Here's What BAIC Motor's (HKG:1958) Strong Returns On Capital Mean

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Ergo, when we looked at the ROCE trends at BAIC Motor (HKG:1958), we liked what we saw.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on BAIC Motor is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.23 = CN¥21b ÷ (CN¥177b - CN¥88b) (Based on the trailing twelve months to June 2022).

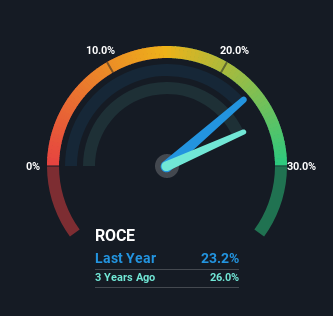

Thus, BAIC Motor has an ROCE of 23%. That's a fantastic return and not only that, it outpaces the average of 1.6% earned by companies in a similar industry.

Check out our latest analysis for BAIC Motor

Above you can see how the current ROCE for BAIC Motor compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

How Are Returns Trending?

It's hard not to be impressed by BAIC Motor's returns on capital. The company has consistently earned 23% for the last five years, and the capital employed within the business has risen 28% in that time. Now considering ROCE is an attractive 23%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. If BAIC Motor can keep this up, we'd be very optimistic about its future.

On a side note, BAIC Motor's current liabilities are still rather high at 49% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Bottom Line On BAIC Motor's ROCE

BAIC Motor has demonstrated its proficiency by generating high returns on increasing amounts of capital employed, which we're thrilled about. What's surprising though is that the stock has collapsed 73% over the last five years, so there might be other areas of the business hurting its prospects. So in light of that'd we think it's worthwhile looking further into this stock to see if there's any areas for concern.

On a separate note, we've found 1 warning sign for BAIC Motor you'll probably want to know about.

BAIC Motor is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

Valuation is complex, but we're here to simplify it.

Discover if BAIC Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1958

BAIC Motor

Engages in the research and development, manufacture, sale, and after-sale service of passenger vehicles in the People’s Republic of China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives