- Greece

- /

- Electronic Equipment and Components

- /

- ATSE:QUEST

Quest Holdings (ATH:QUEST) Ticks All The Boxes When It Comes To Earnings Growth

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Quest Holdings (ATH:QUEST), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Quest Holdings

How Fast Is Quest Holdings Growing Its Earnings Per Share?

Quest Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Quest Holdings has grown its trailing twelve month EPS from €0.37 to €0.39, in the last year. That amounts to a small improvement of 5.6%.

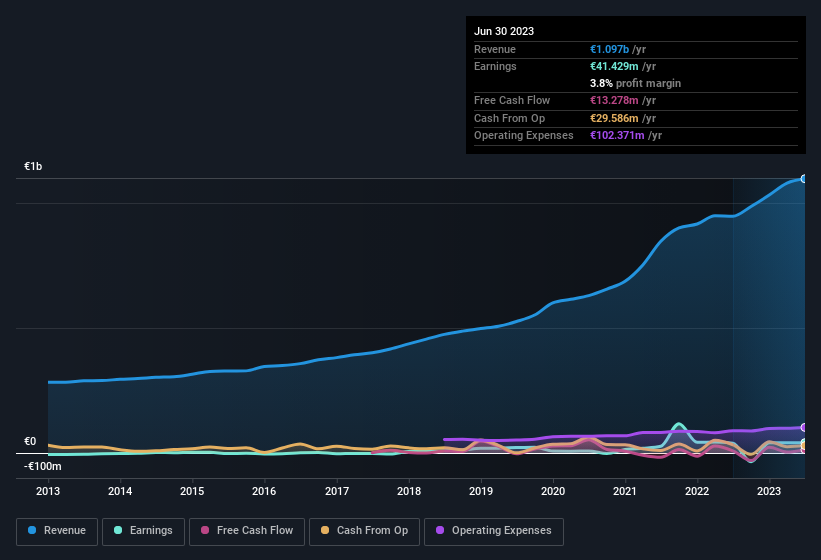

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Quest Holdings maintained stable EBIT margins over the last year, all while growing revenue 16% to €1.1b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Quest Holdings' balance sheet strength, before getting too excited.

Are Quest Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Quest Holdings insiders own a meaningful share of the business. To be exact, company insiders hold 76% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a staggering €408m. That means they have plenty of their own capital riding on the performance of the business!

Is Quest Holdings Worth Keeping An Eye On?

As previously touched on, Quest Holdings is a growing business, which is encouraging. If that's not enough on its own, there is also the rather notable levels of insider ownership. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Even so, be aware that Quest Holdings is showing 1 warning sign in our investment analysis , you should know about...

Although Quest Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Quest Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:QUEST

Quest Holdings

Engages in the distribution of information technology and telecommunications products in Greece, Romania, Cyprus, Luxembourg, Belgium, Spain, and Italy.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion