- Greece

- /

- Construction

- /

- ATSE:GEKTERNA

Here's Why We Think GEK TERNA Holdings Real Estate Construction (ATH:GEKTERNA) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like GEK TERNA Holdings Real Estate Construction (ATH:GEKTERNA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide GEK TERNA Holdings Real Estate Construction with the means to add long-term value to shareholders.

See our latest analysis for GEK TERNA Holdings Real Estate Construction

GEK TERNA Holdings Real Estate Construction's Improving Profits

In the last three years GEK TERNA Holdings Real Estate Construction's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, GEK TERNA Holdings Real Estate Construction's EPS grew from €1.04 to €1.77, over the previous 12 months. It's a rarity to see 71% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

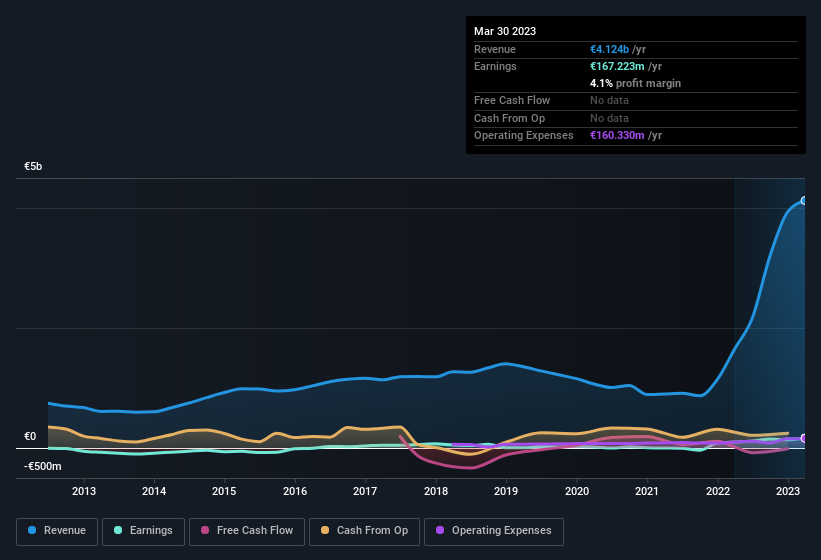

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note GEK TERNA Holdings Real Estate Construction achieved similar EBIT margins to last year, revenue grew by a solid 150% to €4.1b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are GEK TERNA Holdings Real Estate Construction Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's worth noting that there was some insider selling of GEK TERNA Holdings Real Estate Construction shares last year, worth €4.0m. But this is outweighed by the trades from Executive Vice Chairman Michael Gourzis who spent €4.1m buying shares, at an average price of around €11.77. Overall, that is something good to take away.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for GEK TERNA Holdings Real Estate Construction will reveal that insiders own a significant piece of the pie. Actually, with 35% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. €476m That level of investment from insiders is nothing to sneeze at.

Is GEK TERNA Holdings Real Estate Construction Worth Keeping An Eye On?

GEK TERNA Holdings Real Estate Construction's earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest GEK TERNA Holdings Real Estate Construction belongs near the top of your watchlist. Before you take the next step you should know about the 2 warning signs for GEK TERNA Holdings Real Estate Construction (1 makes us a bit uncomfortable!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, GEK TERNA Holdings Real Estate Construction isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Gek Terna, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:GEKTERNA

Gek Terna

Engages in the construction, energy, industry, real estate, and concession businesses in Greece, the Balkans, the Middle East, Eastern Europe, North America, and internationally.

Slight with moderate growth potential.

Market Insights

Community Narratives