BYD (SEHK:1211): Evaluating the Current Valuation and Long-Term Growth Outlook

Reviewed by Kshitija Bhandaru

See our latest analysis for BYD.

BYD’s share price has been relatively steady around HK$109, with momentum building over the past year as investors recognize the company’s consistent growth and ability to adapt amid industry shifts. BYD’s 1-year total shareholder return stands at a modest 8.6%. Its three- and five-year total returns of 71% and 177% respectively underscore substantial long-term value creation for patient investors.

If you’re tracking the fast-changing auto landscape, this could be an ideal time to discover other leading electric and traditional auto manufacturers using our curated list: See the full list for free.

Given BYD’s strong track record and recent share price stability, the real question for investors is whether the current valuation offers untapped upside or if the market has already accounted for all of the company’s future gains.

Price-to-Earnings of 21.7x: Is it justified?

BYD’s shares trade at a price-to-earnings (P/E) ratio of 21.7x, higher than both the industry standard and its own estimated fair ratio. This suggests the market is currently pricing in strong growth prospects or unique advantages for the company.

The P/E ratio measures how much investors are willing to pay per dollar of earnings, making it a key gauge of valuation for auto manufacturers. For BYD, the market is assigning a premium compared to peers in Asia and to its own fair value benchmark. This may reflect optimism around future earnings growth or competitive positioning.

However, at 21.7x, this multiple is slightly higher than the Asian auto industry average of 21.6x and also exceeds the peer average of 9.9x. Compared to its estimated fair price-to-earnings ratio of 17.8x, BYD’s shares appear expensive. This indicates that further earnings growth is already priced in or that the company is viewed as a sector leader.

Explore the SWS fair ratio for BYD

Result: Price-to-Earnings of 21.7x (OVERVALUED)

However, accelerating competition from global peers or unexpected shifts in demand could challenge BYD’s premium valuation and reduce investor sentiment in the months ahead.

Find out about the key risks to this BYD narrative.

Another View: Discounted Cash Flow Perspective

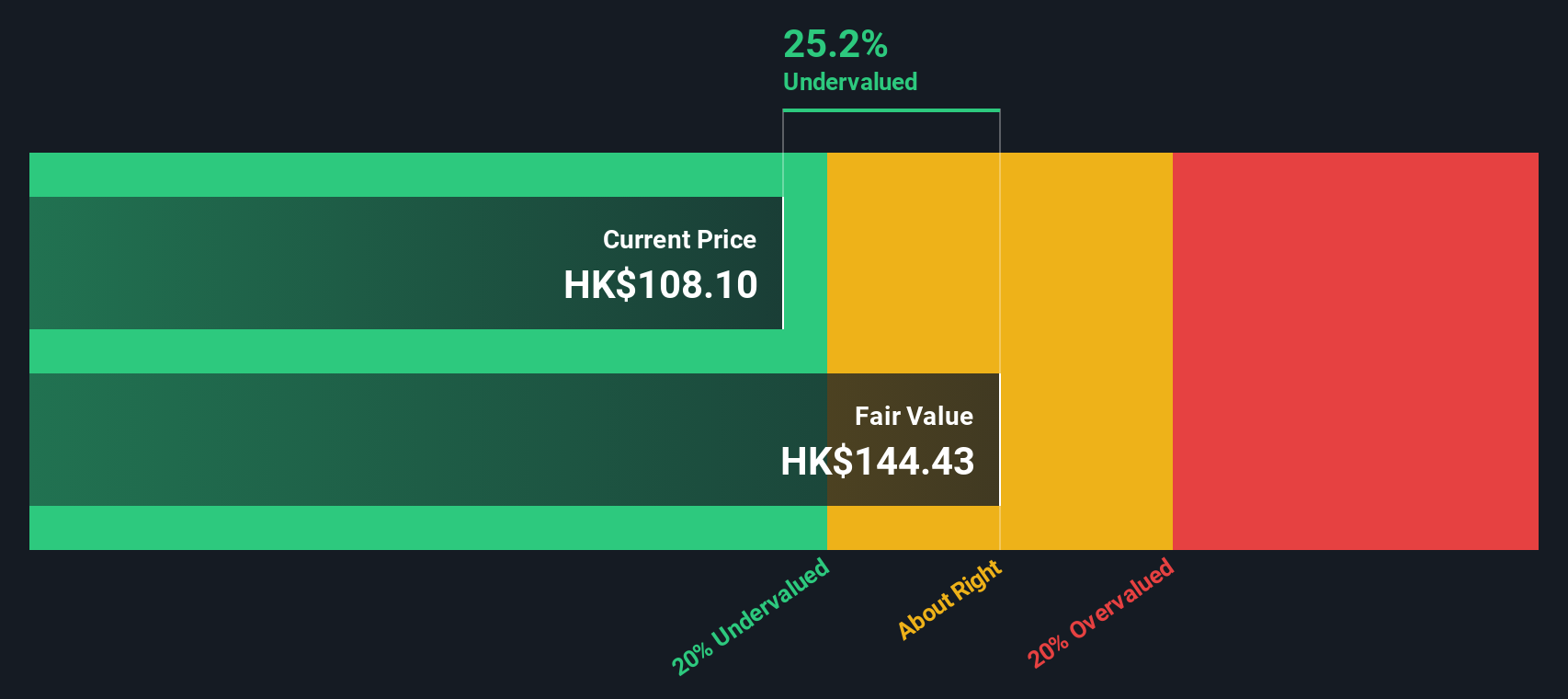

While the market's price-to-earnings ratio paints BYD as overvalued, the SWS DCF model offers a different angle. BYD’s current share price of HK$109.4 is nearly 24% below our estimate of fair value at HK$144.21. This suggests shares may actually be undervalued based on future cash flows. Could the market be missing something significant, or is this a sign that the models diverge as industry dynamics shift?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BYD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BYD Narrative

Keep in mind, if you see things differently or want to dive deeper into the data yourself, you can quickly put together your own perspective in under three minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BYD.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Uncover your next smart investment move with ideas that could transform your portfolio and keep you ahead of the crowd.

- Unleash the potential of high-yield assets by sifting through these 19 dividend stocks with yields > 3% boasting impressive returns above 3% for income-focused investors.

- Accelerate your portfolio’s growth by targeting innovation leaders using these 24 AI penny stocks poised at the intersection of artificial intelligence and market disruption.

- Capture value before the rest of the market catches on with these 910 undervalued stocks based on cash flows that may be set for a rebound based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives