With EPS Growth And More, Aegean Airlines (ATH:AEGN) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Aegean Airlines (ATH:AEGN), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Aegean Airlines

Aegean Airlines' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Aegean Airlines to have grown EPS from €0.63 to €1.92 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Aegean Airlines' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Aegean Airlines is growing revenues, and EBIT margins improved by 6.4 percentage points to 15%, over the last year. Both of which are great metrics to check off for potential growth.

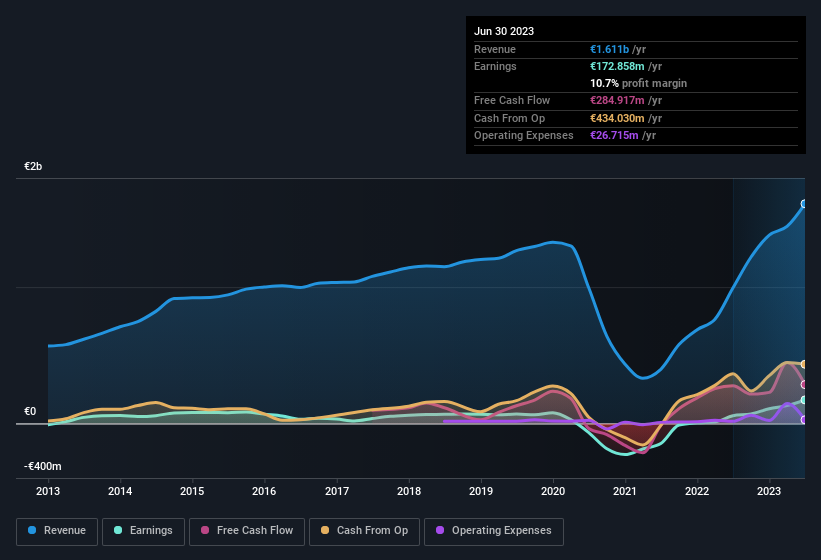

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Aegean Airlines?

Are Aegean Airlines Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One gleaming positive for Aegean Airlines, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one fell swoop, Executive Chairman Eftichios Vassilakis, spent €298k, at a price of €7.28 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

The good news, alongside the insider buying, for Aegean Airlines bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth €116m. This totals to 14% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

Should You Add Aegean Airlines To Your Watchlist?

Aegean Airlines' earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Aegean Airlines deserves timely attention. What about risks? Every company has them, and we've spotted 2 warning signs for Aegean Airlines (of which 1 doesn't sit too well with us!) you should know about.

Keen growth investors love to see insider buying. Thankfully, Aegean Airlines isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:AEGN

Aegean Airlines

Operates as an airline company that engages in the provision of public airline transportation services in Greece and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives