- Greece

- /

- Oil and Gas

- /

- ATSE:MOH

Motor Oil (Hellas) Corinth Refineries' (ATH:MOH) three-year earnings growth trails the notable shareholder returns

Thanks in no small measure to Vanguard founder Jack Bogle, it's easy buy a low cost index fund, which should provide the average market return. But you can make superior returns by picking better-than average stocks. For example, the Motor Oil (Hellas) Corinth Refineries S.A. (ATH:MOH) share price is up 52% in the last three years, slightly above the market return. The bad news is that the share price seems to lack positive momentum recently, since it has dropped 20% in the last year.

The past week has proven to be lucrative for Motor Oil (Hellas) Corinth Refineries investors, so let's see if fundamentals drove the company's three-year performance.

See our latest analysis for Motor Oil (Hellas) Corinth Refineries

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

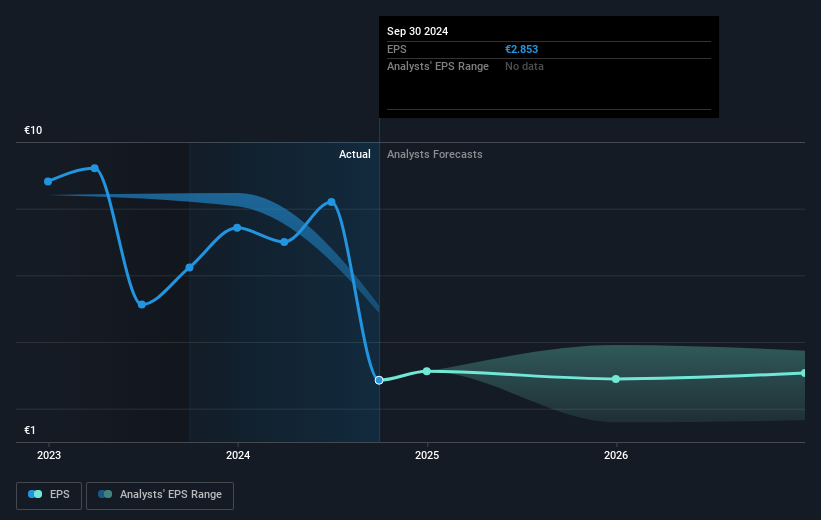

Motor Oil (Hellas) Corinth Refineries was able to grow its EPS at 17% per year over three years, sending the share price higher. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 15% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Quite to the contrary, the share price has arguably reflected the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Motor Oil (Hellas) Corinth Refineries' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Motor Oil (Hellas) Corinth Refineries' TSR for the last 3 years was 86%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in Motor Oil (Hellas) Corinth Refineries had a tough year, with a total loss of 14% (including dividends), against a market gain of about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Motor Oil (Hellas) Corinth Refineries (of which 2 are a bit unpleasant!) you should know about.

We will like Motor Oil (Hellas) Corinth Refineries better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:MOH

Motor Oil (Hellas) Corinth Refineries

Motor Oil (Hellas) Corinth Refineries S.A.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026