau, and the People’s Republic of China.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives