- Greece

- /

- Electric Utilities

- /

- ATSE:ADMIE

Admie Holding (ATH:ADMIE) Is Growing Earnings But Are They A Good Guide?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Admie Holding's (ATH:ADMIE) statutory profits are a good guide to its underlying earnings.

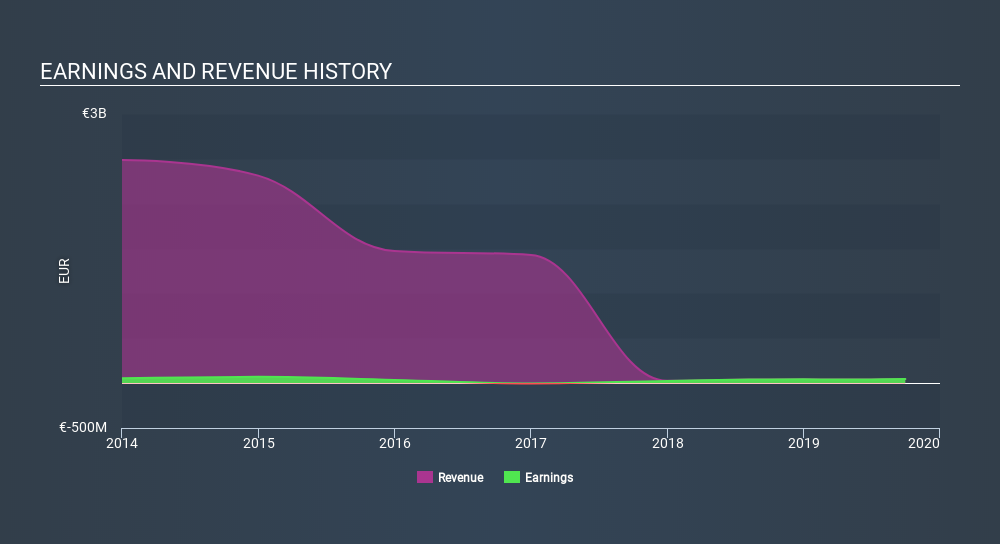

While Admie Holding was able to generate revenue of €45.8m in the last twelve months, we think its profit result of €45.9m was more important. Even though its revenue is down over the last three years, its profit has actually increased, as you can see, below.

Check out our latest analysis for Admie Holding

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Admie Holding.

Our Take On Admie Holding's Profit Performance

Therefore, it seems possible to us that Admie Holding's true underlying earnings power is actually less than its statutory profit. So while earnings quality is important, it's equally important to consider the risks facing Admie Holding at this point in time. For example, Admie Holding has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Our examination of Admie Holding has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:ADMIE

Admie Holding

Operates, controls, maintains, and develops an electricity transmission system for the supply of electricity in Greece.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives