- Hong Kong

- /

- Auto Components

- /

- SEHK:1148

Does Xinchen China Power Holdings' (HKG:1148) CEO Salary Compare Well With Industry Peers?

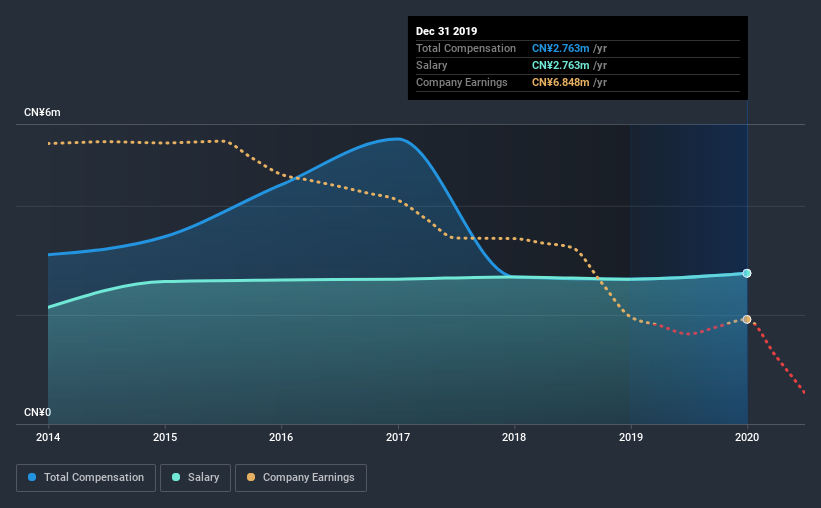

Yunxian Wang is the CEO of Xinchen China Power Holdings Limited (HKG:1148), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also assess whether Xinchen China Power Holdings pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Xinchen China Power Holdings

Comparing Xinchen China Power Holdings Limited's CEO Compensation With the industry

Our data indicates that Xinchen China Power Holdings Limited has a market capitalization of HK$455m, and total annual CEO compensation was reported as CN¥2.8m for the year to December 2019. That's just a smallish increase of 4.1% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CN¥2.8m.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥929k. Accordingly, our analysis reveals that Xinchen China Power Holdings Limited pays Yunxian Wang north of the industry median. Moreover, Yunxian Wang also holds HK$2.3m worth of Xinchen China Power Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥2.8m | CN¥2.7m | 100% |

| Other | - | - | - |

| Total Compensation | CN¥2.8m | CN¥2.7m | 100% |

On an industry level, roughly 69% of total compensation represents salary and 31% is other remuneration. On a company level, Xinchen China Power Holdings prefers to reward its CEO through a salary, opting not to pay Yunxian Wang through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Xinchen China Power Holdings Limited's Growth

Over the last three years, Xinchen China Power Holdings Limited has shrunk its earnings per share by 113% per year. Its revenue is down 37% over the previous year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Xinchen China Power Holdings Limited Been A Good Investment?

Given the total shareholder loss of 66% over three years, many shareholders in Xinchen China Power Holdings Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Xinchen China Power Holdings pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As previously discussed, Yunxian is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. This doesn't look good against shareholder returns, which have been negative for the past three years. Add to that declining EPS growth, and you have the perfect recipe for shareholder irritation. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Xinchen China Power Holdings that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Xinchen China Power Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1148

Xinchen China Power Holdings

Through its subsidiaries, engages in the development, manufacture, and sale of automotive engines primarily in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026