Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Mytilineos (ATH:MYTIL), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Mytilineos with the means to add long-term value to shareholders.

See our latest analysis for Mytilineos

Mytilineos' Improving Profits

In the last three years Mytilineos' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Mytilineos' EPS grew from €1.86 to €4.13, over the previous 12 months. It's a rarity to see 122% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

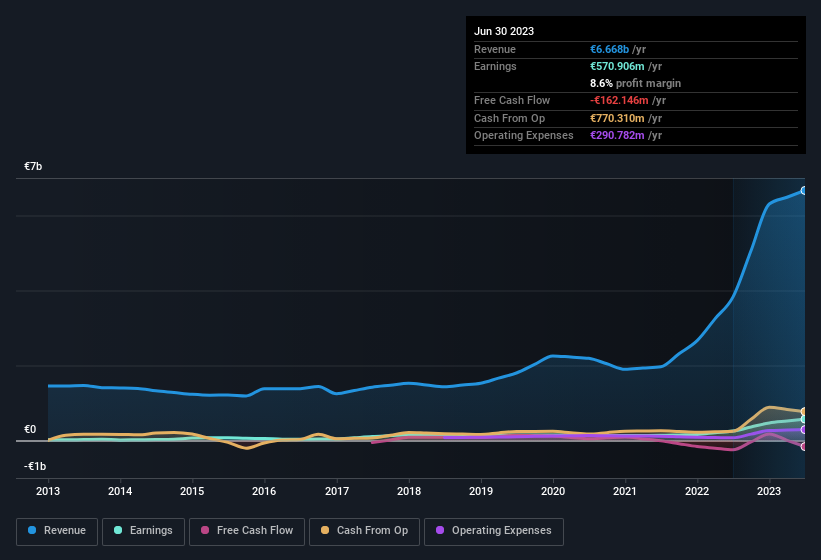

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Mytilineos shareholders can take confidence from the fact that EBIT margins are up from 11% to 13%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Mytilineos' future profits.

Are Mytilineos Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The €991k worth of shares that insiders sold during the last 12 months pales in comparison to the €2.6m they spent on acquiring shares in the company. This adds to the interest in Mytilineos because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by company insider Nikolaos Papapetrou for €703k worth of shares, at about €23.43 per share.

On top of the insider buying, it's good to see that Mytilineos insiders have a valuable investment in the business. To be specific, they have €21m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Mytilineos To Your Watchlist?

Mytilineos' earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Mytilineos belongs near the top of your watchlist. However, before you get too excited we've discovered 3 warning signs for Mytilineos (1 is significant!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Mytilineos, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:MYTIL

Metlen Energy & Metals

Operates in energy, metals, and infrastructure and concessions sectors in Greece, the European Union, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives