- Greece

- /

- Metals and Mining

- /

- ATSE:ELHA

A Piece Of The Puzzle Missing From Elvalhalcor Hellenic Copper and Aluminium Industry S.A.'s (ATH:ELHA) 28% Share Price Climb

Despite an already strong run, Elvalhalcor Hellenic Copper and Aluminium Industry S.A. (ATH:ELHA) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

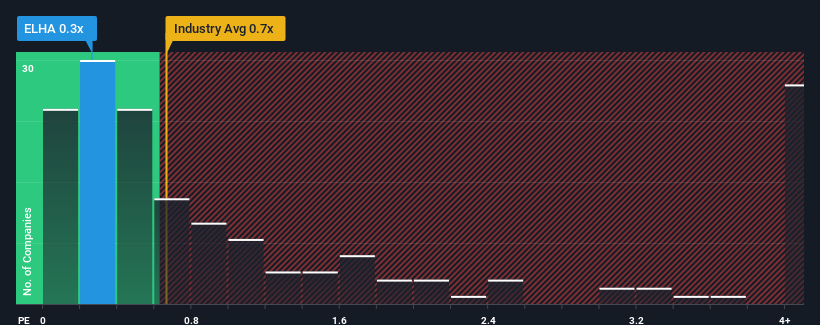

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Elvalhalcor Hellenic Copper and Aluminium Industry's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Greece is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Elvalhalcor Hellenic Copper and Aluminium Industry

How Elvalhalcor Hellenic Copper and Aluminium Industry Has Been Performing

For instance, Elvalhalcor Hellenic Copper and Aluminium Industry's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Elvalhalcor Hellenic Copper and Aluminium Industry will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Elvalhalcor Hellenic Copper and Aluminium Industry's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.8%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 74% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to shrink 0.7% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's peculiar that Elvalhalcor Hellenic Copper and Aluminium Industry's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Elvalhalcor Hellenic Copper and Aluminium Industry's P/S

Its shares have lifted substantially and now Elvalhalcor Hellenic Copper and Aluminium Industry's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Elvalhalcor Hellenic Copper and Aluminium Industry revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Elvalhalcor Hellenic Copper and Aluminium Industry is showing 4 warning signs in our investment analysis, and 1 of those is concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elvalhalcor Hellenic Copper and Aluminium Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ELHA

Elvalhalcor Hellenic Copper and Aluminium Industry

Elvalhalcor Hellenic Copper and Aluminium Industry S.A.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)