Guangzhou Automobile Group (SEHK:2238): Assessing Valuation as Shares Gain Momentum

Reviewed by Kshitija Bhandaru

Guangzhou Automobile Group (SEHK:2238) shares have caught the eye of investors recently, especially after their one-year total return reached 6% and quarterly returns jumped 13%. Let’s take a closer look at what is driving this performance.

See our latest analysis for Guangzhou Automobile Group.

The recent climb in Guangzhou Automobile Group's share price, capped by a strong 13% rise over the past quarter, signals growing optimism about its near-term prospects. Even though its one-year total shareholder return sits at 6%, longer-term returns remain subdued. However, current momentum suggests sentiment may be shifting in its favor.

Curious what other auto stocks are on the move? Now might be the perfect time to discover See the full list for free.

With shares up recently but long-term returns lagging, the real question is whether Guangzhou Automobile Group is trading at an attractive valuation now, or if investors have already priced in expectations for a strong rebound ahead.

Price-To-Sales of 0.3x: Is it justified?

Guangzhou Automobile Group is currently trading at a price-to-sales (P/S) ratio of just 0.3x, notably below both peers and the industry. At the last close price of HK$3.37, this suggests that the market is not attributing much future growth or profitability to the company when compared to similar stocks.

The price-to-sales ratio compares a company’s market capitalization to its total revenue. For auto makers like Guangzhou Automobile Group, it is a widely used metric because earnings can fluctuate significantly from year to year, making sales a steadier baseline for comparison.

Trading at a P/S multiple far beneath the peer average of 4.8x and the Asian industry average of 1.1x signals a pronounced discount. This may imply investors remain cautious, possibly due to lack of recent profitability or slower revenue growth. Relative to an estimated fair ratio of 0.5x, the current valuation is still attractive and could leave room for upside if sales stabilize or profitability returns.

Explore the SWS fair ratio for Guangzhou Automobile Group

Result: Price-to-Sales of 0.3x (UNDERVALUED)

However, persistent losses and only modest revenue growth could continue to weigh on investor sentiment, especially if competition in the sector intensifies further.

Find out about the key risks to this Guangzhou Automobile Group narrative.

Another View: What Does the SWS DCF Model Say?

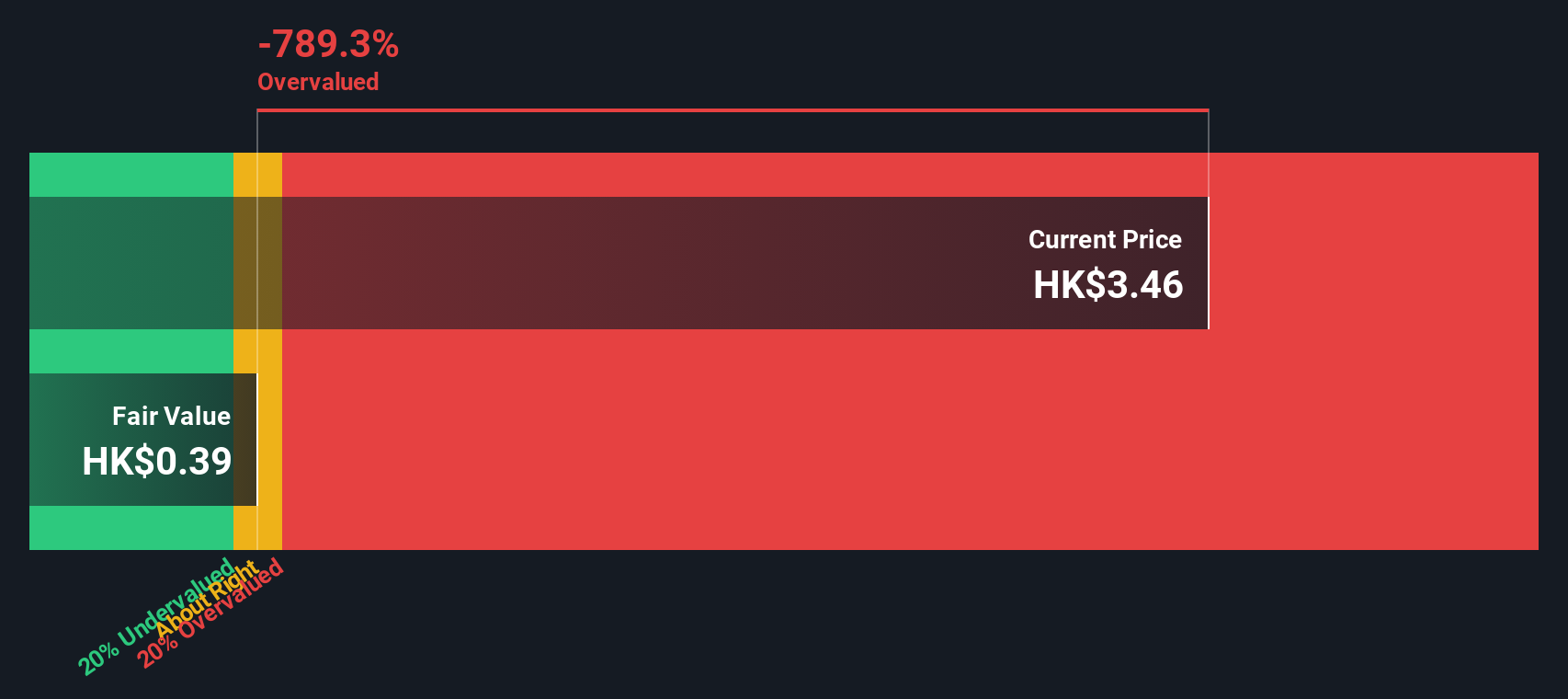

While the low price-to-sales ratio makes Guangzhou Automobile Group appear undervalued, our DCF model offers a very different perspective. According to the SWS DCF model, the current share price of HK$3.37 is actually above its estimated fair value of HK$0.41. This suggests the stock may be overvalued on this measure. This raises the question: which viewpoint provides a more realistic picture for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guangzhou Automobile Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guangzhou Automobile Group Narrative

If you see things differently or want a hands-on look at the numbers, you can quickly shape your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Guangzhou Automobile Group.

Looking for more investment ideas?

Don’t let fresh opportunities pass you by. Put yourself ahead of other investors by screening for smart picks you might not have considered yet.

- Tap into tomorrow’s market leaders by checking out these 896 undervalued stocks based on cash flows with solid fundamentals and attractive valuations others may have overlooked.

- Benefit from rising passive income trends by reviewing these 19 dividend stocks with yields > 3% featuring yields above 3% and robust payout histories.

- Spot breakthrough tech by targeting these 24 AI penny stocks focused on advancements in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2238

Guangzhou Automobile Group

Research, develops, manufactures, and sells vehicles and motorcycles, and parts and components in Mainland China and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion