Does BYD’s Share Price Drop Signal a New Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you are wondering whether BYD stock deserves a spot in your portfolio, you are definitely not alone. The company’s recent share price moves have given both bulls and bears something to talk about. After a dip of 1.4% over the past week and an 8.5% decline in the last month, it is tempting to ask if the market is recalibrating its view of BYD’s growth potential or simply reacting to short-term noise. Still, when you take a step back, the longer-term story looks remarkably strong, with shares up 20.7% year-to-date and a 127.7% gain over the past five years.

Some of these moves can be tied to the shifting landscape for electric vehicles, as global EV demand continues to expand and BYD’s international ambitions keep making the news. For example, the company’s launch of new models targeting overseas markets and headlines around supply chain innovation have fueled optimism. At the same time, competitors refocusing their strategies have also put BYD in the spotlight. Even with the stock’s recent volatility, the core question remains the same for investors: is BYD undervalued right now?

According to a recent valuation score, BYD checks the box for undervaluation on three out of six major measures. That is a value score of 3, which is respectable but not a runaway bargain. Of course, any single score is just the start. Let’s dig into how each approach stacks up and see how this can help provide a clearer picture of BYD’s true worth by the end of this article.

Why BYD is lagging behind its peers

Approach 1: BYD Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future free cash flows and then discounting those amounts back to today's value. This approach helps investors look beyond short-term swings and focus on the underlying cash generation potential of the business.

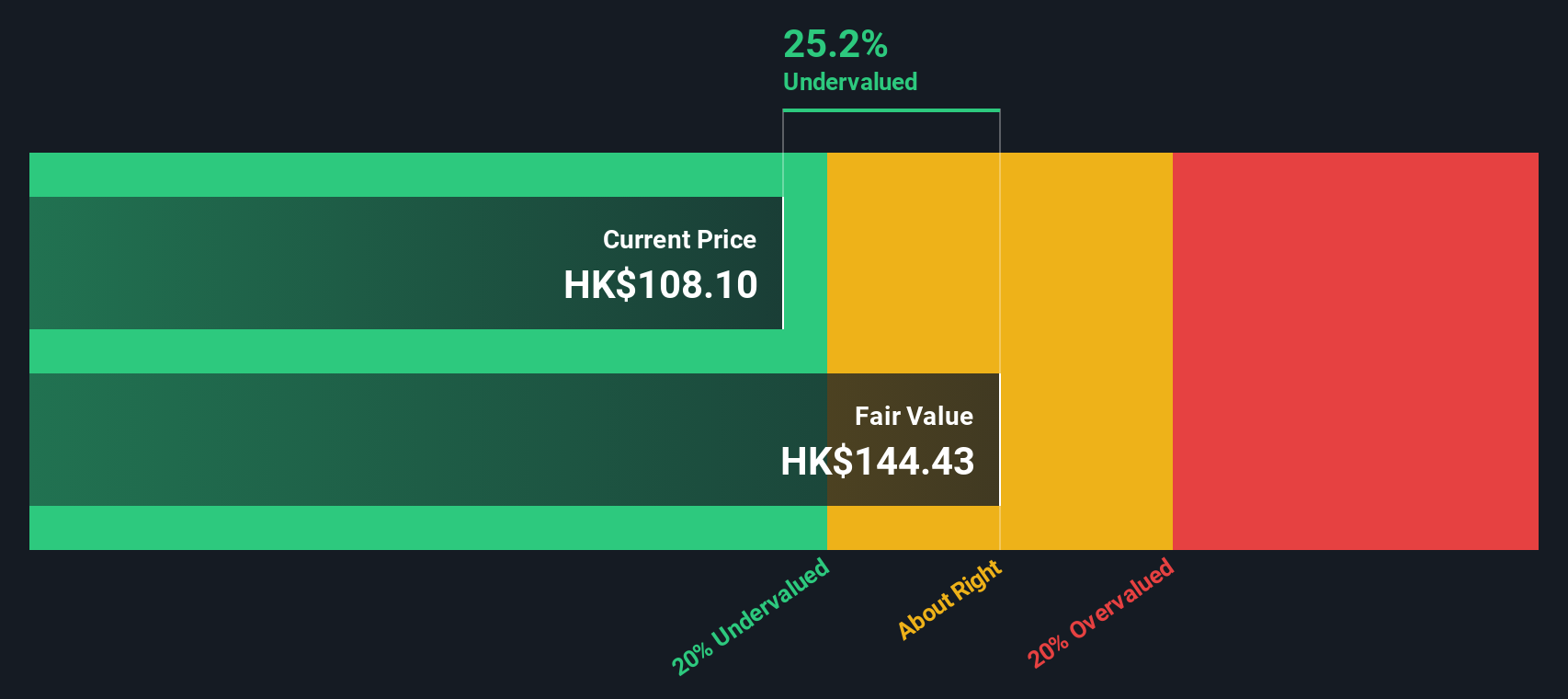

For BYD, the most recently reported trailing twelve months free cash flow stands at a negative CN¥124.3 million. However, estimates point to a rapid turnaround and strong growth ahead. By 2027, analysts project BYD's free cash flow will reach roughly CN¥78.8 billion, and extended forecasts suggest this could climb to more than CN¥121.7 billion in 2035. These gains reflect both anticipated market demand and BYD's aggressive international expansion.

Plugging these figures into a two-stage DCF model, BYD's intrinsic value is estimated at HK$122.47 per share. With the current stock price trading about 15.2% lower than this estimate, the DCF model indicates BYD is undervalued at today's levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BYD is undervalued by 15.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: BYD Price vs Earnings

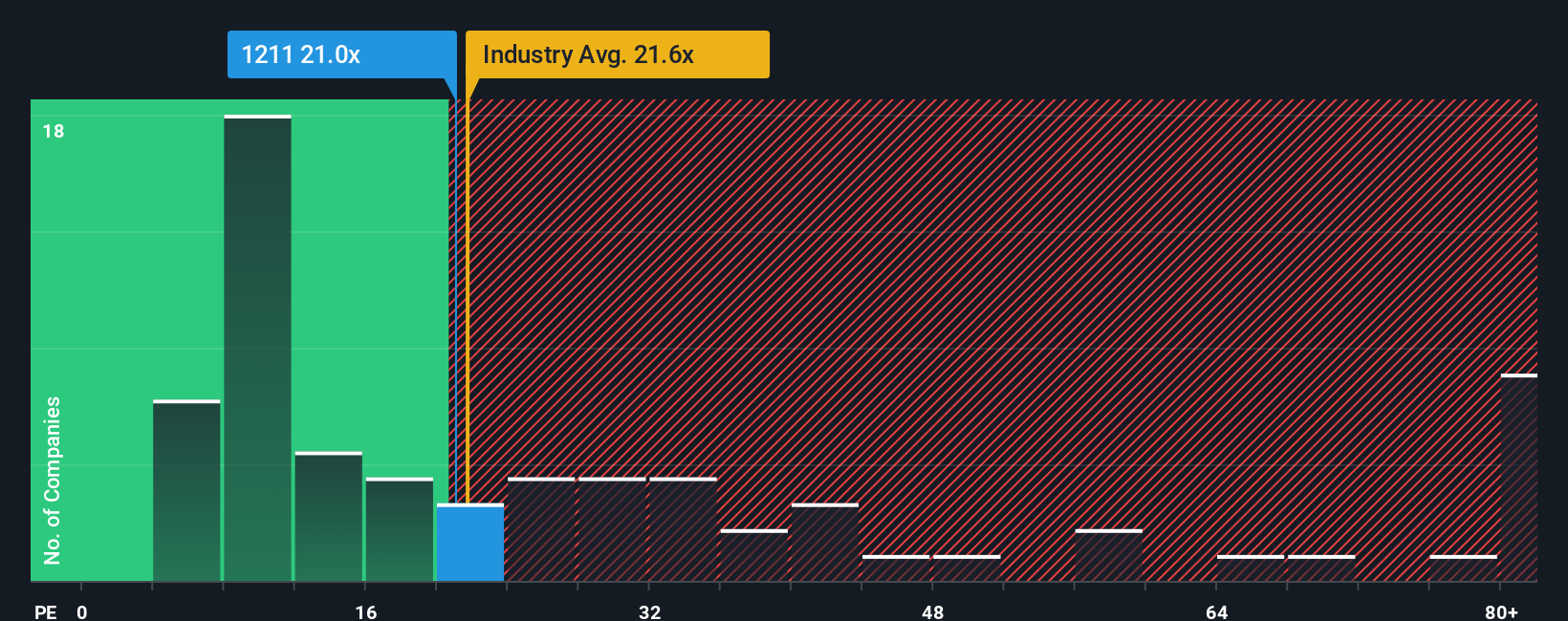

The price-to-earnings (PE) ratio is a widely used valuation method for profitable businesses because it relates the company's market value to its underlying earnings. For investors, it provides a straightforward way to compare how much the market is willing to pay for a dollar of earnings today relative to other businesses.

It is important to note that what counts as a “normal” or “fair” PE ratio depends on several factors, especially a company's expected growth and risk. Fast-growing, less risky companies can often support higher PE multiples. In contrast, slower growth or greater uncertainty typically translates to lower ratios.

Currently, BYD trades at a PE ratio of 20.68x. In comparison, the average PE for its auto industry peers stands at 9.56x, and the wider auto industry average is 18.38x. The proprietary “Fair Ratio” calculated by Simply Wall St, which incorporates BYD’s growth outlook, margins, industry, market cap, and risk factors, sits at 17.35x. Unlike a basic peer or industry comparison, the Fair Ratio gives a more tailored benchmark by taking into account both company-specific and broader market characteristics.

With the current PE just moderately above its Fair Ratio, the numbers suggest that BYD is slightly overvalued but not dramatically so. The difference is not large enough to signal the stock is either a bargain or materially overpriced.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BYD Narrative

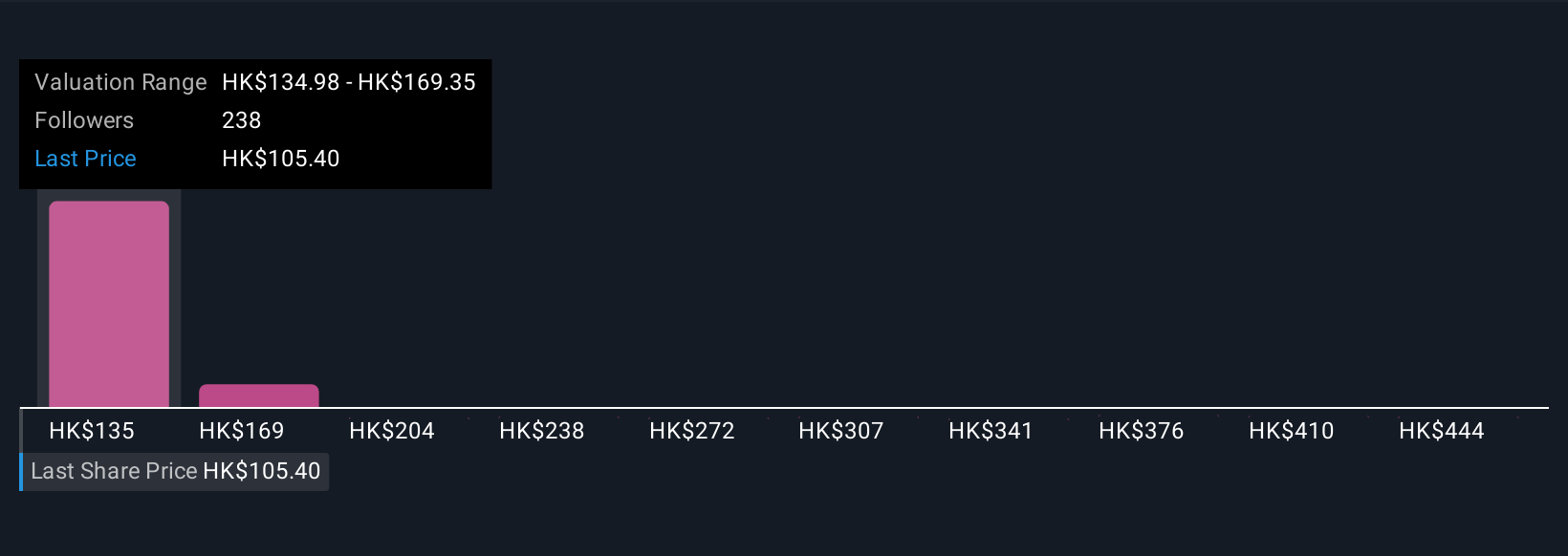

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story about a company that supports your own estimates for its fair value, future revenue, profits, and margins. Instead of only relying on numbers and ratios, Narratives let you connect the company's overall story to your financial forecast and tie it directly to a fair value outcome. These tools are easy to use and available to millions of investors through the Community page on Simply Wall St’s platform.

Narratives help you confidently decide when to buy or sell by comparing your Fair Value calculation with the current price. They automatically update whenever important news or results come in. For instance, one BYD investor’s Narrative might see tremendous international growth and set the highest fair value, while another might take a more cautious approach and arrive at the lowest fair value. By using Narratives, you can clearly see how different perspectives lead to different decisions, making investment more dynamic and adaptable to new information.

Do you think there's more to the story for BYD? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives