- United Kingdom

- /

- Capital Markets

- /

- LSE:IGG

Top UK Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the UK market navigates the challenges posed by weak global cues and faltering trade data from China, particularly impacting the FTSE 100 index, investors are closely observing how these economic factors influence their portfolios. In such uncertain times, dividend stocks can offer a degree of stability and income potential, making them an attractive consideration for those looking to balance growth with reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.43% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.92% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.92% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.20% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.59% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.30% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.18% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.22% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.52% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.21% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

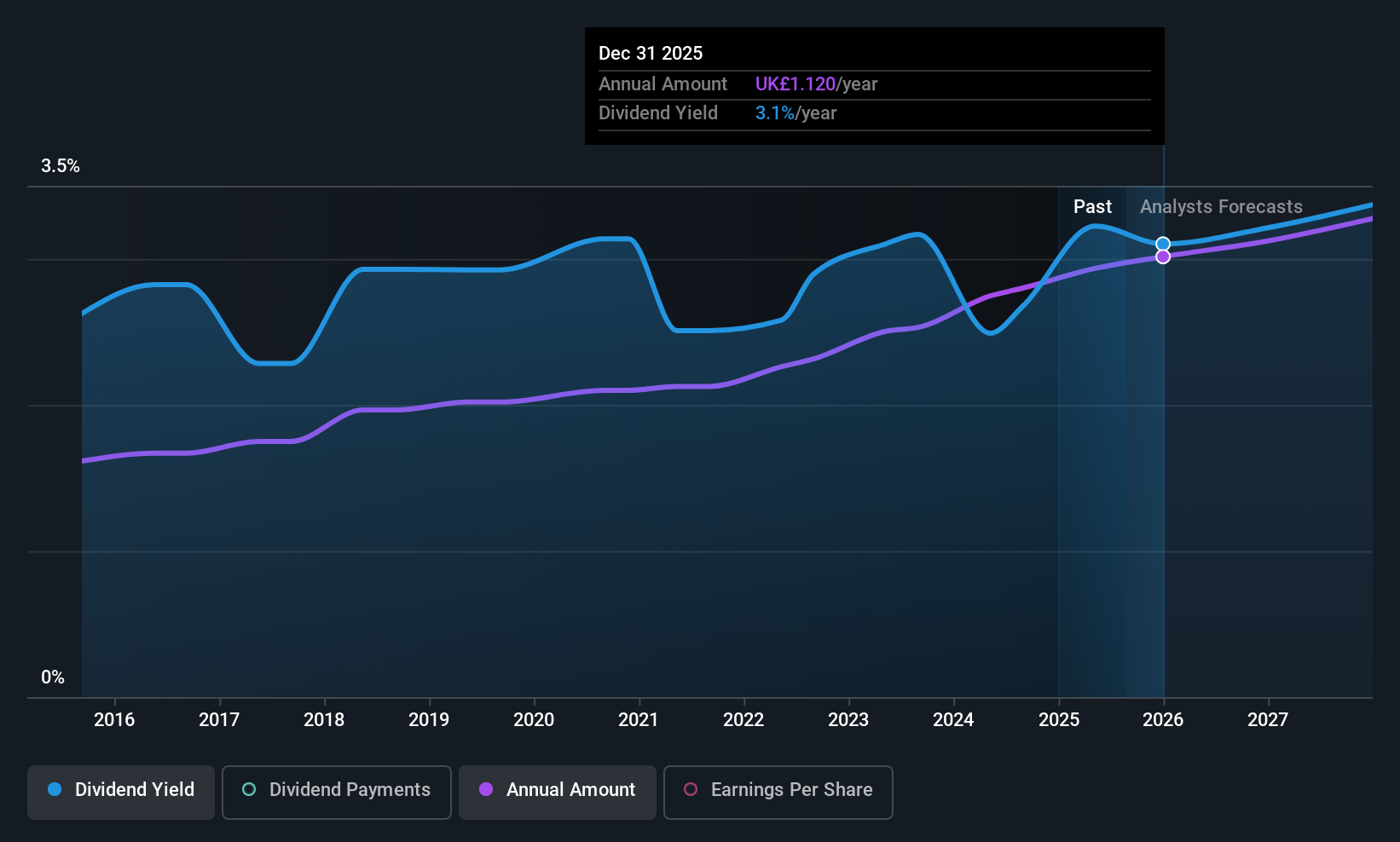

Clarkson (LSE:CKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clarkson PLC offers integrated shipping services across Europe, the Middle East, Africa, the Americas, Asia-Pacific, and globally with a market cap of £1.11 billion.

Operations: Clarkson PLC generates revenue from four main segments: Broking (£503.80 million), Support (£66.30 million), Research (£25.80 million), and Financial services (£53.20 million).

Dividend Yield: 3%

Clarkson's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 44.9% and 40.5%, respectively. However, the dividend yield of 3.04% is below the top UK payers' average of 5.39%. Despite a history of volatility in dividends over the past decade, recent increases show some growth potential. Recent executive changes include the announced retirement of CFO Jeff Woyda after over 18 years with Clarkson, which may impact future stability.

- Delve into the full analysis dividend report here for a deeper understanding of Clarkson.

- The analysis detailed in our Clarkson valuation report hints at an inflated share price compared to its estimated value.

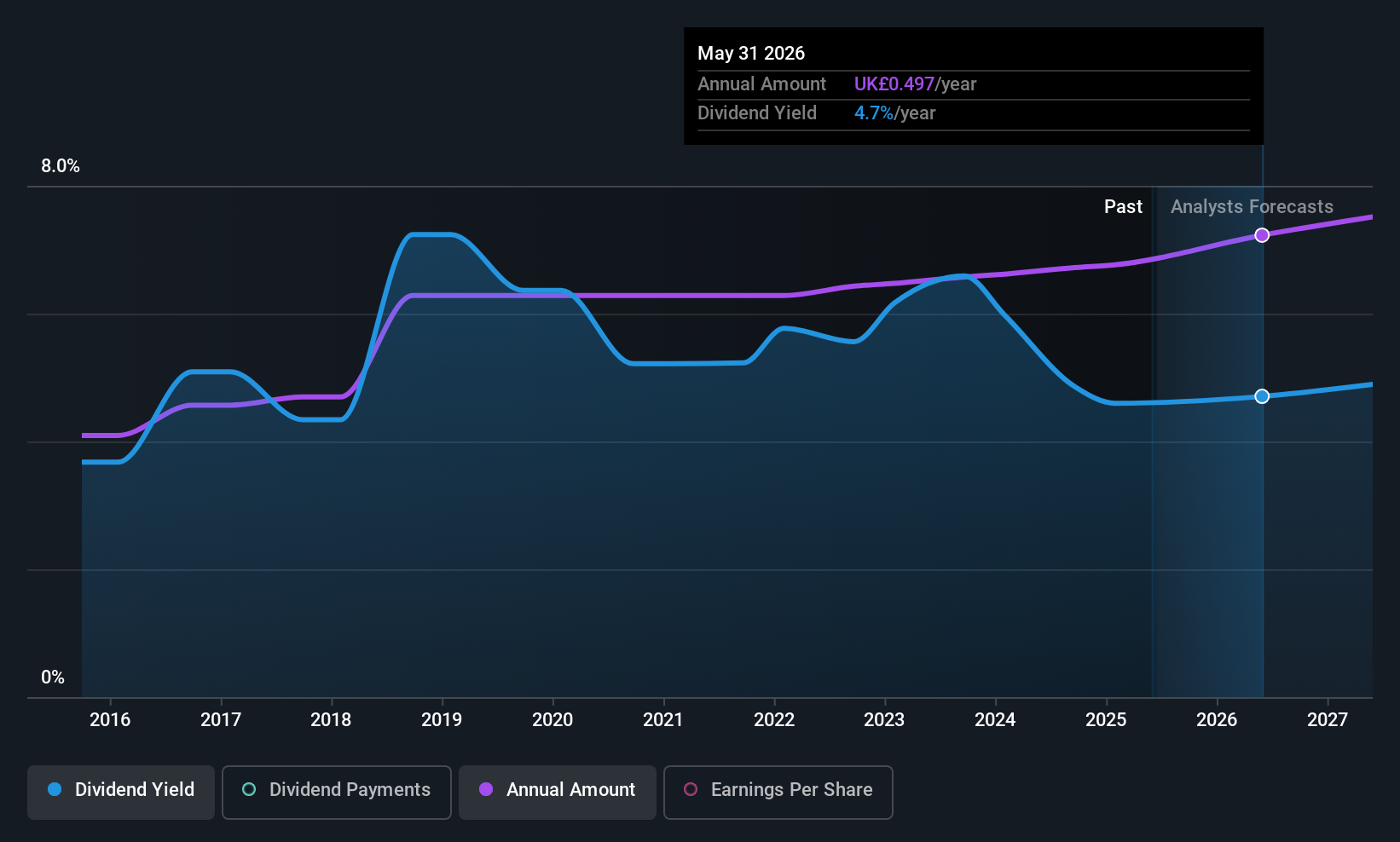

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company specializing in online trading across various regions including the UK, Ireland, Asia-Pacific, the Middle East, the US, Europe, and emerging markets with a market cap of £3.86 billion.

Operations: IG Group Holdings plc generates its revenue primarily from its brokerage segment, which amounts to £1.05 billion.

Dividend Yield: 4.2%

IG Group Holdings' dividend is well-supported by earnings and cash flows, with payout ratios of 44.4% and 33.5%, respectively, ensuring sustainability. The yield stands at 4.22%, below the UK's top-tier average of 5.39%, but dividends have been stable and growing over the past decade. Trading at a significant discount to its estimated fair value, IGG remains attractive for value investors despite forecasts of declining earnings growth. Recent leadership changes include Chairman Mike McTighe's planned departure by year-end 2025.

- Dive into the specifics of IG Group Holdings here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of IG Group Holdings shares in the market.

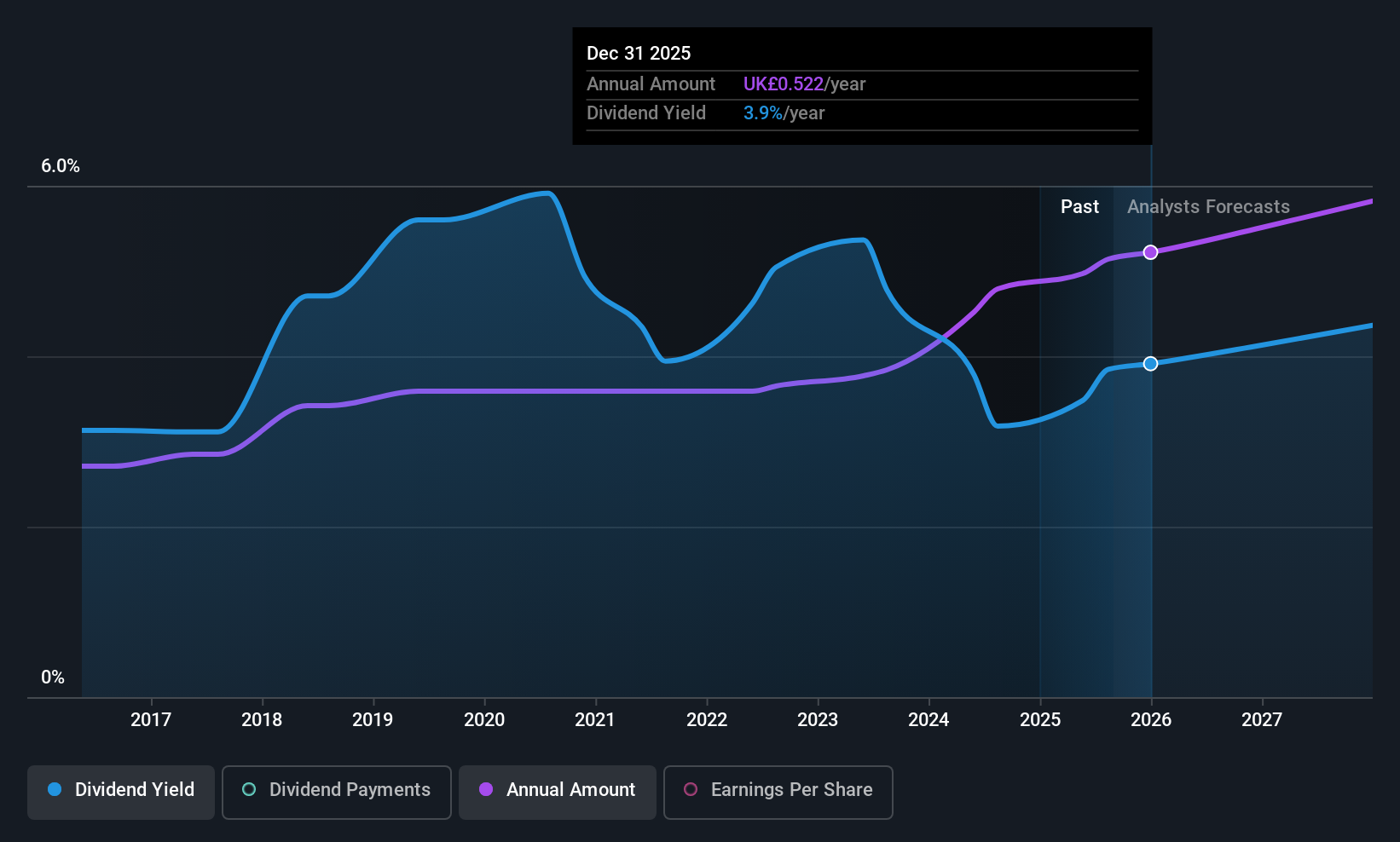

Keller Group (LSE:KLR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc offers specialist geotechnical services across North America, Europe, the Middle East, and the Asia-Pacific with a market cap of £1.13 billion.

Operations: Keller Group plc generates revenue of £2.95 billion from its specialist geotechnical services across various regions.

Dividend Yield: 3.2%

Keller Group's dividend payments have been reliable and stable over the past decade, supported by low payout ratios of 26.4% for earnings and 35.6% for cash flow, ensuring sustainability. Although its yield of 3.18% is below the UK's top-tier average, dividends have shown growth, including a recent increase to 18.3 pence per share. The company trades at a significant discount to its estimated fair value and recently completed a £25.2 million share buyback program while undergoing board changes with the termination of Director Michael James Speakman.

- Unlock comprehensive insights into our analysis of Keller Group stock in this dividend report.

- Our expertly prepared valuation report Keller Group implies its share price may be lower than expected.

Seize The Opportunity

- Reveal the 49 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IGG

IG Group Holdings

A fintech company, engages in the online trading business in the United Kingdom, Ireland, the Asia-Pacific, the Middle East, the United States, Europe, and institutional and emerging markets.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives