As global markets grapple with inflation concerns and geopolitical uncertainties, Asia's stock markets present a unique landscape for investors seeking opportunities in the small-cap sector. With China's focus on boosting consumption and Japan's steady wage growth trends, the region is ripe for uncovering stocks that could thrive amidst these dynamic economic conditions. In this environment, identifying companies with strong fundamentals and innovative business models can be key to navigating potential market volatility while capitalizing on emerging growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 59.47% | 4.91% | 62.26% | ★★★★★★ |

| Techshine ElectronicsLtd | 0.94% | 15.06% | 17.62% | ★★★★★★ |

| Saison Technology | NA | 0.96% | -11.65% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| Renxin New MaterialLtd | NA | 0.65% | -39.64% | ★★★★★★ |

| Episil-Precision | 10.16% | 6.22% | 40.32% | ★★★★★★ |

| Neosem | 2.52% | 27.62% | 27.36% | ★★★★★★ |

| Jinsanjiang (Zhaoqing) Silicon Material | 4.36% | 14.46% | -8.89% | ★★★★★☆ |

| Jiangsu Longda Superalloy | 17.07% | 19.16% | 11.40% | ★★★★★☆ |

| Ck SolutionLtd | 30.35% | 8.36% | 70.74% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Luzhou Bank (SEHK:1983)

Simply Wall St Value Rating: ★★★★★★

Overview: Luzhou Bank Co., Ltd. is a financial institution offering corporate and retail banking as well as financial market services in China, with a market capitalization of approximately HK$5.41 billion.

Operations: Luzhou Bank generates revenue primarily through its corporate and retail banking services, along with financial market activities in China. The bank's net profit margin is a key indicator of its profitability.

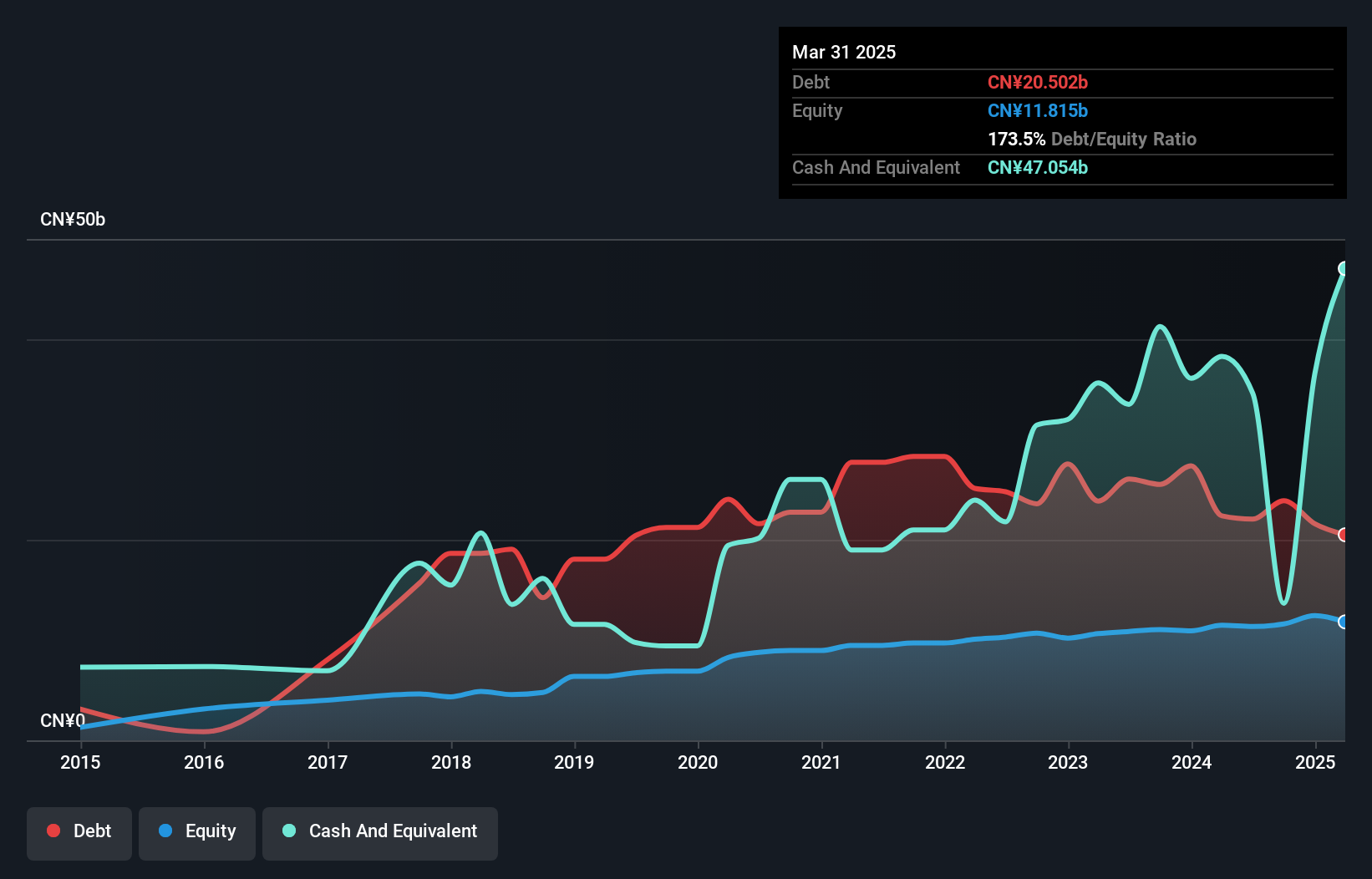

Luzhou Bank, with total assets of CN¥168.5 billion and equity of CN¥11.6 billion, is making waves in the banking sector. Its earnings growth of 54.7% over the past year surpasses the industry average of 2.5%, showcasing its robust performance despite being a smaller player in the market. The bank's total deposits stand at CN¥131.3 billion against loans worth CN¥97.8 billion, supported by a net interest margin of 2.4%. With an allowance for bad loans at just 1.3% and trading at 46% below estimated fair value, Luzhou Bank seems to offer significant potential amidst recent board changes enhancing governance structures.

- Click to explore a detailed breakdown of our findings in Luzhou Bank's health report.

Explore historical data to track Luzhou Bank's performance over time in our Past section.

Huaihe Energy (Group)Ltd (SHSE:600575)

Simply Wall St Value Rating: ★★★★★★

Overview: Huaihe Energy (Group) Co., Ltd operates in the logistics and trade sector within China, with a market capitalization of CN¥13.14 billion.

Operations: Huaihe Energy (Group) Co., Ltd derives its revenue primarily from logistics and trade activities within China. The company reported a market capitalization of CN¥13.14 billion.

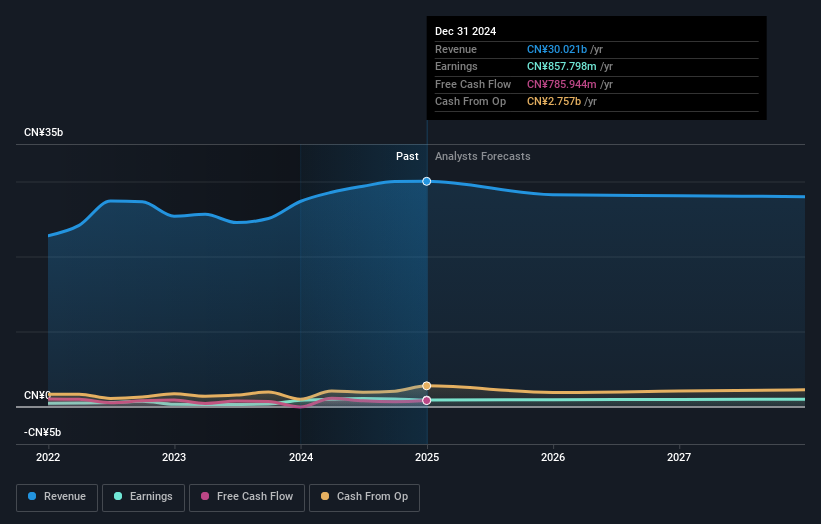

Huaihe Energy, a smaller player in the energy sector, has shown impressive growth with earnings surging 216% over the past year, outpacing the industry's modest 1.7% rise. The company boasts high-quality earnings and maintains a favorable price-to-earnings ratio of 13x compared to the broader CN market's 39.2x. Financial health appears robust as its debt-to-equity ratio improved from 44.8% to 41% over five years, while net debt to equity stands at a satisfactory level of around 21%. Recent board-approved private placements suggest strategic moves for future expansion or stability in operations.

- Delve into the full analysis health report here for a deeper understanding of Huaihe Energy (Group)Ltd.

Gain insights into Huaihe Energy (Group)Ltd's past trends and performance with our Past report.

Shandong Oriental Ocean Sci-Tech (SZSE:002086)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Oriental Ocean Sci-Tech Co., Ltd. operates in the fields of seawater seedling breeding, aquaculture, aquatic product processing, biotechnology, bonded warehousing, and logistics both within China and internationally, with a market capitalization of CN¥5.78 billion.

Operations: The company's revenue streams are primarily derived from aquaculture and aquatic product processing, with significant contributions from biotechnology and logistics. It has a market capitalization of CN¥5.78 billion. The net profit margin is noted at 3.5%, reflecting the efficiency of operations across its diverse business segments.

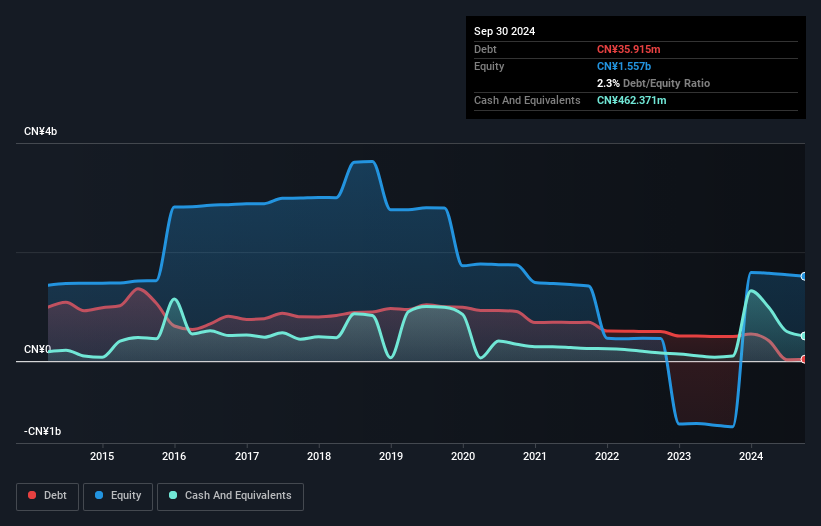

Shandong Oriental Ocean Sci-Tech stands out with its recent profitability, a notable achievement compared to the food industry's -6.8% earnings growth. Its price-to-earnings ratio of 3.3x is attractive against the CN market's 39.2x, indicating potential undervaluation. The company has successfully reduced its debt-to-equity ratio from 35.5% to 2.3% over five years, showcasing effective financial management strategies and more cash than total debt further strengthens its position despite not being free cash flow positive yet and experiencing share price volatility recently, suggesting cautious optimism for investors eyeing this promising player in Asia's market landscape.

Turning Ideas Into Actions

- Get an in-depth perspective on all 2601 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002086

Shandong Oriental Ocean Sci-Tech

Engages in the seawater seedling breeding, aquaculture, aquatic product processing, biotechnology, bonded warehousing, and logistics businesses in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives