- Hong Kong

- /

- Auto Components

- /

- SEHK:6830

With EPS Growth And More, Huazhong In-Vehicle Holdings (HKG:6830) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Huazhong In-Vehicle Holdings (HKG:6830). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Huazhong In-Vehicle Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for Huazhong In-Vehicle Holdings

How Quickly Is Huazhong In-Vehicle Holdings Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Huazhong In-Vehicle Holdings has managed to grow EPS by 19% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

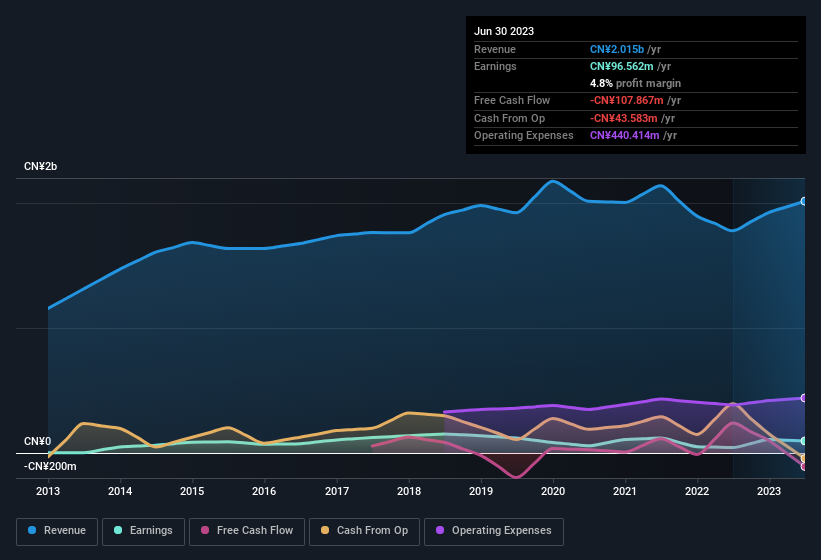

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Huazhong In-Vehicle Holdings maintained stable EBIT margins over the last year, all while growing revenue 13% to CN¥2.0b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Huazhong In-Vehicle Holdings Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Huazhong In-Vehicle Holdings insiders own a meaningful share of the business. To be exact, company insiders hold 75% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. This insider holding amounts to This is an incredible endorsement from them.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Huazhong In-Vehicle Holdings, with market caps between CN¥1.5b and CN¥5.8b, is around CN¥3.1m.

Huazhong In-Vehicle Holdings' CEO took home a total compensation package worth CN¥1.9m in the year leading up to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Huazhong In-Vehicle Holdings Deserve A Spot On Your Watchlist?

You can't deny that Huazhong In-Vehicle Holdings has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the key takeaway is that Huazhong In-Vehicle Holdings is worth keeping an eye on. Before you take the next step you should know about the 2 warning signs for Huazhong In-Vehicle Holdings (1 is a bit unpleasant!) that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Huazhong In-Vehicle Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6830

Huazhong In-Vehicle Holdings

An investment holding company, manufactures, supplies, and sells automobile body parts in Mainland China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026