- Greece

- /

- Telecom Services and Carriers

- /

- ATSE:HTO

Shareholders in Hellenic Telecommunications Organization (ATH:HTO) are in the red if they invested three years ago

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Hellenic Telecommunications Organization S.A. (ATH:HTO) shareholders have had that experience, with the share price dropping 14% in three years, versus a market return of about 76%.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Hellenic Telecommunications Organization

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, Hellenic Telecommunications Organization actually managed to grow EPS by 24% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

It is a little bizarre to see the share price down, despite a strong improvement to earnings per share. So we'll have to take a look at other metrics to try to understand the price action.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. Hellenic Telecommunications Organization has maintained its top line over three years, so we doubt that has shareholders worried. So it might be worth looking at how revenue growth over time, in greater detail.

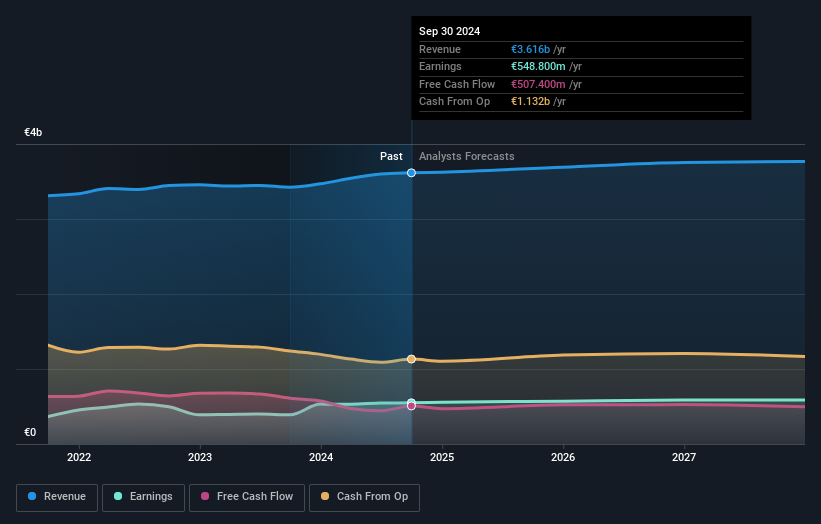

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Hellenic Telecommunications Organization has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Hellenic Telecommunications Organization stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Hellenic Telecommunications Organization, it has a TSR of -2.1% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Hellenic Telecommunications Organization shareholders have received returns of 17% over twelve months (even including dividends), which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 7%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Keeping this in mind, a solid next step might be to take a look at Hellenic Telecommunications Organization's dividend track record. This free interactive graph is a great place to start.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hellenic Telecommunications Organization might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:HTO

Hellenic Telecommunications Organization

Hellenic Telecommunications Organization S.A.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives