- United Kingdom

- /

- Professional Services

- /

- LSE:ELIX

Elixirr International And 2 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, yet over the past 12 months, it has risen by 7.5%, with earnings forecasted to grow by 14% annually. In this context of steady growth potential, identifying promising small-cap stocks like Elixirr International can be key for investors seeking opportunities in lesser-known companies with strong potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc, with a market cap of £323.46 million, operates through its subsidiaries to provide management consultancy services in the United Kingdom, the United States, and internationally.

Operations: Elixirr generates revenue primarily from management consulting services, amounting to £97.37 million.

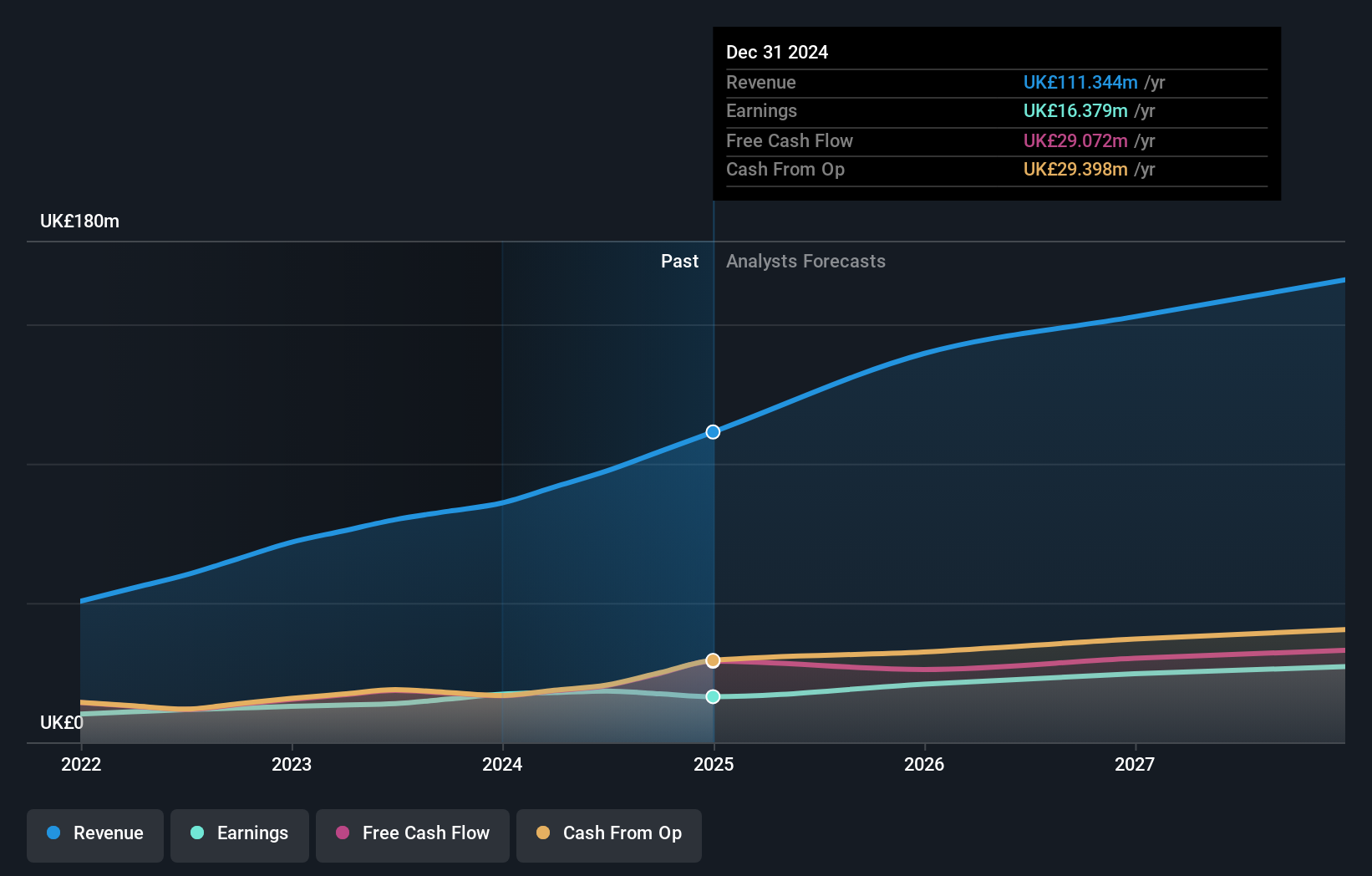

Elixirr International, a nimble player in the professional services sector, has demonstrated robust growth with earnings up 32.8% over the past year, outpacing the industry's -12.2%. Trading at 55.5% below its estimated fair value and boasting high-quality earnings, Elixirr offers compelling relative value against peers. Recent results show sales of £53 million for H1 2024, up from £41 million last year, with net income rising to £8.84 million from £7.67 million—a promising trajectory bolstered by strategic partnerships like that with Peak Performance Project (P3).

- Delve into the full analysis health report here for a deeper understanding of Elixirr International.

Volex (AIM:VLX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Volex plc manufactures and sells power and data cables across North America, Europe, and Asia with a market cap of £582.79 million.

Operations: The company generates revenue primarily from the sale of power and data cables, with significant contributions from North America ($372.30 million), Europe ($355.40 million), and Asia ($185.10 million).

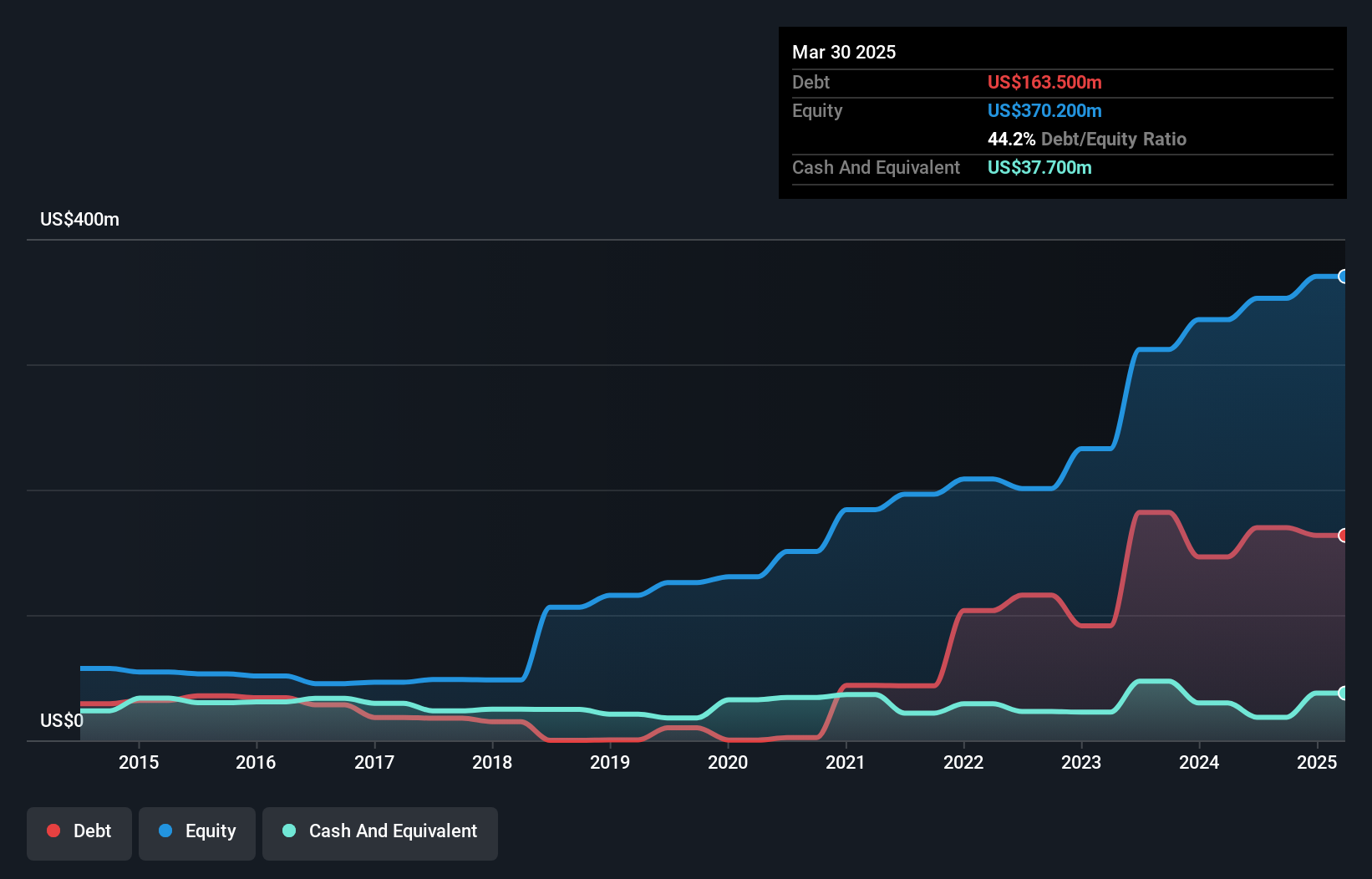

Volex, a nimble player in the electrical industry, boasts high-quality earnings with a net debt to equity ratio of 34.7%, deemed satisfactory. Over the past year, its earnings growth of 7% outpaced the industry's 1.6%. Despite an increase in its debt to equity ratio from 0.3% to 43.6% over five years, interest payments remain well covered at 4.7 times EBIT. A recent dividend boost of £0.028 per share suggests confidence in future prospects amidst forecasted revenue growth nearing 9%.

- Take a closer look at Volex's potential here in our health report.

Gain insights into Volex's historical performance by reviewing our past performance report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £268.55 million, supplies energy and utility solutions through its subsidiaries primarily in the United Kingdom.

Operations: Yü Group generates revenue primarily from supplying energy and utility solutions in the UK. The company's financial performance is marked by a focus on managing costs to optimize profitability. Notably, its gross profit margin reflects the efficiency of its operations.

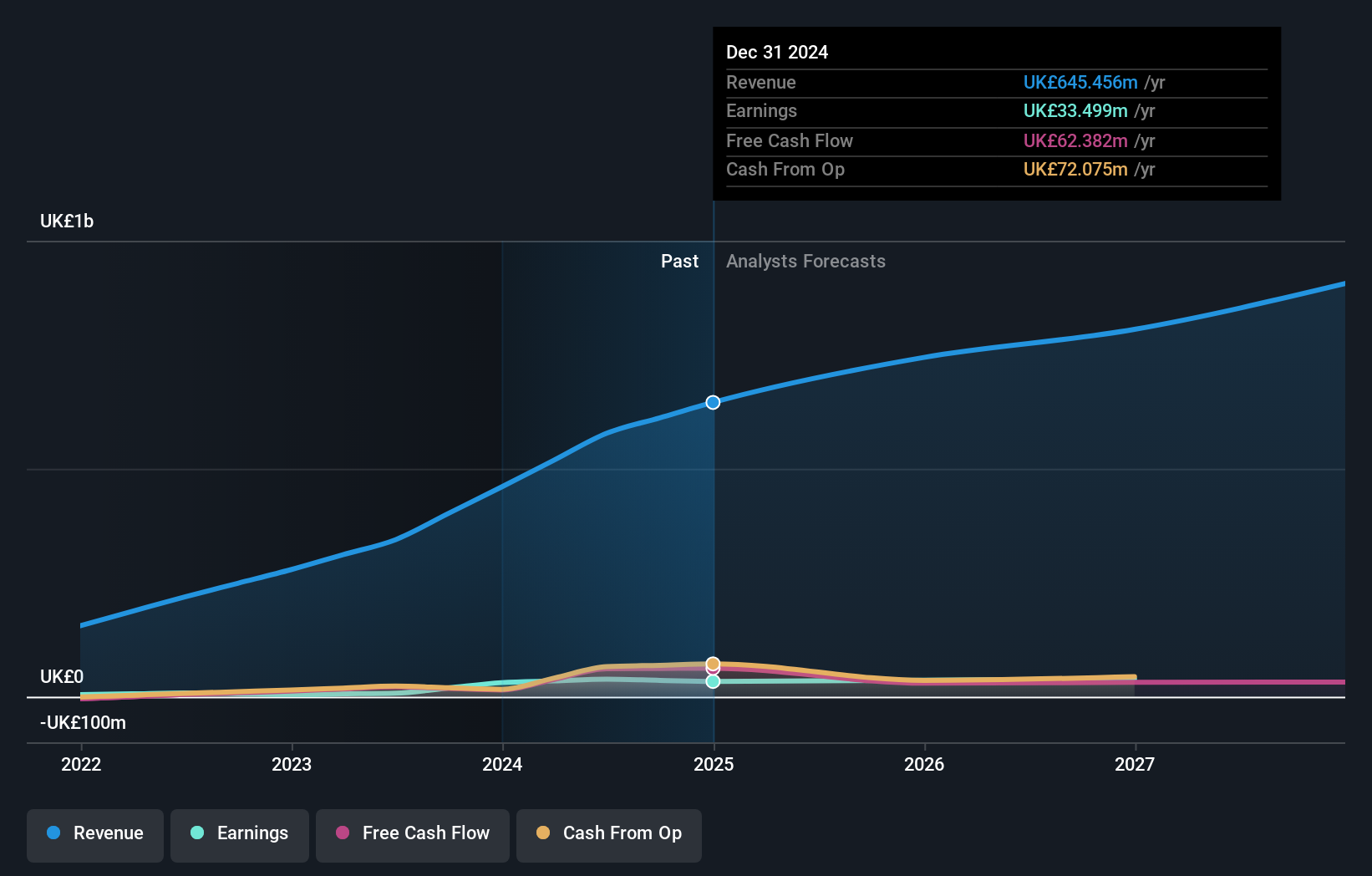

Yü Group, a dynamic player in the UK, has seen earnings skyrocket by 400% over the past year, outpacing its industry peers. Despite a volatile share price recently, it trades at 63.6% below its estimated fair value. The company has successfully repurchased shares worth £3.99 million and reported impressive half-year sales of £312.68 million compared to last year's £194.9 million, with net income doubling to £14.69 million from £7.31 million previously.

- Navigate through the intricacies of Yü Group with our comprehensive health report here.

Explore historical data to track Yü Group's performance over time in our Past section.

Next Steps

- Click through to start exploring the rest of the 79 UK Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elixirr International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ELIX

Elixirr International

Through its subsidiaries, provides management consultancy services in the United Kingdom, the United States, and internationally.

High growth potential and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026