- United Kingdom

- /

- Renewable Energy

- /

- AIM:YU.

Discovering Undiscovered Gems in the United Kingdom May 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China and global economic uncertainties. Despite these hurdles, the pursuit of undiscovered gems within the UK market remains a compelling endeavor, as investors seek stocks that demonstrate resilience and potential for growth even in volatile conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Filtronic (AIM:FTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology globally and has a market cap of £247.47 million.

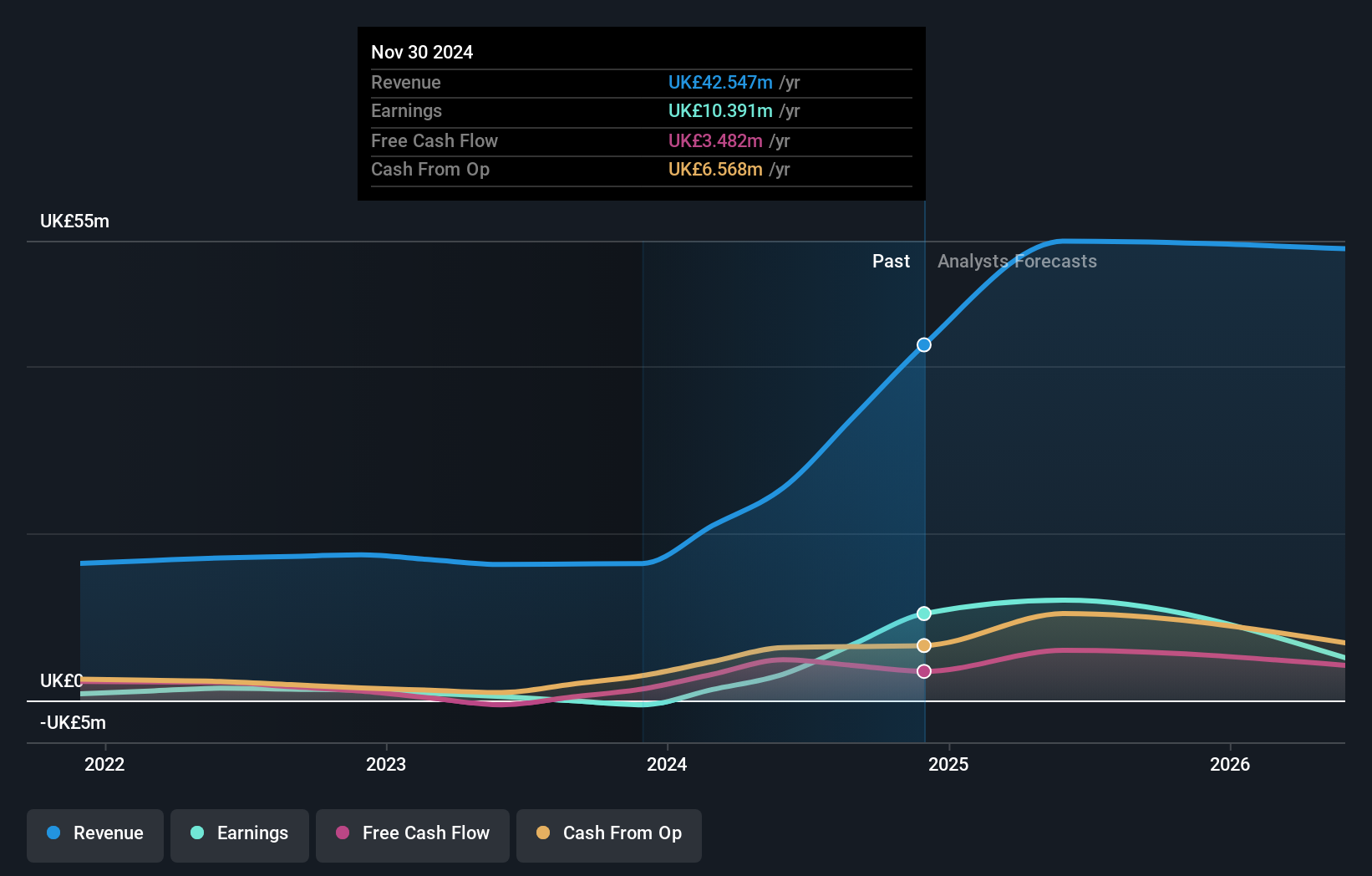

Operations: Filtronic's primary revenue stream is from its Wireless Communications Equipment segment, generating £42.55 million. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of converting revenue into actual profit after all expenses are accounted for.

Filtronic, a nimble player in the communications sector, has recently turned profitable and is debt-free, contrasting its previous 12% debt-to-equity ratio five years ago. Despite a volatile share price lately, it maintains a Price-To-Earnings ratio of 23.8x, below the industry average of 29.1x. The company is making waves with strategic partnerships; notably with SpaceX for E-band SSPA modules and a new contract under ESA's ARTES program to develop feeder link technology for satellite networks. However, earnings are forecasted to dip by an average of 43.8% annually over the next three years.

- Get an in-depth perspective on Filtronic's performance by reading our health report here.

Examine Filtronic's past performance report to understand how it has performed in the past.

Renew Holdings (AIM:RNWH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Renew Holdings plc is a UK-based company offering engineering services, with a market cap of £650.67 million.

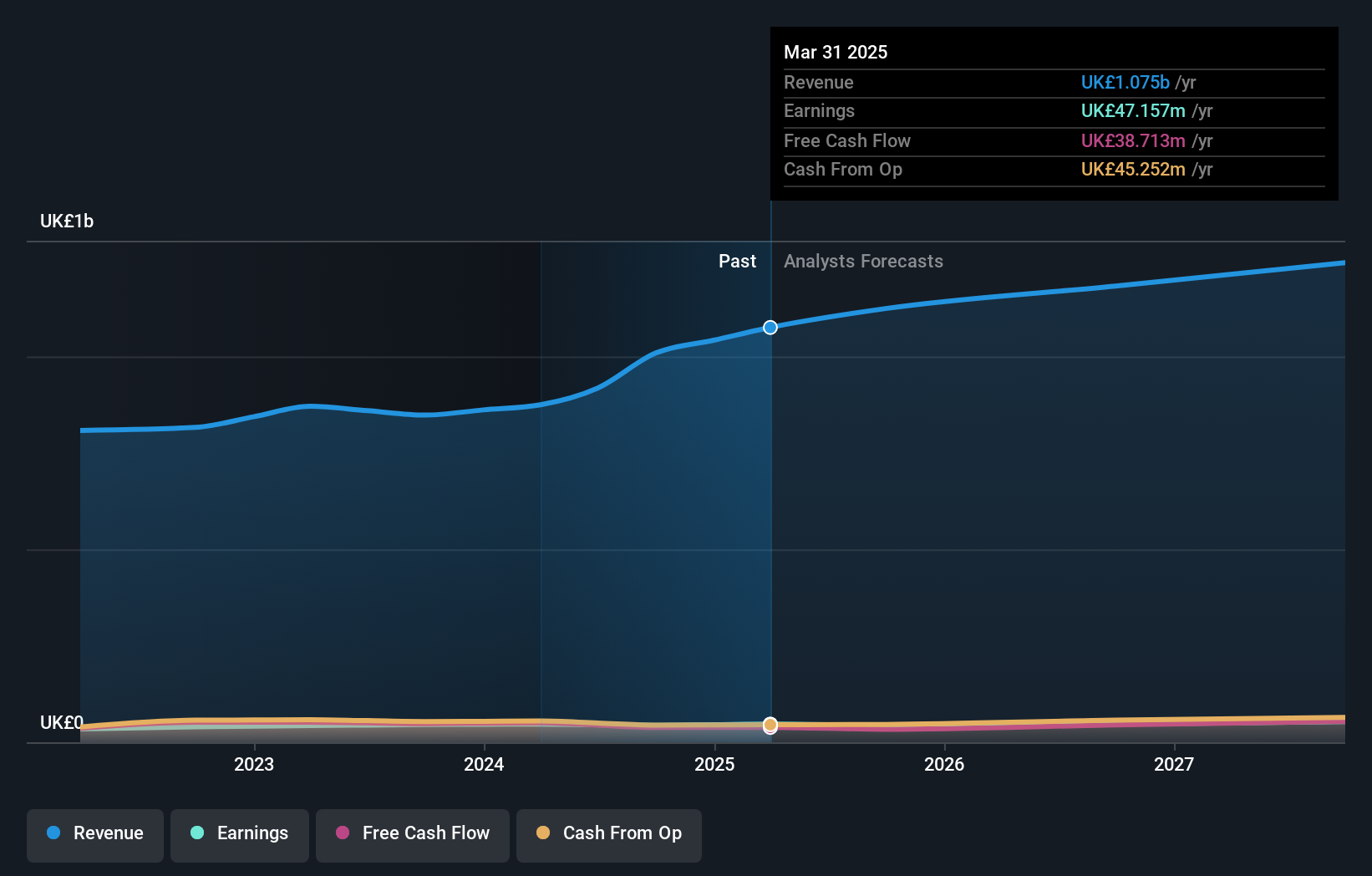

Operations: The company generates revenue primarily from its engineering services segment, amounting to £1.01 billion.

Renew Holdings, a UK-based engineering services firm, is making waves with its strategic focus on the onshore wind and transmission sectors. The company has streamlined operations by divesting its Specialist Building division, allowing it to hone in on core services. With a debt to equity ratio rising slightly from 23.7% to 25.2% over five years, financial health remains stable as cash exceeds total debt. Trading at £7.55 per share—41% below fair value estimates—Renew offers potential for growth despite recent negative earnings growth of -4.5%. EBIT covers interest payments 62 times over, indicating strong profitability prospects ahead.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £264.44 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

Operations: Yü Group generates revenue primarily from its Retail segment, contributing £645.26 million, and Smart segment at £12.73 million, with a minor contribution from Metering Assets at £0.66 million. The company experiences a deduction of £13.20 million due to Intra-segment Trading.

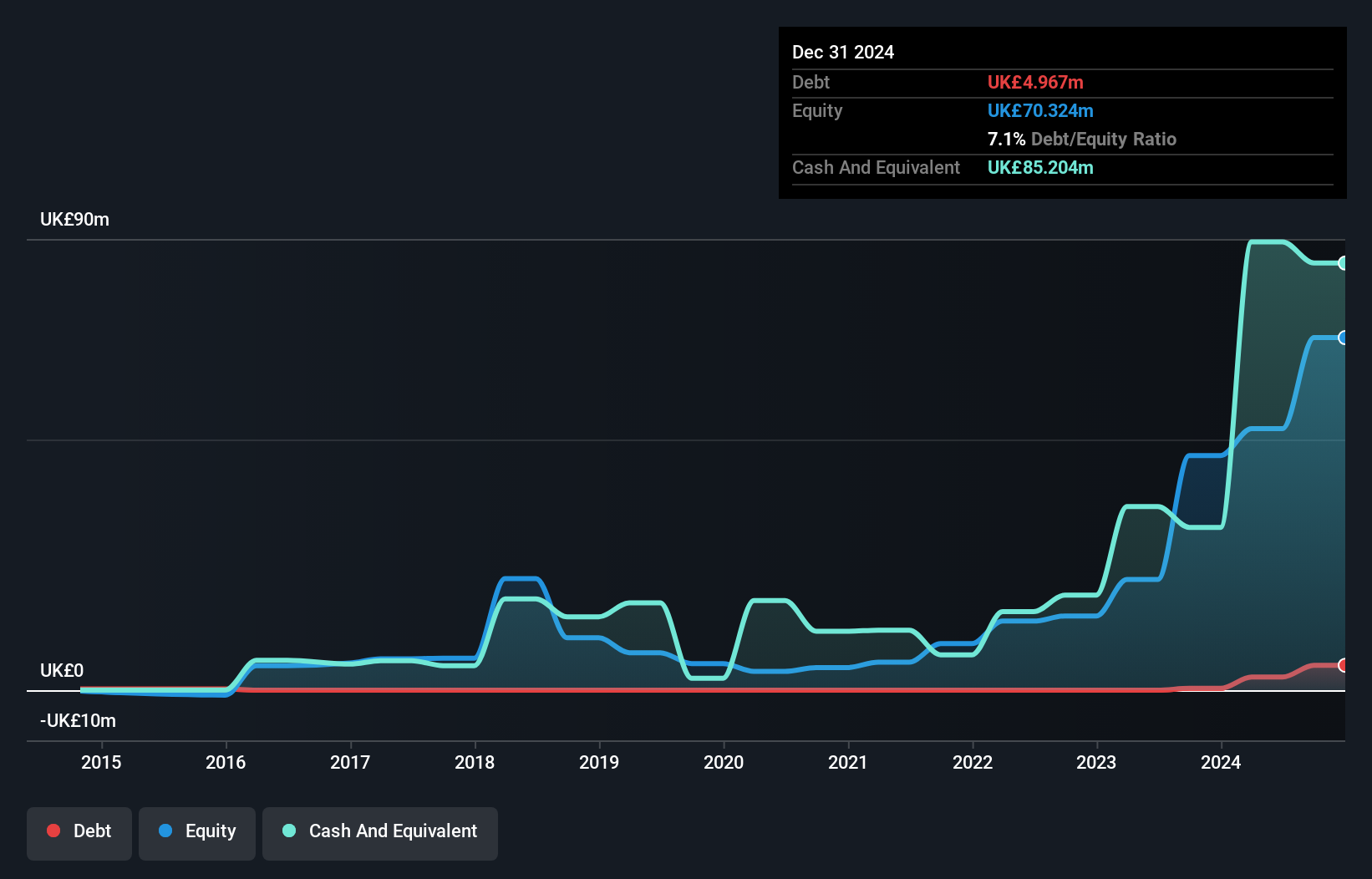

Yü Group, a dynamic player in the UK market, has been making waves with its robust financial performance. Over the past year, earnings grew by 8.6%, outpacing the Renewable Energy industry's -6.1%. The company is trading at a significant discount of 42% below its estimated fair value and maintains high-quality earnings with more cash than debt on hand. Recent announcements highlight impressive sales growth to £645 million from £460 million last year and net income rising to £33.5 million from £30.86 million, suggesting strong operational momentum and potential for continued expansion in fiscal 2025.

- Click here and access our complete health analysis report to understand the dynamics of Yü Group.

Gain insights into Yü Group's historical performance by reviewing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 59 UK Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yü Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YU.

Yü Group

Through its subsidiaries, supplies energy and utility solutions primarily in the United Kingdom.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives