- Greece

- /

- Oil and Gas

- /

- ATSE:ELPE

HELLENiQ ENERGY Holdings S.A.'s (ATH:ELPE) Revenues Are Not Doing Enough For Some Investors

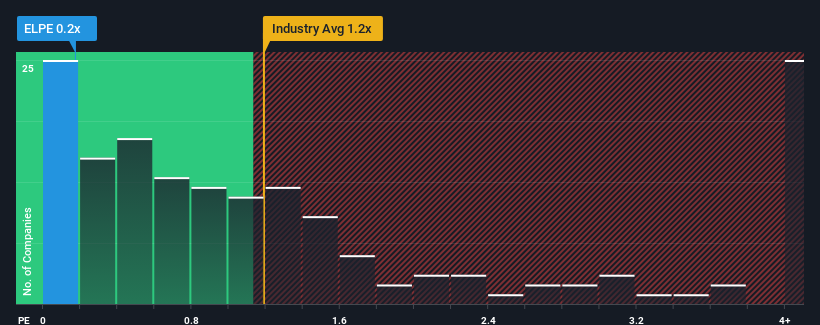

When close to half the companies operating in the Oil and Gas industry in Greece have price-to-sales ratios (or "P/S") above 1.2x, you may consider HELLENiQ ENERGY Holdings S.A. (ATH:ELPE) as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for HELLENiQ ENERGY Holdings

How Has HELLENiQ ENERGY Holdings Performed Recently?

Recent times have been pleasing for HELLENiQ ENERGY Holdings as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on HELLENiQ ENERGY Holdings will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think HELLENiQ ENERGY Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as HELLENiQ ENERGY Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 69% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to slump, contracting by 5.6% each year during the coming three years according to the seven analysts following the company. That's not great when the rest of the industry is expected to grow by 0.2% each year.

With this information, we are not surprised that HELLENiQ ENERGY Holdings is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of HELLENiQ ENERGY Holdings' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, HELLENiQ ENERGY Holdings' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for HELLENiQ ENERGY Holdings (1 is a bit concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HELLENiQ ENERGY Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ELPE

HELLENiQ ENERGY Holdings

Operates in the energy sector primarily in Greece, the Southeastern Europe, and the East Mediterranean.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives