- Greece

- /

- Metals and Mining

- /

- ATSE:ALMY

Should You Be Adding Alumil Aluminium Industry (ATH:ALMY) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Alumil Aluminium Industry (ATH:ALMY). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Alumil Aluminium Industry

How Fast Is Alumil Aluminium Industry Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Outstandingly, Alumil Aluminium Industry's EPS shot from €0.22 to €0.49, over the last year. It's not often a company can achieve year-on-year growth of 117%. The best case scenario? That the business has hit a true inflection point.

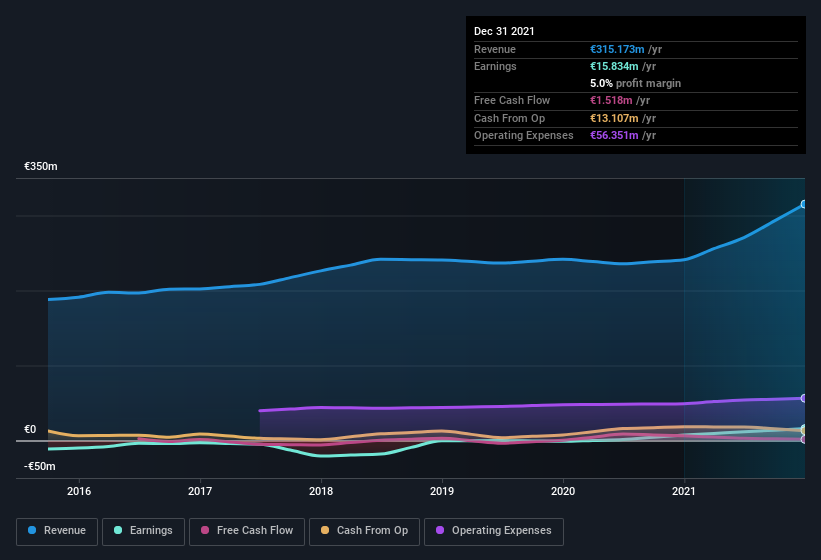

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Alumil Aluminium Industry achieved similar EBIT margins to last year, revenue grew by a solid 31% to €315m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Alumil Aluminium Industry isn't a huge company, given its market capitalisation of €62m. That makes it extra important to check on its balance sheet strength.

Are Alumil Aluminium Industry Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Alumil Aluminium Industry will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 47% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about €30m riding on the stock, at current prices. That's nothing to sneeze at!

Is Alumil Aluminium Industry Worth Keeping An Eye On?

Alumil Aluminium Industry's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Alumil Aluminium Industry for a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Alumil Aluminium Industry (including 1 which can't be ignored).

Although Alumil Aluminium Industry certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ALMY

Alumil Aluminium Industry

Engages in the design and production of architectural aluminum systems in Greece and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives