As global markets navigate a landscape of fluctuating inflation and interest rate adjustments, the Hong Kong market has seen its own share of volatility. In this environment, dividend stocks can offer a measure of stability and income potential for investors. When evaluating dividend stocks, it's essential to consider their yield consistency, payout ratio, and the company's overall financial health.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.67% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.67% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.71% | ★★★★★☆ |

| Lenovo Group (SEHK:992) | 4.11% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 9.21% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.95% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.74% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.80% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 7.55% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.51% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top SEHK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

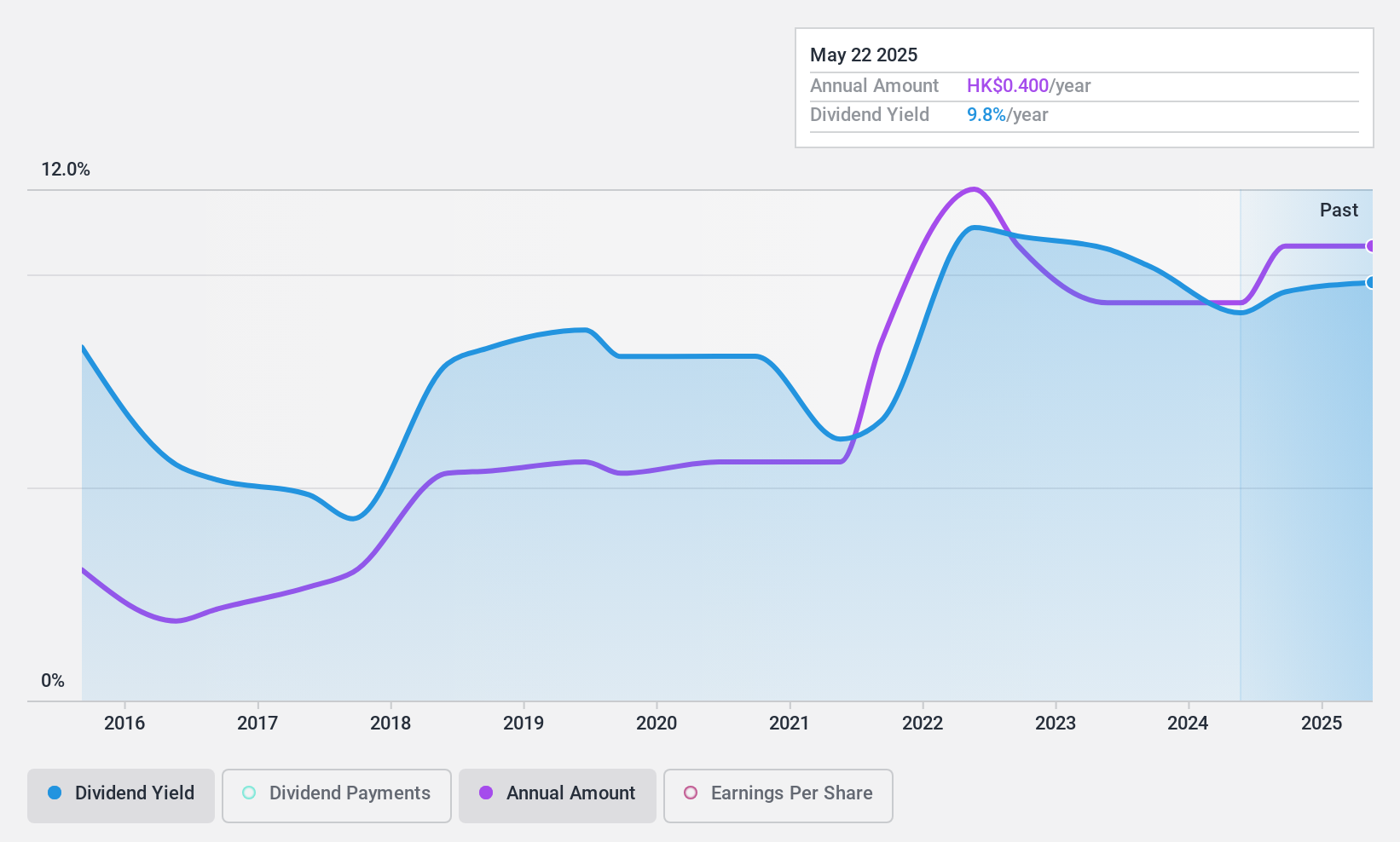

S.A.S. Dragon Holdings (SEHK:1184)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S.A.S. Dragon Holdings Limited is an investment holding company that distributes electronic components and semiconductor products across various regions including Hong Kong, Mainland China, Taiwan, the USA, Vietnam, Singapore, Macao and internationally, with a market cap of HK$2.50 billion.

Operations: The company generates HK$26.73 billion in revenue from the distribution of electronic components and semiconductor products.

Dividend Yield: 10%

S.A.S. Dragon Holdings announced an interim dividend of HK$0.15 per share for the six months ended June 30, 2024, with payment on October 9, 2024. The company reported strong earnings growth with sales reaching HK$13.64 billion and net income at HK$330.29 million for the first half of 2024. Despite a reasonable payout ratio of 54.1%, dividends have been volatile and not well covered by free cash flows, raising concerns about sustainability despite recent increases.

- Click to explore a detailed breakdown of our findings in S.A.S. Dragon Holdings' dividend report.

- Our valuation report here indicates S.A.S. Dragon Holdings may be undervalued.

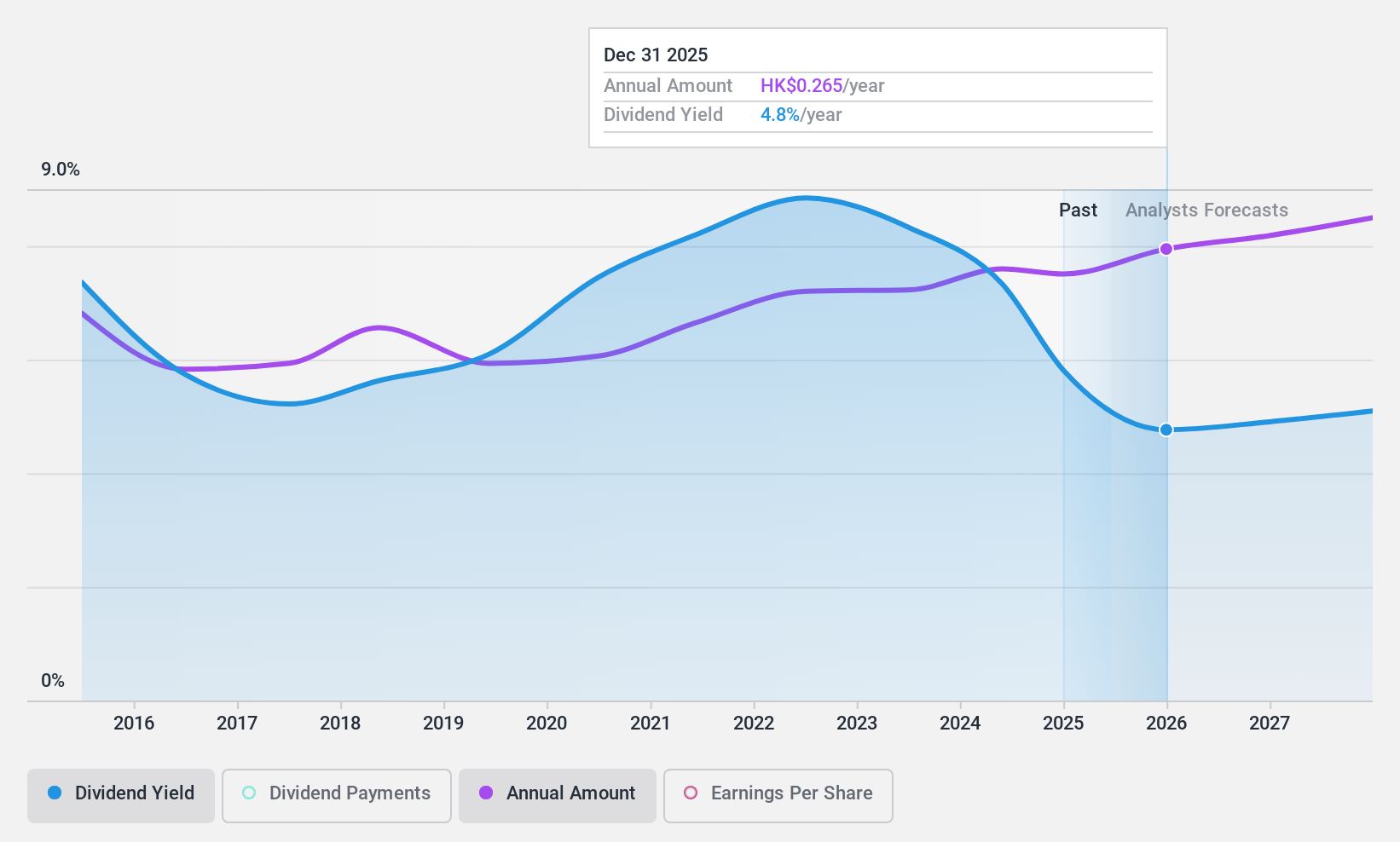

Agricultural Bank of China (SEHK:1288)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Agricultural Bank of China Limited, along with its subsidiaries, offers a range of banking products and services and has a market cap of approximately HK$1.67 trillion.

Operations: Agricultural Bank of China Limited generates revenue from several segments, including Personal Banking (CN¥310.36 billion), Corporate Banking (CN¥196.96 billion), and Treasury Operations (CN¥36.07 billion).

Dividend Yield: 7.2%

Agricultural Bank of China, trading at 72% below its estimated fair value, offers a reliable dividend yield of 7.23%, though it is lower than the top 25% in Hong Kong. With a low payout ratio of 31.8%, dividends are well-covered and stable over the past decade. Recent earnings showed slight growth with net income rising to CNY135.89 billion for H1 2024, alongside board changes and approved interim cash dividends totaling RMB40.74 billion for shareholders in January 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Agricultural Bank of China.

- The analysis detailed in our Agricultural Bank of China valuation report hints at an deflated share price compared to its estimated value.

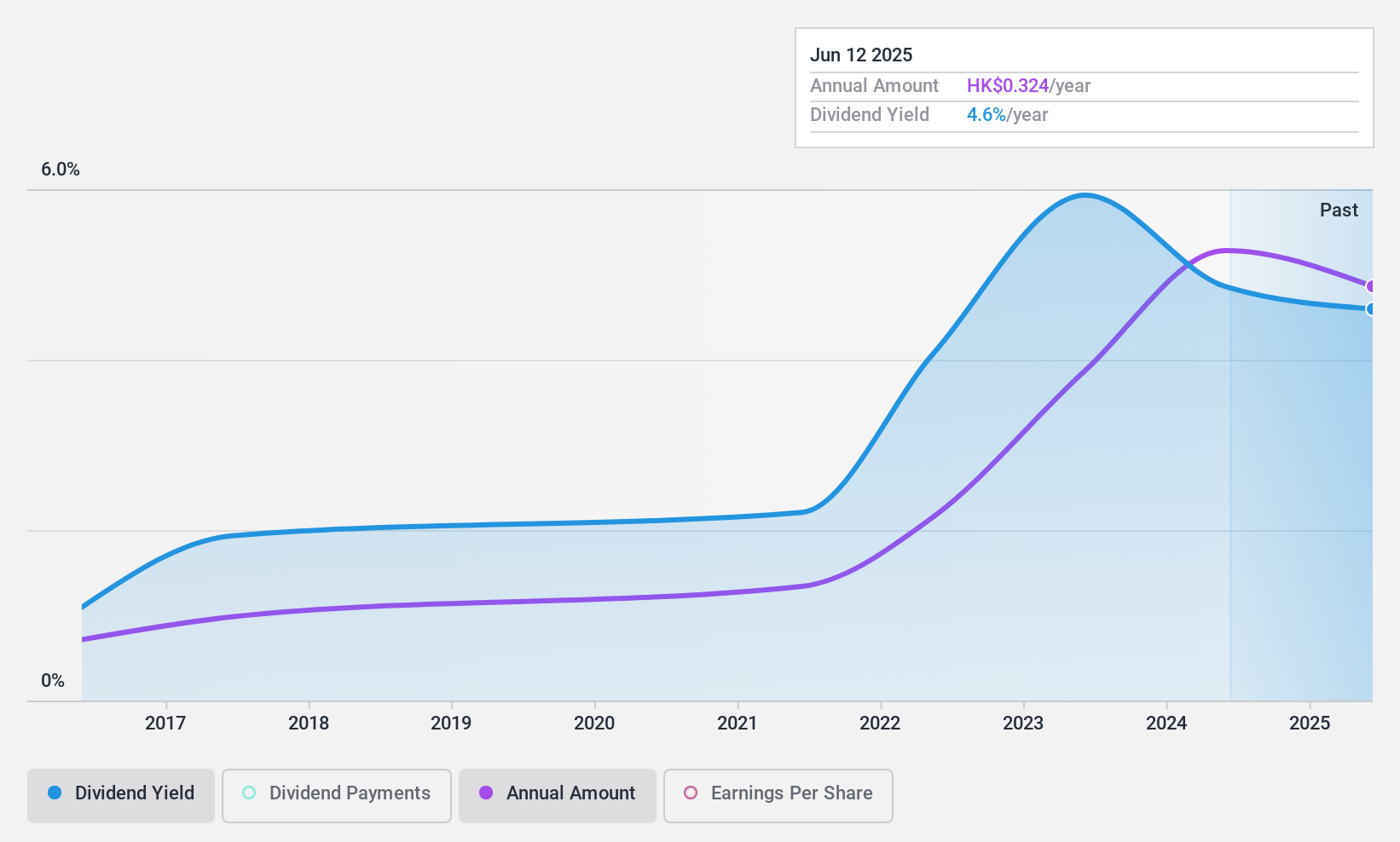

First Tractor (SEHK:38)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited engages in the research, development, manufacture, and sale of agricultural and power machinery worldwide, with a market cap of HK$16.18 billion.

Operations: First Tractor Company Limited generates revenue from the sale of agricultural and power machinery, along with related products.

Dividend Yield: 4.4%

First Tractor reported H1 2024 earnings with net income rising to CNY 905.35 million from CNY 754.14 million a year ago, reflecting strong profitability. The company trades at a good value, 28.2% below estimated fair value, and offers a dividend yield of 4.44%, lower than the top quartile in Hong Kong but well-covered by both earnings and cash flows with payout ratios of 31.3% and 40.2%, respectively, despite having an unstable dividend history over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of First Tractor.

- Our comprehensive valuation report raises the possibility that First Tractor is priced lower than what may be justified by its financials.

Make It Happen

- Navigate through the entire inventory of 74 Top SEHK Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:38

First Tractor

Engages in the research and development, manufacture, and sale of agricultural and power machinery, and related products worldwide.

Flawless balance sheet with proven track record and pays a dividend.