- United Kingdom

- /

- Airlines

- /

- LSE:WIZZ

Wizz Air Holdings (LSE:WIZZ) Reports Revenue Growth Despite Earnings Decline and High Leverage

Reviewed by Simply Wall St

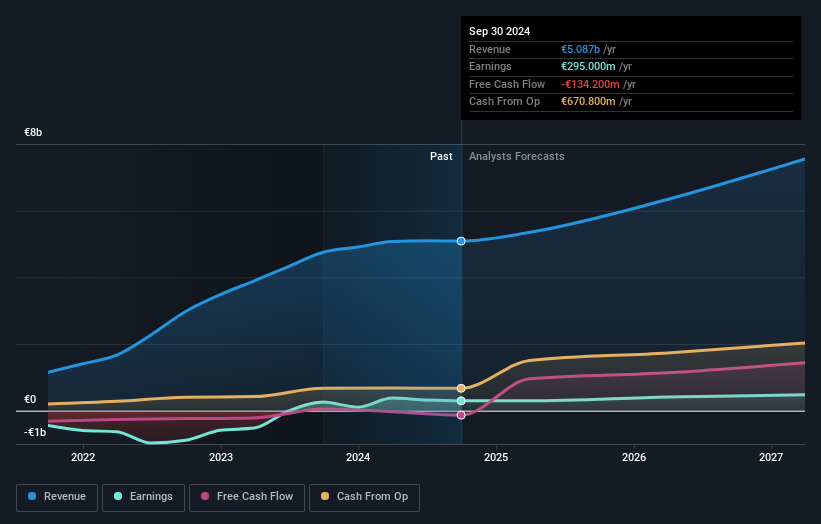

Wizz Air Holdings (LSE:WIZZ) recently announced its half-year earnings, revealing a slight revenue increase to EUR 3,066.1 million, despite a drop in net income compared to the previous year. The company continues to expand its market presence, highlighted by the introduction of a new route from Milan to Abu Dhabi using the Airbus A321XLR, aiming to leverage advanced technology for growth. However, challenges such as high leverage and regulatory hurdles pose risks, which are discussed alongside strategic initiatives in the following analysis.

Dive into the specifics of Wizz Air Holdings here with our thorough analysis report.

Key Assets Propelling Wizz Air Holdings Forward

Wizz Air Holdings has demonstrated financial health with earnings forecasted to grow at 17.2% annually, surpassing the UK market average. This growth is supported by a revenue increase of 14.8% per year, significantly outpacing the market's 3.6%. The company's strategic cost management has allowed it to maintain a stable net profit margin, which improved from 5.4% to 5.8% over the last year. The leadership, under the guidance of CEO József Váradi, has effectively managed costs, contributing to operational efficiency and strong customer loyalty, as evidenced by repeat bookings.

Internal Limitations Hindering Wizz Air Holdings's Growth

Wizz Air faces challenges with a high net debt to equity ratio of 1294.6%, indicating significant leverage. Interest payments on this debt are poorly covered by EBIT, with only 0.1x coverage, raising concerns about financial stability. Additionally, the company's Return on Equity, though high at 76.22%, is skewed by its substantial debt levels. A one-off gain of €244.8M has also impacted financial results, potentially masking underlying performance.

Areas for Expansion and Innovation for Wizz Air Holdings

Opportunities abound as Wizz Air continues to expand its market presence. The introduction of a new direct route from Milan to Abu Dhabi using the Airbus A321XLR aircraft highlights its commitment to leveraging advanced technology for intercontinental travel. This move not only strengthens its Italian network but also positions the company to capitalize on emerging markets. Furthermore, trading at £15.17, significantly below the estimated fair value of £138.05, suggests potential for price appreciation, indicating that the market may undervalue its growth prospects.

Regulatory Challenges Facing Wizz Air Holdings

However, the company must navigate several external threats. The macroeconomic environment remains unpredictable, posing potential risks to travel demand. Supply chain issues, particularly delays in aircraft deliveries, threaten to disrupt growth plans. Regulatory compliance continues to be a complex challenge, potentially leading to increased costs and operational hurdles. These factors necessitate strategic vigilance to maintain market position amidst competitive pressures.

Conclusion

Wizz Air Holdings is positioned for significant growth with earnings projected to increase at an impressive 17.2% annually, supported by strong revenue growth and effective cost management under CEO József Váradi. However, the company's high leverage, with a net debt to equity ratio of 1294.6%, presents a challenge, as does the inadequate coverage of interest payments by EBIT, which may impact financial stability. Despite these internal limitations, Wizz Air's strategic expansion into new markets, such as the Milan to Abu Dhabi route, and its current trading price of £15.17, well below the estimated fair value of £138.05, suggest substantial potential for future price appreciation. Nevertheless, the company must remain vigilant against external threats, including macroeconomic uncertainties and regulatory challenges, to sustain its competitive edge and capitalize on its growth prospects.

Make It Happen

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Wizz Air Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:WIZZ

Wizz Air Holdings

Engages in the provision of passenger air transportation services.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives