In the last year, multiple insiders have substantially increased their holdings of Metlen Energy & Metals S.A. (ATH:MYTIL) stock, indicating that insiders' optimism about the company's prospects has increased.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for Metlen Energy & Metals

The Last 12 Months Of Insider Transactions At Metlen Energy & Metals

Over the last year, we can see that the biggest insider purchase was by CEO, MD & Chairman Evangelos Mytilineos for €858k worth of shares, at about €34.32 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being €31.06). It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

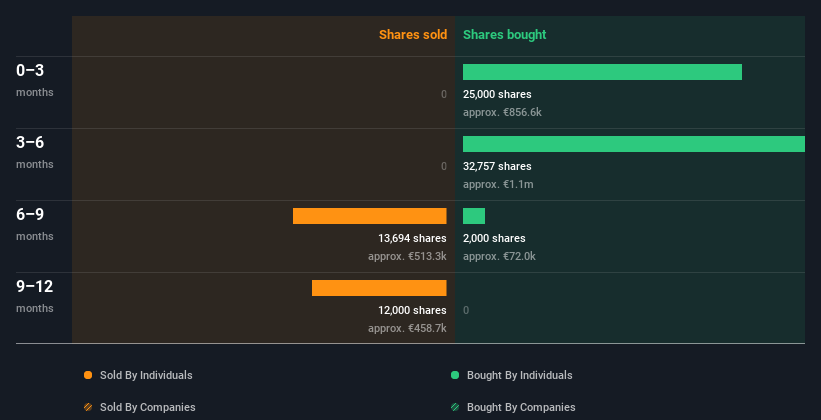

In the last twelve months insiders purchased 59.76k shares for €2.1m. On the other hand they divested 25.69k shares, for €974k. In total, Metlen Energy & Metals insiders bought more than they sold over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

Metlen Energy & Metals is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insiders At Metlen Energy & Metals Have Bought Stock Recently

Over the last quarter, Metlen Energy & Metals insiders have spent a meaningful amount on shares. We can see that CEO, MD & Chairman Evangelos Mytilineos paid €858k for shares in the company. No-one sold. This could be interpreted as suggesting a positive outlook.

Insider Ownership Of Metlen Energy & Metals

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. Metlen Energy & Metals insiders own about €24m worth of shares. That equates to 0.6% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The Metlen Energy & Metals Insider Transactions Indicate?

It's certainly positive to see the recent insider purchase. And the longer term insider transactions also give us confidence. Insiders likely see value in Metlen Energy & Metals shares, given these transactions (along with notable insider ownership of the company). While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Every company has risks, and we've spotted 3 warning signs for Metlen Energy & Metals (of which 2 are a bit unpleasant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:MYTIL

Metlen Energy & Metals

Operates in metallurgy, sustainable engineering solution, renewables and storage development, and power and gas sectors in Greece, the European Union, Hellas, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives