Global markets have experienced a tumultuous week, with major indices finishing mostly lower amid a busy period of earnings reports and economic data releases. Despite the challenges faced by larger growth stocks, small-cap stocks have shown resilience, highlighting potential opportunities in lesser-known areas of the market. Penny stocks, often representing smaller or newer companies, continue to intrigue investors seeking hidden value and financial strength. In this article, we explore three penny stocks that stand out for their solid balance sheets and potential for long-term growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.565 | MYR2.81B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$533.22M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.92 | £467.47M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £347M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.52 | MYR756.88M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.87 | £391.86M | ★★★★☆☆ |

Click here to see the full list of 5,790 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Luzhou Bank (SEHK:1983)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Luzhou Bank Co., Ltd. operates in the People’s Republic of China, offering corporate and retail banking as well as financial market services, with a market cap of HK$4.73 billion.

Operations: Luzhou Bank Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$4.73B

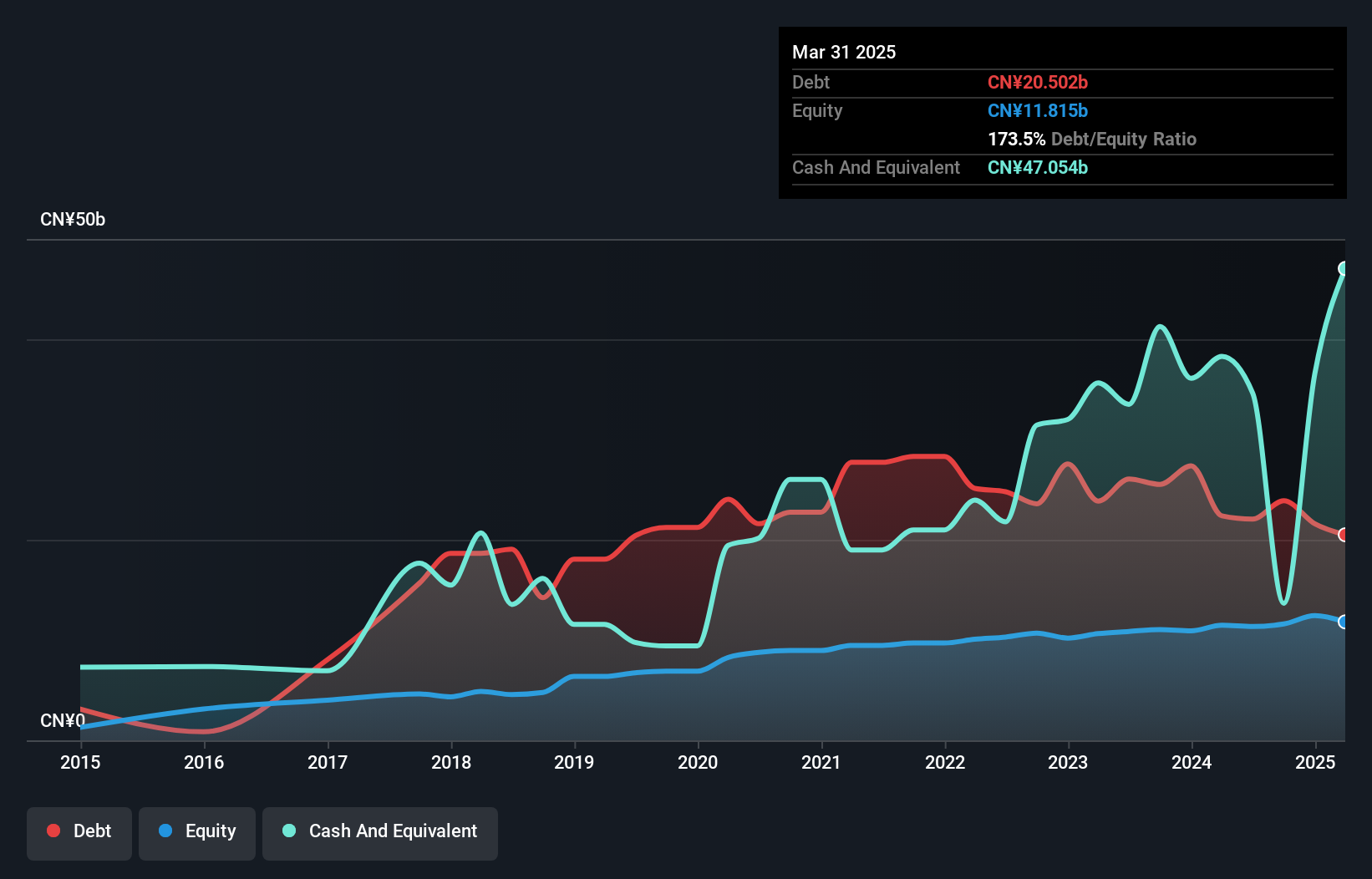

Luzhou Bank, with a market cap of HK$4.73 billion, has demonstrated strong financial performance, reporting net income of CNY 1,070.16 million for the nine months ending September 2024. The bank's earnings growth over the past year significantly outpaced industry averages and its five-year historical growth rate. Luzhou Bank maintains an appropriate loans to deposits ratio and a sufficient allowance for bad loans while benefiting from primarily low-risk funding sources like customer deposits. However, its return on equity remains low at 10.2%, and it has an unstable dividend track record despite trading below estimated fair value.

- Navigate through the intricacies of Luzhou Bank with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Luzhou Bank's track record.

Frencken Group (SGX:E28)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frencken Group Limited is an investment holding company that offers original design, original equipment, and diversified integrated manufacturing solutions globally, with a market cap of SGD529.59 million.

Operations: The company's revenue is primarily generated from its Mechatronics segment, which accounts for SGD670.12 million, followed by Integrated Manufacturing Services (IMS) at SGD91.79 million, and Investment Holding & Management Services contributing SGD10.65 million.

Market Cap: SGD529.59M

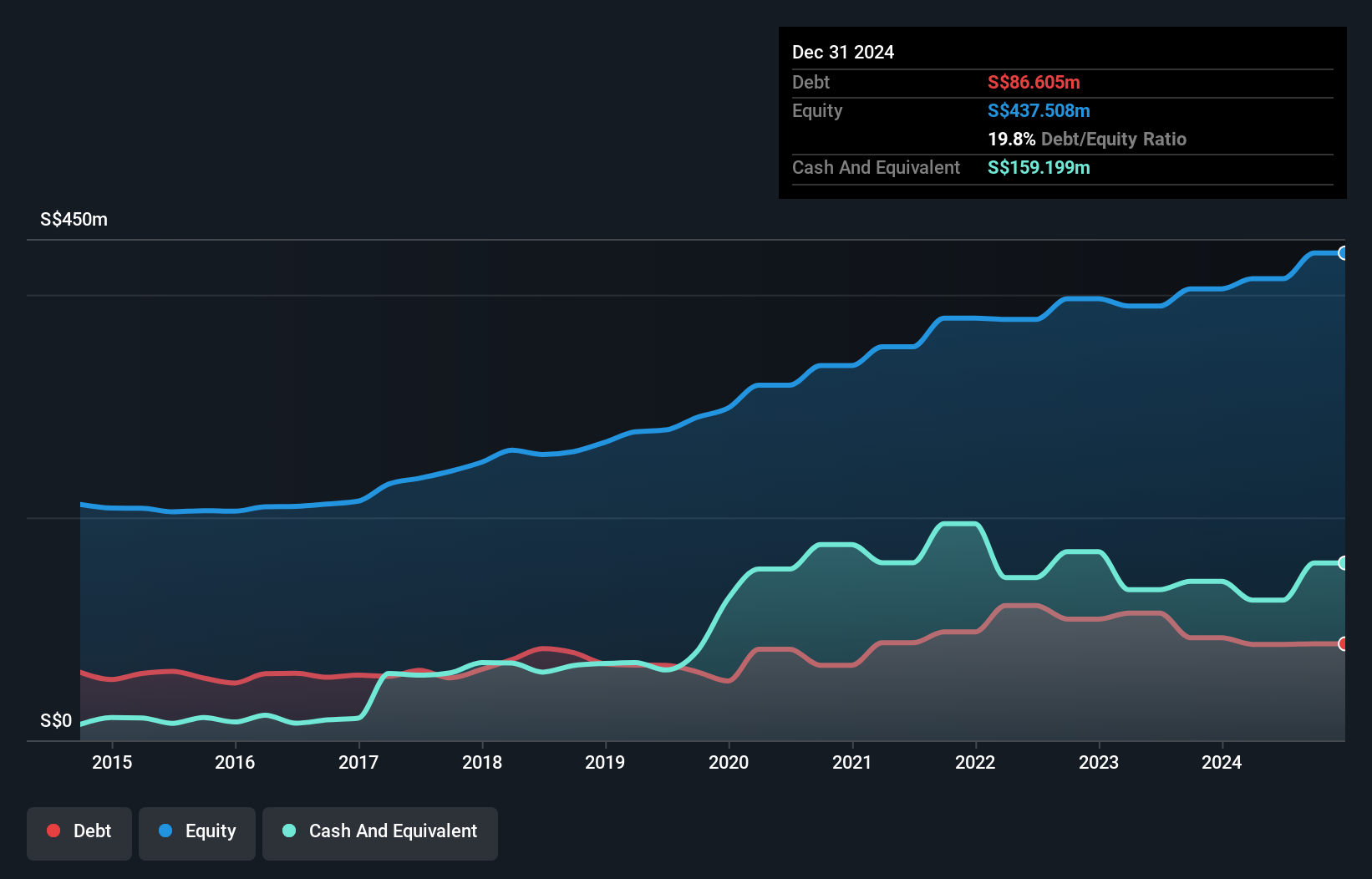

Frencken Group Limited, with a market cap of SGD529.59 million, has shown steady financial performance with half-year sales of SGD372.72 million and net income rising to SGD18.15 million. The company’s management and board are experienced, and its debt levels have decreased over time, supported by strong operating cash flow coverage. Frencken's short-term assets comfortably cover both short- and long-term liabilities, indicating solid financial health. Despite low return on equity at 9.2%, the stock is trading significantly below estimated fair value according to analysts who forecast earnings growth at 13.58% annually, suggesting potential for future appreciation.

- Get an in-depth perspective on Frencken Group's performance by reading our balance sheet health report here.

- Understand Frencken Group's earnings outlook by examining our growth report.

Guangdong Delian Group (SZSE:002666)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangdong Delian Group Co., Ltd. operates in the automobile fine chemicals, automobile sales service, and automobile repair and maintenance sectors in China, with a market cap of CN¥3.45 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: CN¥3.45B

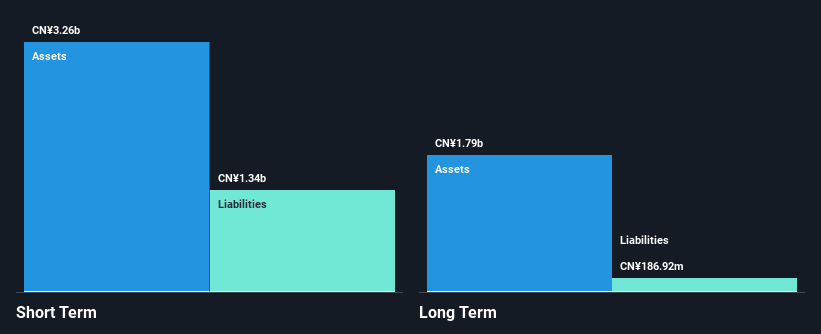

Guangdong Delian Group, with a market cap of CN¥3.45 billion, has shown an improvement in net profit margins from 0.5% to 1.4% year-over-year, despite a decline in sales from CN¥4.02 billion to CN¥3.49 billion over the same period. The company maintains strong liquidity with short-term assets of CN¥3.3 billion exceeding both short- and long-term liabilities significantly, while its debt is well-covered by operating cash flow at 37.8%. However, shareholder dilution increased by 4.2% due to recent private placements raising approximately CN¥100 million, impacting equity value perception despite trading below estimated fair value.

- Click to explore a detailed breakdown of our findings in Guangdong Delian Group's financial health report.

- Assess Guangdong Delian Group's previous results with our detailed historical performance reports.

Next Steps

- Explore the 5,790 names from our Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:E28

Frencken Group

An investment holding company, provides original design, original equipment, and diversified integrated manufacturing solutions worldwide.

Flawless balance sheet and undervalued.