- Greece

- /

- Metals and Mining

- /

- ATSE:IKTIN

Iktinos Hellas S.A. Greek Marble Industry Technical and Touristic Company's (ATH:IKTIN) Popularity With Investors Is Under Threat From Overpricing

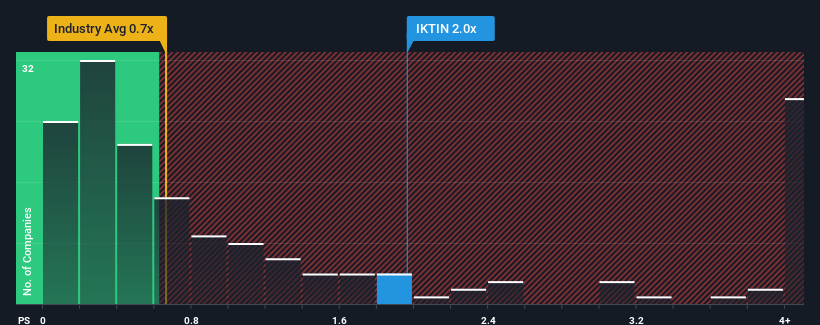

When close to half the companies in the Metals and Mining industry in Greece have price-to-sales ratios (or "P/S") below 0.3x, you may consider Iktinos Hellas S.A. Greek Marble Industry Technical and Touristic Company (ATH:IKTIN) as a stock to potentially avoid with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Iktinos Hellas Greek Marble Industry Technical and Touristic

How Iktinos Hellas Greek Marble Industry Technical and Touristic Has Been Performing

As an illustration, revenue has deteriorated at Iktinos Hellas Greek Marble Industry Technical and Touristic over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Iktinos Hellas Greek Marble Industry Technical and Touristic, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Iktinos Hellas Greek Marble Industry Technical and Touristic?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Iktinos Hellas Greek Marble Industry Technical and Touristic's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.4%. This means it has also seen a slide in revenue over the longer-term as revenue is down 19% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 1.2% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

In light of this, it's odd that Iktinos Hellas Greek Marble Industry Technical and Touristic's P/S sits above the majority of other companies. In general, when revenue shrink rapidly the P/S premium often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From Iktinos Hellas Greek Marble Industry Technical and Touristic's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Iktinos Hellas Greek Marble Industry Technical and Touristic revealed its sharp three-year contraction in revenue isn't impacting its high P/S anywhere near as much as we would have predicted, given the industry is set to shrink less severely. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 4 warning signs we've spotted with Iktinos Hellas Greek Marble Industry Technical and Touristic (including 2 which are a bit unpleasant).

If these risks are making you reconsider your opinion on Iktinos Hellas Greek Marble Industry Technical and Touristic, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:IKTIN

Iktinos Hellas Greek Marble Industry Technical and Touristic

Engages in the quarrying, processing, and trading in marbles and granites in Greece, the Euro Area, and internationally.

Slight risk with worrying balance sheet.

Market Insights

Community Narratives