- United Kingdom

- /

- Transportation

- /

- LSE:FGP

FirstGroup plc's (LON:FGP) Price Is Right But Growth Is Lacking After Shares Rocket 26%

FirstGroup plc (LON:FGP) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 8.8% isn't as attractive.

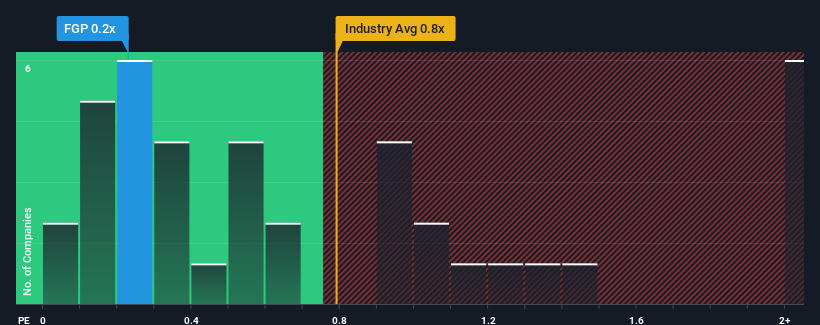

Even after such a large jump in price, when close to half the companies operating in the United Kingdom's Transportation industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider FirstGroup as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

We check all companies for important risks. See what we found for FirstGroup in our free report.See our latest analysis for FirstGroup

What Does FirstGroup's P/S Mean For Shareholders?

Recent times haven't been great for FirstGroup as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on FirstGroup.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, FirstGroup would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 10% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 7.2% during the coming year according to the five analysts following the company. Meanwhile, the broader industry is forecast to expand by 4.4%, which paints a poor picture.

With this information, we are not surprised that FirstGroup is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Despite FirstGroup's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that FirstGroup maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for FirstGroup with six simple checks.

If these risks are making you reconsider your opinion on FirstGroup, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FGP

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives