Flexopack Société Anonyme Commercial and Industrial Plastics (ATH:FLEXO) Has A Pretty Healthy Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Flexopack Société Anonyme Commercial and Industrial Plastics Company (ATH:FLEXO) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Flexopack Société Anonyme Commercial and Industrial Plastics

How Much Debt Does Flexopack Société Anonyme Commercial and Industrial Plastics Carry?

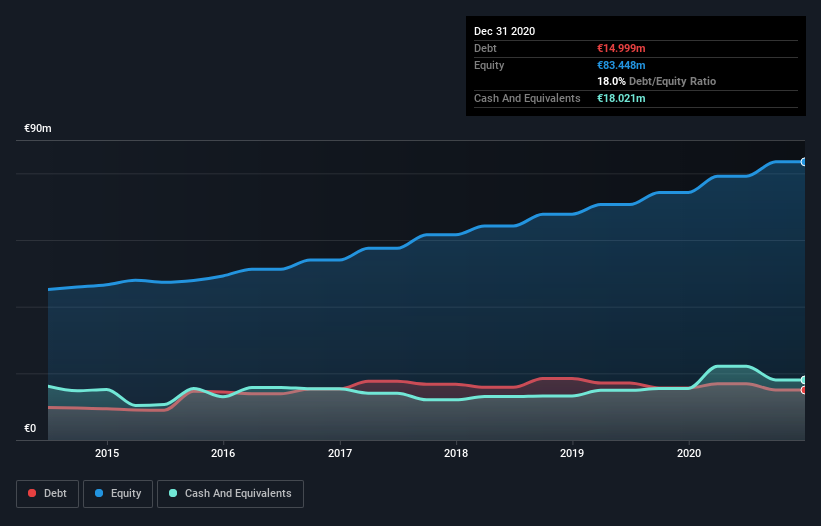

As you can see below, Flexopack Société Anonyme Commercial and Industrial Plastics had €15.0m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. But on the other hand it also has €18.0m in cash, leading to a €3.02m net cash position.

A Look At Flexopack Société Anonyme Commercial and Industrial Plastics' Liabilities

Zooming in on the latest balance sheet data, we can see that Flexopack Société Anonyme Commercial and Industrial Plastics had liabilities of €23.6m due within 12 months and liabilities of €15.8m due beyond that. On the other hand, it had cash of €18.0m and €16.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €4.64m.

Since publicly traded Flexopack Société Anonyme Commercial and Industrial Plastics shares are worth a total of €103.4m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Flexopack Société Anonyme Commercial and Industrial Plastics also has more cash than debt, so we're pretty confident it can manage its debt safely.

In addition to that, we're happy to report that Flexopack Société Anonyme Commercial and Industrial Plastics has boosted its EBIT by 60%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Flexopack Société Anonyme Commercial and Industrial Plastics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Flexopack Société Anonyme Commercial and Industrial Plastics has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Flexopack Société Anonyme Commercial and Industrial Plastics's free cash flow amounted to 37% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

We could understand if investors are concerned about Flexopack Société Anonyme Commercial and Industrial Plastics's liabilities, but we can be reassured by the fact it has has net cash of €3.02m. And it impressed us with its EBIT growth of 60% over the last year. So we don't think Flexopack Société Anonyme Commercial and Industrial Plastics's use of debt is risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Flexopack Société Anonyme Commercial and Industrial Plastics's earnings per share history for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Flexopack Société Anonyme Commercial and Industrial Plastics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ATSE:FLEXO

Flexopack Société Anonyme Commercial and Industrial Plastics

Manufactures and sells flexible plastic packaging materials for the food industry in Greece, other European countries, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives