- Greece

- /

- Diversified Financial

- /

- ATSE:TELL

Bank of Greece's (ATH:TELL) Could Be A Buy For Its Upcoming Dividend

Readers hoping to buy Bank of Greece (ATH:TELL) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You will need to purchase shares before the 26th of March to receive the dividend, which will be paid on the 2nd of April.

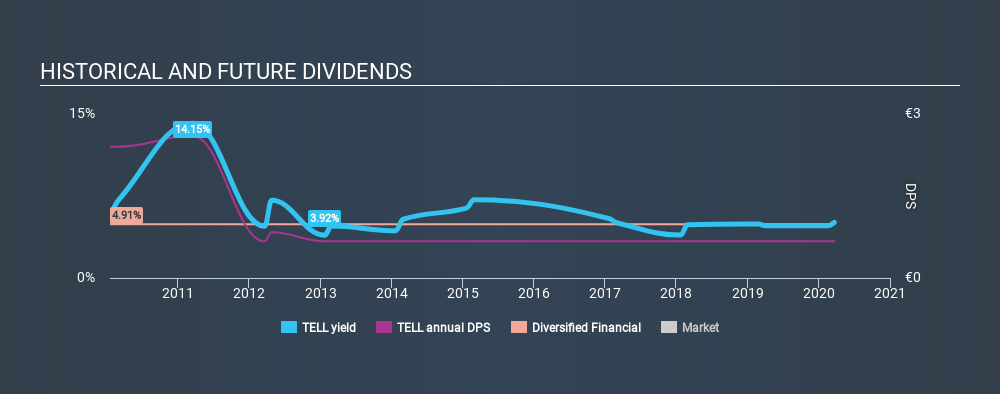

Bank of Greece's upcoming dividend is €0.67 a share, following on from the last 12 months, when the company distributed a total of €0.67 per share to shareholders. Looking at the last 12 months of distributions, Bank of Greece has a trailing yield of approximately 5.1% on its current stock price of €13.2. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Bank of Greece

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Bank of Greece has a low and conservative payout ratio of just 2.0% of its income after tax.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit Bank of Greece paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Earnings per share are basically flat over the past 12 months. Growth is a prerequisite for an outstanding dividend company over the long term, but we wouldn't read too much into flat numbers over any one year time frame.

One year is not very long in the grand scheme of things though, so we wouldn't draw too strong a conclusion based on these results.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Bank of Greece has seen its dividend decline 12% per annum on average over the past ten years, which is not great to see.

The Bottom Line

From a dividend perspective, should investors buy or avoid Bank of Greece? Bank of Greece has seen its earnings per share stagnate in recent years, although the company reinvests more than half of its profits in the business, which could bode well for its future prospects. Overall, Bank of Greece looks like a promising dividend stock in this analysis, and we think it would be worth investigating further.

So while Bank of Greece looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. Be aware that Bank of Greece is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable...

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:TELL

Bank of Greece

Provides various financial products and services in Greece.

Good value second-rate dividend payer.