- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:SPK

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, with major indices experiencing fluctuations, investors are increasingly seeking stability amidst the volatility. In this environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.08% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.63% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

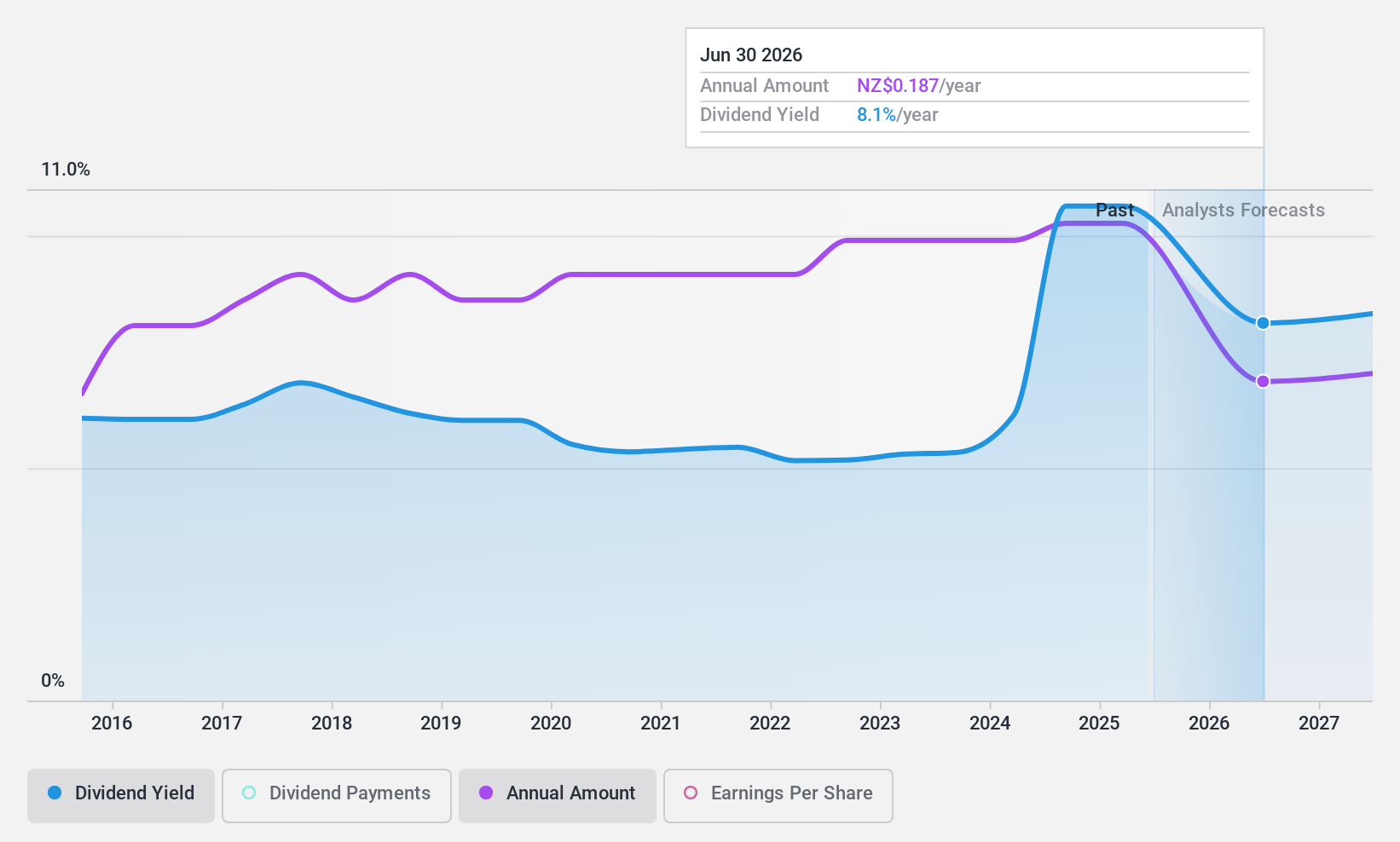

Spark New Zealand (NZSE:SPK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spark New Zealand Limited, along with its subsidiaries, offers telecommunications and digital services in New Zealand and has a market cap of NZ$5.45 billion.

Operations: Spark New Zealand Limited generates revenue from several segments, including Voice (NZ$180 million), Mobile (NZ$1.47 billion), Broadband (NZ$613 million), IT Products (NZ$527 million), IT Services (NZ$165 million), Data Centres (NZ$37 million), and Procurement and Partners (NZ$548 million).

Dividend Yield: 9.2%

Spark New Zealand's dividend yield is among the top 25% in the NZ market, but recent guidance indicates a decrease from 27.5 to 25 cents per share for 2025. While dividends have been stable and reliable over the past decade, they are not well covered by earnings or cash flow due to high payout ratios. The company is trading below its fair value estimate, but it faces challenges with declining profit margins and high debt levels.

- Unlock comprehensive insights into our analysis of Spark New Zealand stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Spark New Zealand shares in the market.

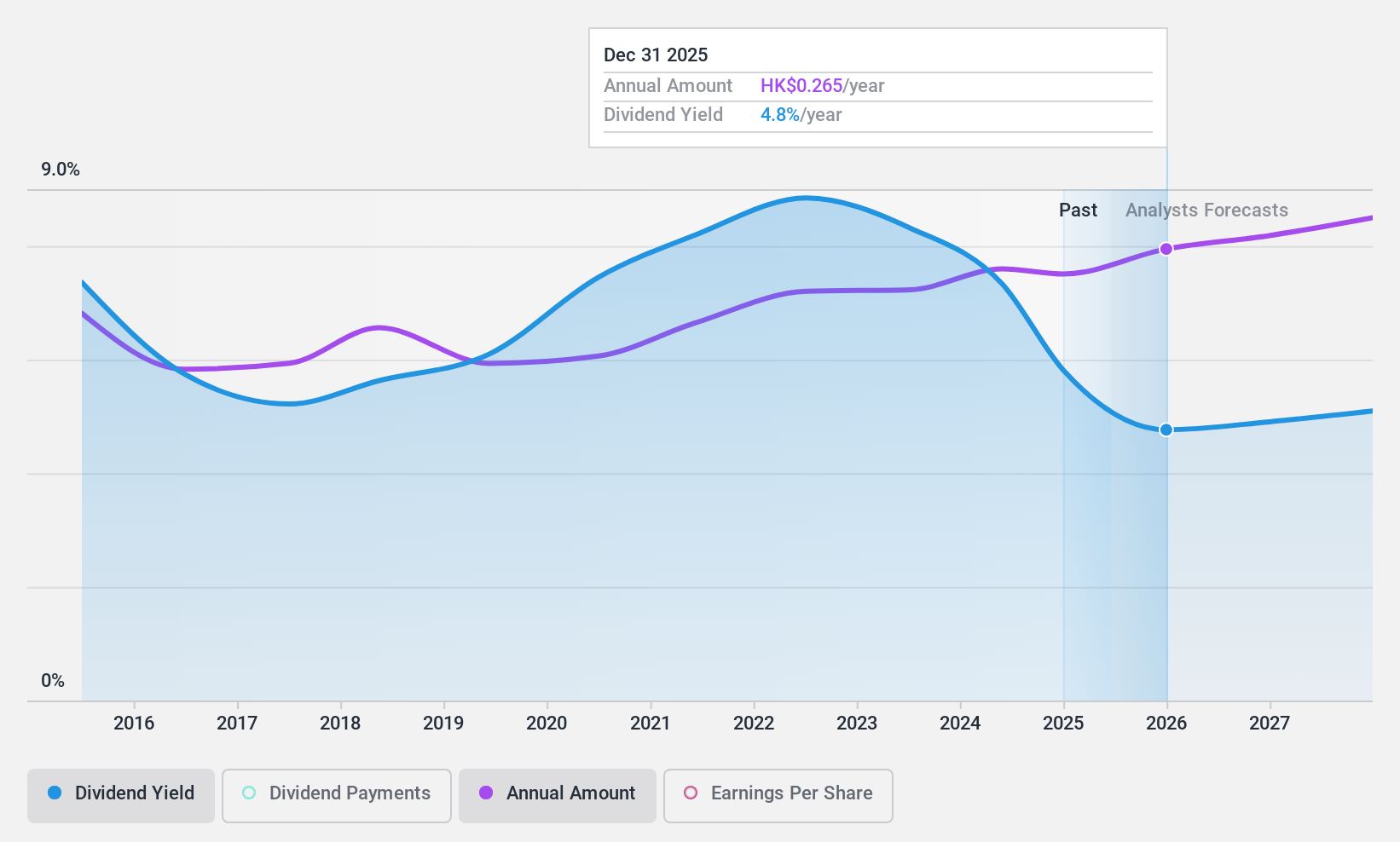

Agricultural Bank of China (SEHK:1288)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Agricultural Bank of China Limited, along with its subsidiaries, offers a range of banking products and services and has a market cap of HK$1.78 trillion.

Operations: Agricultural Bank of China's revenue segments include Corporate Banking (CN¥348.50 billion), Personal Banking (CN¥292.75 billion), Treasury Operations (CN¥190.25 billion), and Asset Management and Other Services (CN¥15.60 billion).

Dividend Yield: 6.3%

Agricultural Bank of China offers a stable dividend, supported by a low payout ratio of 47.3%, ensuring dividends are well covered by earnings. Although its 6.27% yield is below the top tier in Hong Kong, it remains attractive due to consistent growth and stability over the past decade. Recent earnings show modest growth, with net income increasing to CNY 78.48 billion for Q3 2024, underpinning its ability to sustain future payouts effectively.

- Dive into the specifics of Agricultural Bank of China here with our thorough dividend report.

- The valuation report we've compiled suggests that Agricultural Bank of China's current price could be quite moderate.

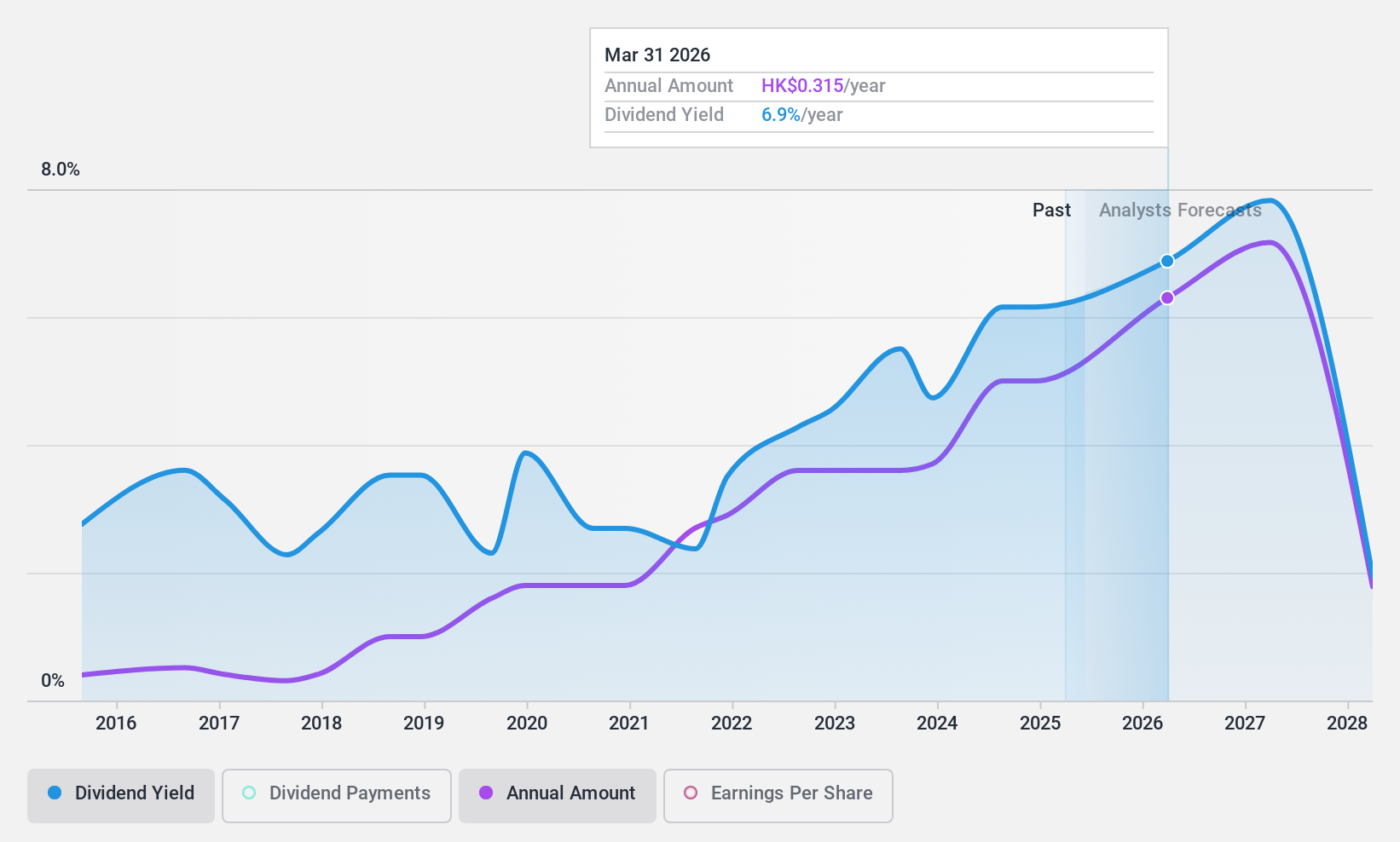

Bosideng International Holdings (SEHK:3998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People's Republic of China with a market cap of HK$50.59 billion.

Operations: Bosideng International Holdings Limited generates revenue primarily from Down Apparels (CN¥19.54 billion), followed by Original Equipment Manufacturing (OEM) Management (CN¥2.70 billion), Ladieswear Apparels (CN¥819.80 million), and Diversified Apparels (CN¥235.33 million).

Dividend Yield: 5.3%

Bosideng International Holdings has shown dividend growth over the past decade, though its payments have been volatile, with drops exceeding 20% annually. The company recently approved a final dividend of HK$0.20 per share. Despite a high payout ratio of 80.4%, dividends are covered by earnings and cash flows, with a cash payout ratio at 36.6%. A strategic partnership with Moose Knuckles may bolster Bosideng's global expansion efforts and revenue growth prospects.

- Get an in-depth perspective on Bosideng International Holdings' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Bosideng International Holdings' share price might be too pessimistic.

Summing It All Up

- Explore the 1937 names from our Top Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SPK

Spark New Zealand

Provides telecommunications and digital services in New Zealand.

Adequate balance sheet average dividend payer.