- Greece

- /

- Construction

- /

- ATSE:AKTR

Aktor Societe Anonyme Holding Company Technical and Energy Projects (ATH:AKTR) increases 6.6% this week, taking five-year gains to 302%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. Long term Aktor Societe Anonyme Holding Company Technical and Energy Projects (ATH:AKTR) shareholders would be well aware of this, since the stock is up 223% in five years. It's also up 13% in about a month.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Aktor Societe Anonyme Holding Company Technical and Energy Projects

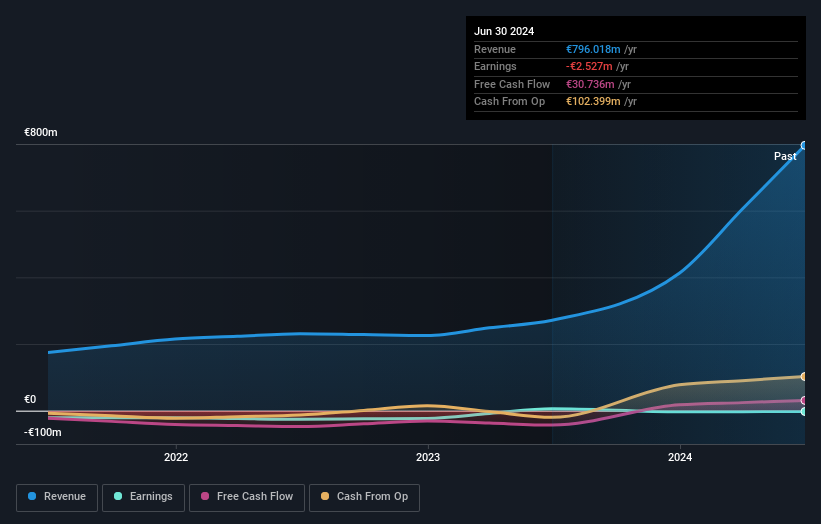

Aktor Societe Anonyme Holding Company Technical and Energy Projects wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Aktor Societe Anonyme Holding Company Technical and Energy Projects saw its revenue grow at 20% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 26% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. Aktor Societe Anonyme Holding Company Technical and Energy Projects seems like a high growth stock - so growth investors might want to add it to their watchlist.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Aktor Societe Anonyme Holding Company Technical and Energy Projects' financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Aktor Societe Anonyme Holding Company Technical and Energy Projects' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Aktor Societe Anonyme Holding Company Technical and Energy Projects hasn't been paying dividends, but its TSR of 302% exceeds its share price return of 223%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Aktor Societe Anonyme Holding Company Technical and Energy Projects provided a TSR of 6.8% over the last twelve months. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 32% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Aktor Societe Anonyme Holding Company Technical and Energy Projects better, we need to consider many other factors. Even so, be aware that Aktor Societe Anonyme Holding Company Technical and Energy Projects is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:AKTR

Aktor Societe Anonyme Holding Company Technical and Energy Projects

Engages in the construction business in Greece, European countries, and internationally.

Mediocre balance sheet very low.

Market Insights

Community Narratives