- Greece

- /

- Hospitality

- /

- ATSE:LAMPS

If You Had Bought Lampsa Hellenic Hotels (ATH:LAMPS) Stock Five Years Ago, You Could Pocket A 17% Gain Today

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term Lampsa Hellenic Hotels S.A. (ATH:LAMPS) shareholders have enjoyed a 17% share price rise over the last half decade, well in excess of the market return of around 13% (not including dividends).

See our latest analysis for Lampsa Hellenic Hotels

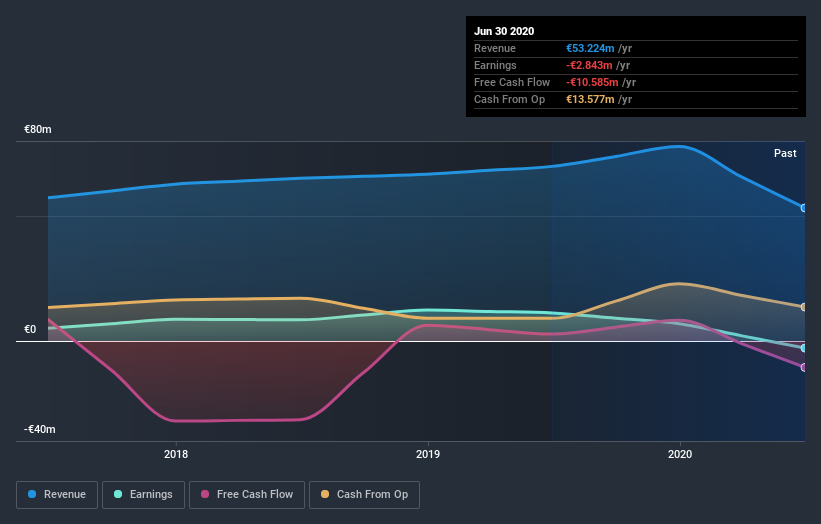

Lampsa Hellenic Hotels wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Lampsa Hellenic Hotels can boast revenue growth at a rate of 6.9% per year. That's a fairly respectable growth rate. While the share price has beat the market, compounding at 3% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Lampsa Hellenic Hotels' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Lampsa Hellenic Hotels' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Lampsa Hellenic Hotels' TSR of 19% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Although it hurts that Lampsa Hellenic Hotels returned a loss of 2.9% in the last twelve months, the broader market was actually worse, returning a loss of 9.4%. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Lampsa Hellenic Hotels better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Lampsa Hellenic Hotels , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

When trading Lampsa Hellenic Hotels or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ATSE:LAMPS

Lampsa Hellenic Hotels

Operates hotels primarily in Greece, Cyprus, and Serbia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives