- Hong Kong

- /

- Auto Components

- /

- SEHK:1057

Zhejiang Shibao's (HKG:1057) Shareholders Are Down 61% On Their Shares

It is doubtless a positive to see that the Zhejiang Shibao Company Limited (HKG:1057) share price has gained some 59% in the last three months. But don't envy holders -- looking back over 5 years the returns have been really bad. In fact, the share price has declined rather badly, down some 61% in that time. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

See our latest analysis for Zhejiang Shibao

Zhejiang Shibao wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Zhejiang Shibao grew its revenue at 1.9% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 10% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Zhejiang Shibao. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

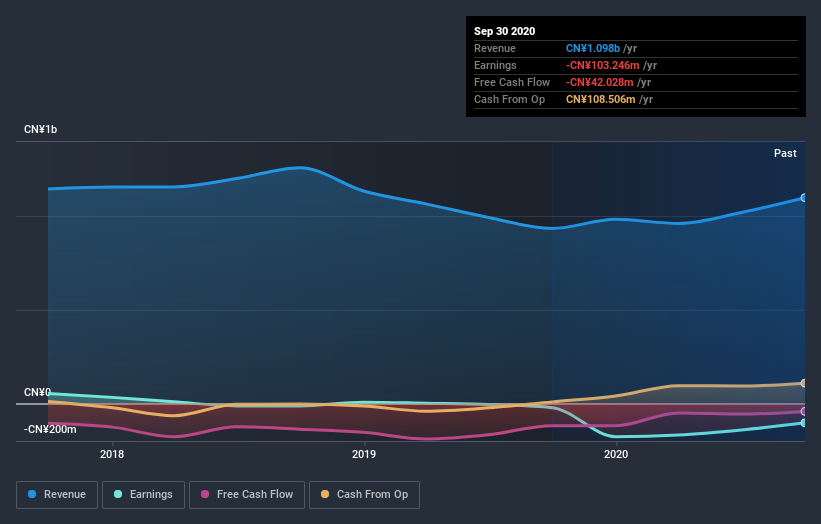

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Zhejiang Shibao's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Zhejiang Shibao shareholders have received a total shareholder return of 42% over one year. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Zhejiang Shibao is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Zhejiang Shibao or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Shibao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1057

Zhejiang Shibao

Researches, designs, develops, produces, and sells automotive steering systems and accessories in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives