- Hong Kong

- /

- Auto Components

- /

- SEHK:179

Here's Why Johnson Electric Holdings (HKG:179) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Johnson Electric Holdings (HKG:179). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Johnson Electric Holdings

Johnson Electric Holdings' Improving Profits

In the last three years Johnson Electric Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Johnson Electric Holdings' EPS catapulted from US$0.12 to US$0.24, over the last year. Year on year growth of 98% is certainly a sight to behold.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Johnson Electric Holdings shareholders can take confidence from the fact that EBIT margins are up from 2.0% to 7.9%, and revenue is growing. That's great to see, on both counts.

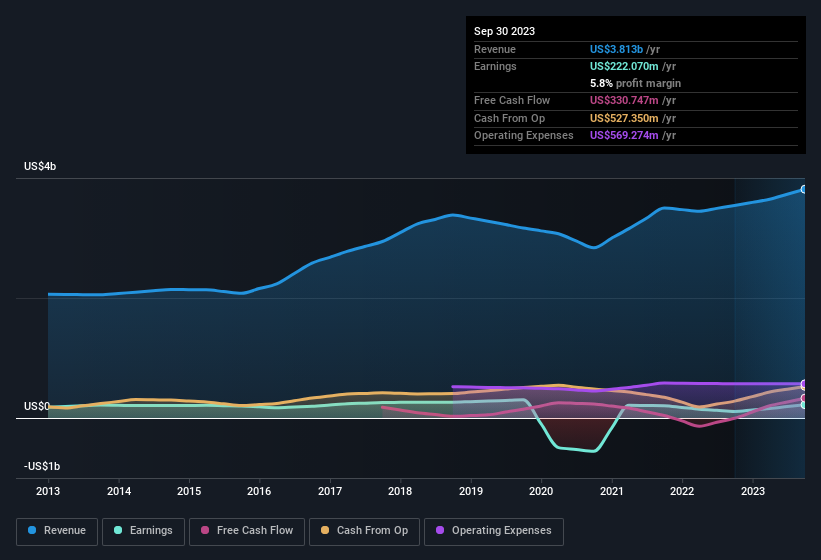

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Johnson Electric Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent US$11m buying Johnson Electric Holdings shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Honorary Chairman, Yik-Chun Wang Koo, who made the biggest single acquisition, paying HK$11m for shares at about HK$9.22 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Johnson Electric Holdings will reveal that insiders own a significant piece of the pie. In fact, they own 69% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. And their holding is extremely valuable at the current share price, totalling US$8.2b. That means they have plenty of their own capital riding on the performance of the business!

Does Johnson Electric Holdings Deserve A Spot On Your Watchlist?

Johnson Electric Holdings' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Johnson Electric Holdings deserves timely attention. You still need to take note of risks, for example - Johnson Electric Holdings has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Johnson Electric Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:179

Johnson Electric Holdings

An investment holding company, engages in the manufacture and sale of motion systems worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives