- United Kingdom

- /

- Renewable Energy

- /

- AIM:YU.

Elixirr International And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

The United Kingdom market has been flat over the last week but has seen a 7.5% increase over the past year, with earnings forecasted to grow by 14% annually. In this context, identifying stocks with strong fundamentals becomes crucial for investors seeking opportunities beyond the mainstream, such as Elixirr International and two other promising companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

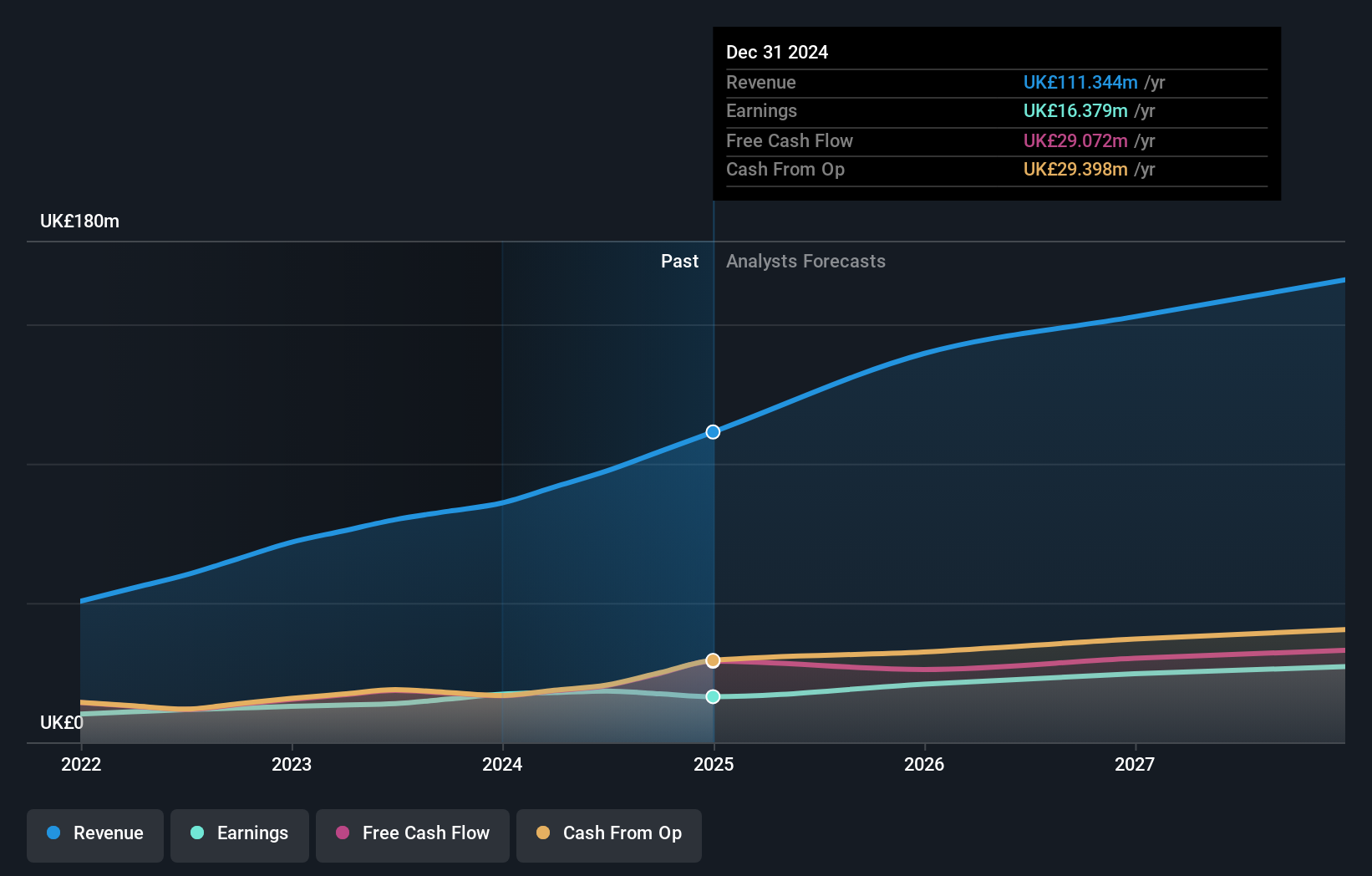

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc is a management consultancy firm operating through its subsidiaries in the United Kingdom, the United States, and internationally, with a market capitalization of £321.13 million.

Operations: Elixirr generates revenue primarily from management consulting services, totaling £97.37 million. The company operates with a market capitalization of £321.13 million.

Elixirr International, a nimble player in the UK market, showcases robust growth with earnings jumping 32.8% last year, outpacing its industry peers. Sales for H1 2024 hit £53.03 million (up from £41.55 million), and net income rose to £8.84 million from £7.67 million previously, reflecting solid operational performance without debt concerns. The company’s strategic partnership with Peak Performance Project underscores its innovative edge in tech solutions, promising continued expansion and efficiency gains in data management systems for athletes globally.

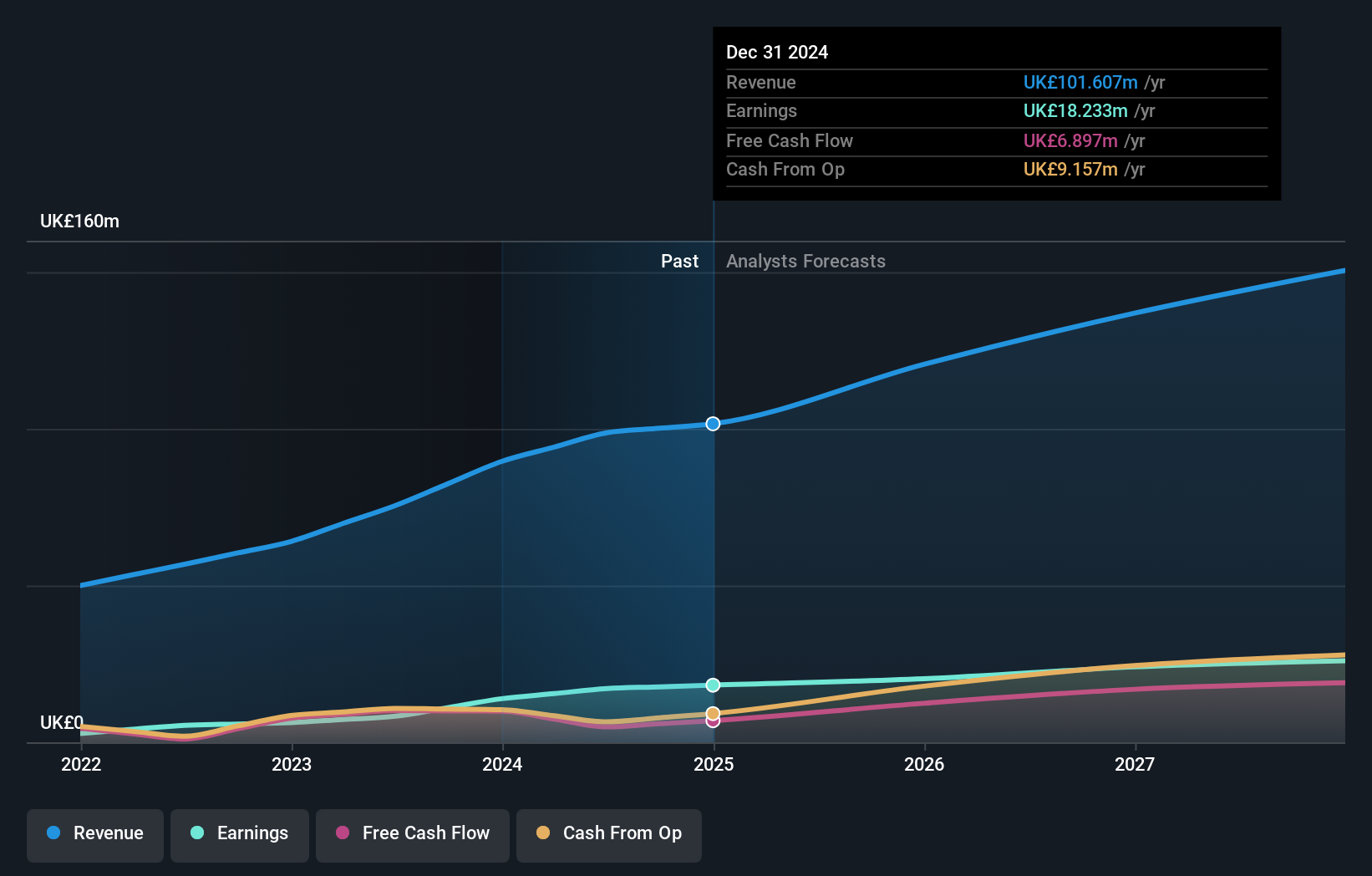

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, along with its subsidiaries, focuses on producing and selling cosmetics and has a market capitalization of £421.37 million.

Operations: Warpaint London generates revenue primarily from its Own Brand segment, contributing £96.72 million, while the Close-Out segment adds £2.12 million.

Warpaint London, a nimble player in the cosmetics industry, has shown impressive growth with earnings surging by 106% last year, outpacing the sector's 7%. The firm is debt-free, enhancing its financial stability. Recent half-year results revealed sales of £45.85 million and net income of £8.02 million. Shareholders can expect an increased interim dividend of 3.5 pence per share, reflecting robust performance and commitment to shareholder returns amidst a volatile market environment.

- Get an in-depth perspective on Warpaint London's performance by reading our health report here.

Understand Warpaint London's track record by examining our Past report.

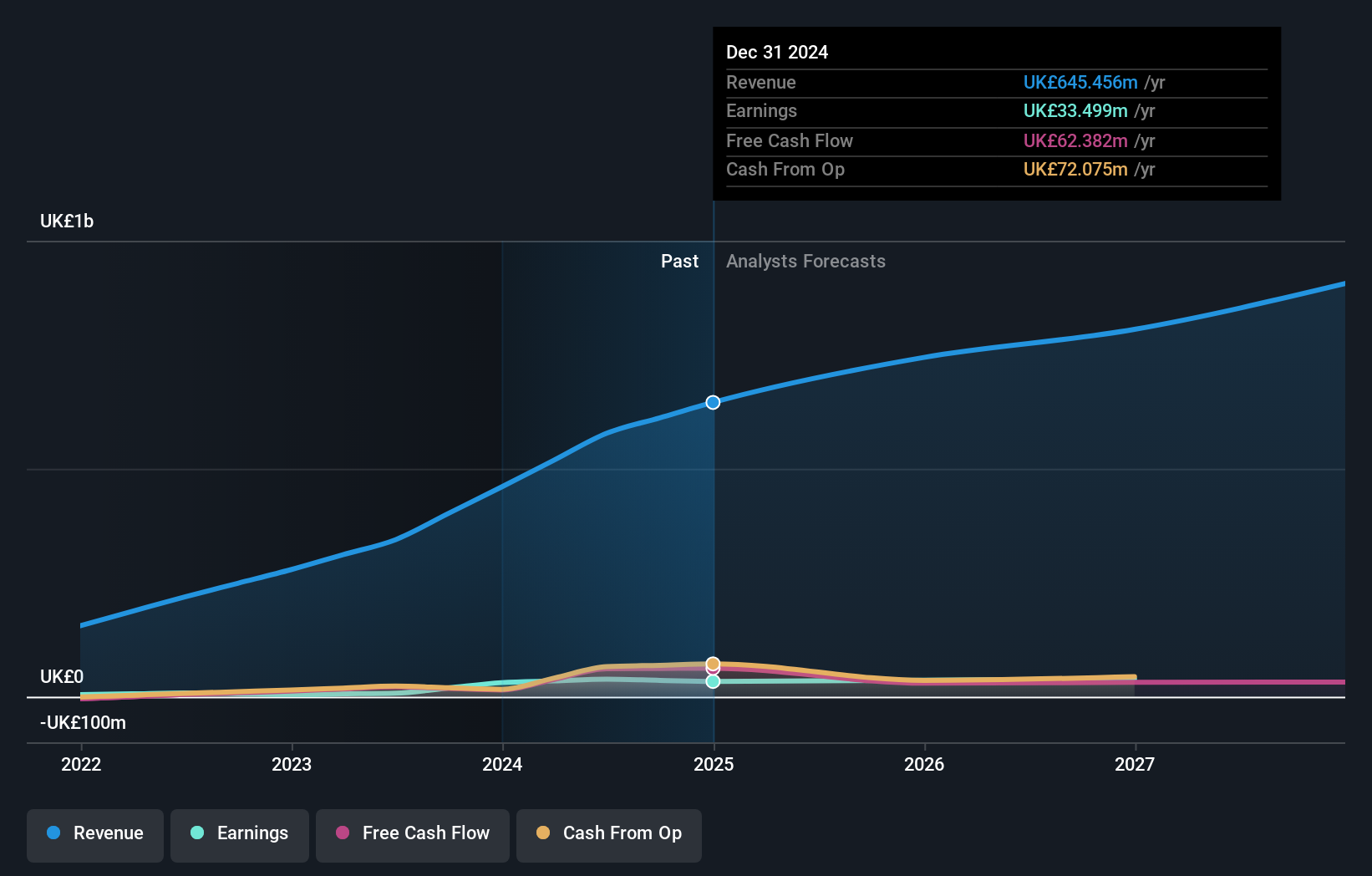

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £275.26 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

Operations: Yü Group generates revenue by supplying energy and utility solutions in the UK. The company's financial performance includes a focus on net profit margin, which reflects its ability to manage costs and generate profits efficiently.

Yü Group, a dynamic player in the UK market, has shown impressive growth with earnings surging 400.4% over the past year, outpacing its industry peers. Trading at a substantial 62.7% below its estimated fair value suggests potential for investors seeking undervalued opportunities. With net income climbing to £14.69 million from £7.31 million last year and basic earnings per share doubling to £0.88, Yü's financial health appears robust despite recent share price volatility and a modest increase in debt-to-equity ratio from 0% to 5%.

- Click here and access our complete health analysis report to understand the dynamics of Yü Group.

Review our historical performance report to gain insights into Yü Group's's past performance.

Key Takeaways

- Embark on your investment journey to our 83 UK Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YU.

Yü Group

Through its subsidiaries, supplies energy and utility solutions primarily in the United Kingdom.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion