- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Top UK Dividend Stocks To Consider In September 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China and declining commodity prices. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income and potential resilience in turbulent markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.75% | ★★★★★★ |

| OSB Group (LSE:OSB) | 8.55% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.07% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.35% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.82% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.71% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.50% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.36% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.98% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.44% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

HSBC Holdings (LSE:HSBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc is a global provider of banking and financial services with a market cap of £120.86 billion.

Operations: HSBC Holdings plc generates its revenue from four primary segments: Commercial Banking ($15.43 billion), Global Banking and Markets ($16.16 billion), and Wealth and Personal Banking ($40.10 billion).

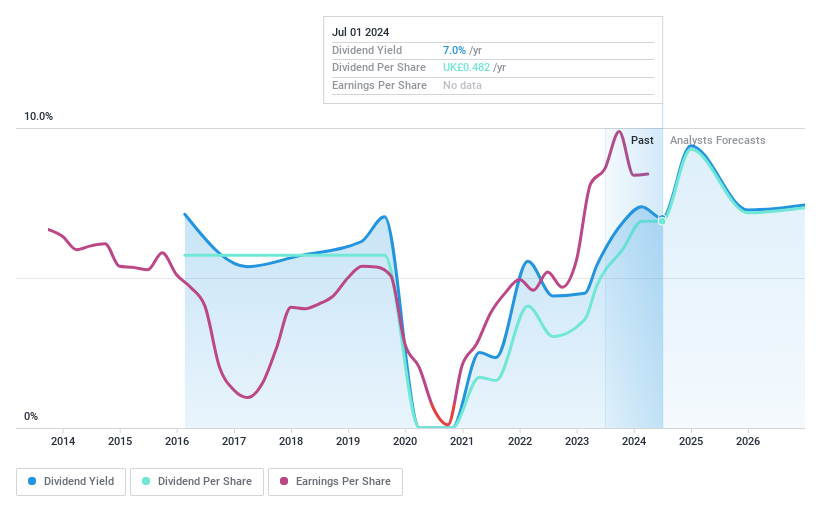

Dividend Yield: 6.8%

HSBC Holdings has shown a commitment to maintaining its dividend payments, recently approving a second interim dividend for 2024 amounting to $1.85 billion. However, the company has only paid dividends for nine years and has experienced volatility in its payouts. Despite this, HSBC's payout ratio of 52.5% indicates that current dividends are covered by earnings. Recent debt financing activities and strategic divestitures may impact future stability but reflect efforts to streamline operations and focus on core markets.

- Click here and access our complete dividend analysis report to understand the dynamics of HSBC Holdings.

- Our valuation report unveils the possibility HSBC Holdings' shares may be trading at a discount.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ocean Wilsons Holdings Limited, with a market cap of £479.17 million, is an investment holding company that provides maritime and logistics services in Brazil.

Operations: Ocean Wilsons Holdings Limited generates $519.35 million in revenue from its maritime services in Brazil.

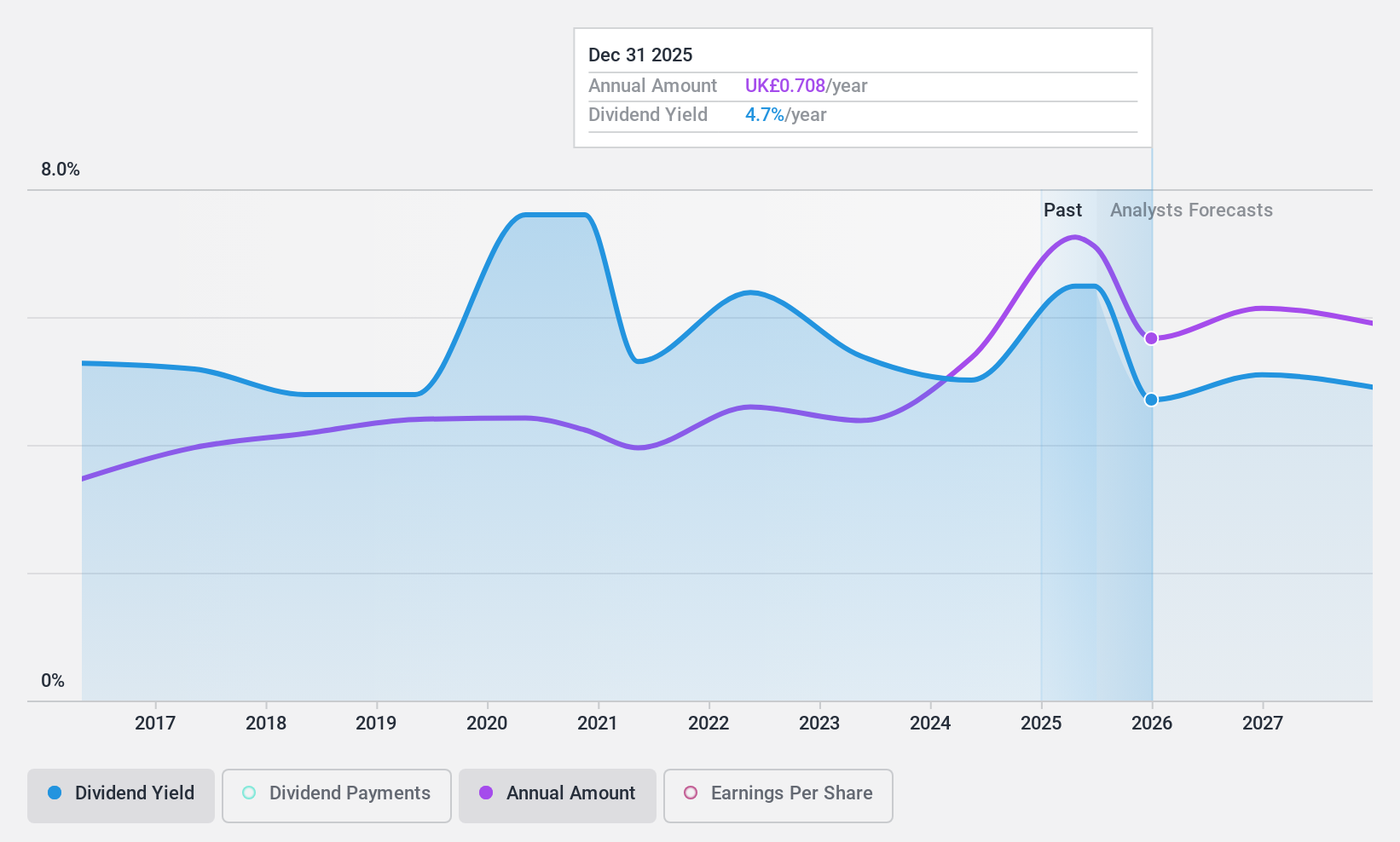

Dividend Yield: 4.7%

Ocean Wilsons Holdings has demonstrated consistent dividend growth over the past decade, with dividends well-covered by earnings (48.7% payout ratio) and cash flows (26.6% cash payout ratio). The company's price-to-earnings ratio of 10.4x is attractive compared to the UK market average of 16.9x. Although its dividend yield of 4.7% is below the top tier in the UK market, it remains reliable and stable. Recent M&A discussions regarding its subsidiary Wilson Sons may influence future performance but are currently speculative.

- Click here to discover the nuances of Ocean Wilsons Holdings with our detailed analytical dividend report.

- According our valuation report, there's an indication that Ocean Wilsons Holdings' share price might be on the expensive side.

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Record plc, with a market cap of £122.72 million, provides currency and derivative management services through its subsidiaries in the United Kingdom, North America, Continental Europe, Australia, and internationally.

Operations: Record plc generates £45.38 million from its currency and derivative management services.

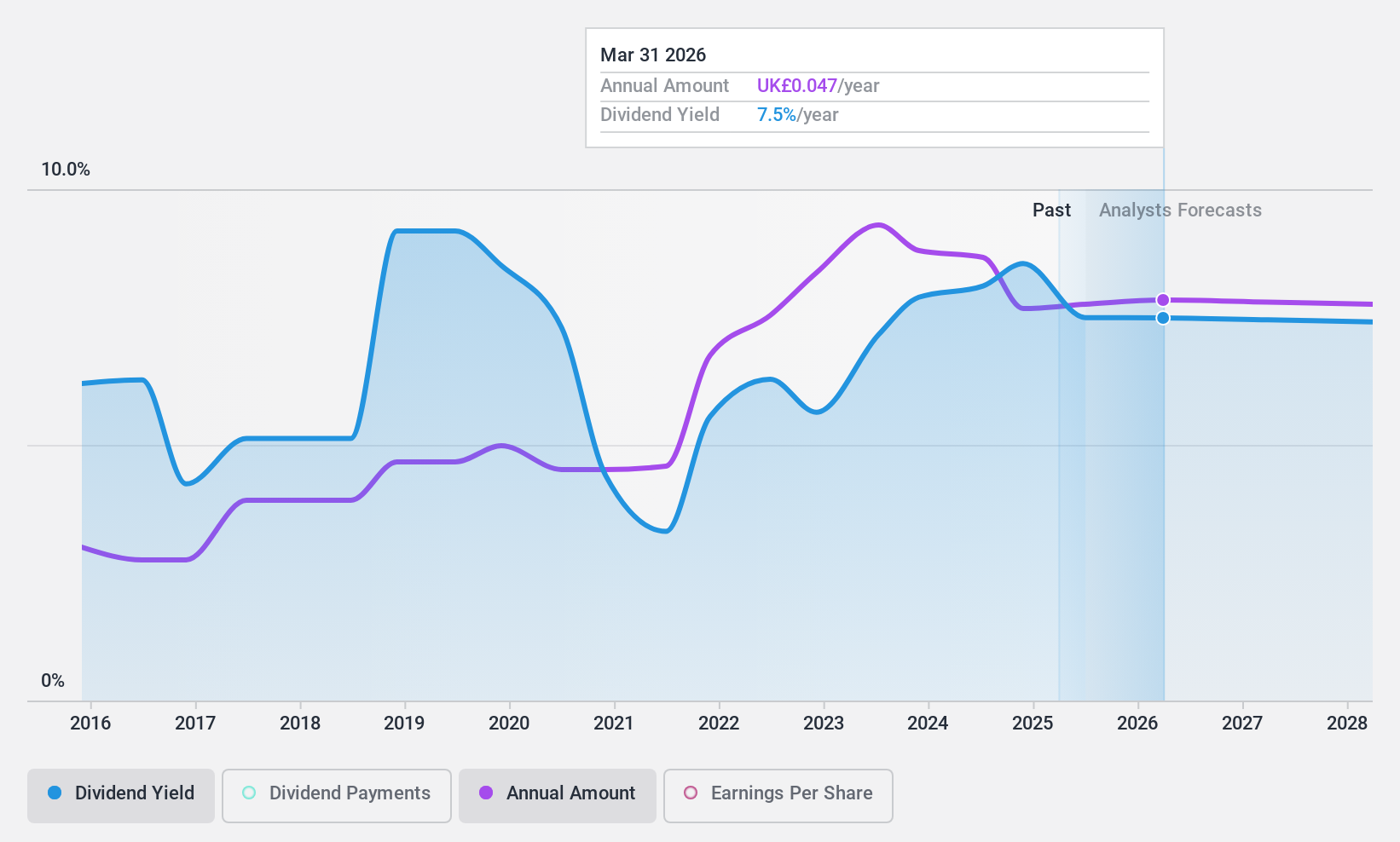

Dividend Yield: 8.2%

Record plc has maintained stable dividends over the past decade, with recent affirmations of a final dividend of 2.45 pence per share and a special dividend of 0.6 pence. However, its high payout ratio (95%) indicates that dividends are not well covered by earnings, though they are supported by cash flows (81.7% cash payout ratio). Despite a slight drop in net income to £9.27 million from £11.34 million, the company continues to offer an attractive yield in the top 25% of UK dividend payers at 8.15%.

- Get an in-depth perspective on Record's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Record shares in the market.

Turning Ideas Into Actions

- Unlock our comprehensive list of 60 Top UK Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

Good value with adequate balance sheet and pays a dividend.