- United Kingdom

- /

- Airlines

- /

- LSE:IAG

Benign Growth For International Consolidated Airlines Group S.A. (LON:IAG) Underpins Stock's 27% Plummet

International Consolidated Airlines Group S.A. (LON:IAG) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

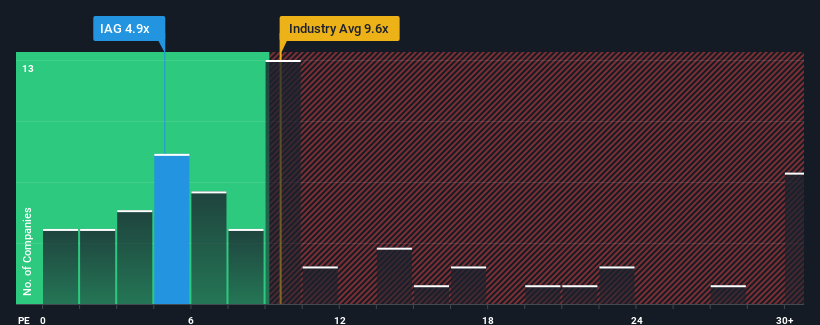

Although its price has dipped substantially, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 15x, you may still consider International Consolidated Airlines Group as a highly attractive investment with its 4.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent earnings growth for International Consolidated Airlines Group has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for International Consolidated Airlines Group

Is There Any Growth For International Consolidated Airlines Group?

There's an inherent assumption that a company should far underperform the market for P/E ratios like International Consolidated Airlines Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 3.5% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 11% per year over the next three years. That's shaping up to be materially lower than the 16% per annum growth forecast for the broader market.

With this information, we can see why International Consolidated Airlines Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From International Consolidated Airlines Group's P/E?

Having almost fallen off a cliff, International Consolidated Airlines Group's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of International Consolidated Airlines Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for International Consolidated Airlines Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IAG

International Consolidated Airlines Group

Engages in the provision of passenger and cargo transportation services in the North Atlantic, Latin America, the Caribbean, Europe, Africa, the Middle East, South Asia, the Asia Pacific, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.