- United Kingdom

- /

- Marine and Shipping

- /

- LSE:CKN

It Might Not Be A Great Idea To Buy Clarkson PLC (LON:CKN) For Its Next Dividend

Clarkson PLC (LON:CKN) stock is about to trade ex-dividend in three days. Investors can purchase shares before the 13th of May in order to be eligible for this dividend, which will be paid on the 28th of May.

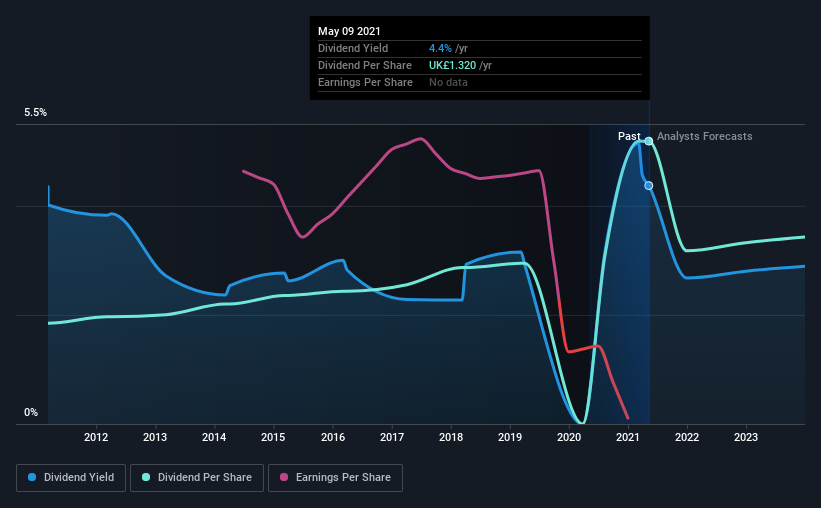

Clarkson's next dividend payment will be UK£0.54 per share, and in the last 12 months, the company paid a total of UK£1.32 per share. Looking at the last 12 months of distributions, Clarkson has a trailing yield of approximately 4.4% on its current stock price of £30.2. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Clarkson can afford its dividend, and if the dividend could grow.

View our latest analysis for Clarkson

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Clarkson lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If Clarkson didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Thankfully its dividend payments took up just 42% of the free cash flow it generated, which is a comfortable payout ratio.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Clarkson reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Clarkson has lifted its dividend by approximately 11% a year on average.

Remember, you can always get a snapshot of Clarkson's financial health, by checking our visualisation of its financial health, here.

The Bottom Line

From a dividend perspective, should investors buy or avoid Clarkson? We're a bit uncomfortable with it paying a dividend while being loss-making. However, we note that the dividend was covered by cash flow. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

With that in mind though, if the poor dividend characteristics of Clarkson don't faze you, it's worth being mindful of the risks involved with this business. For example - Clarkson has 1 warning sign we think you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Clarkson, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CKN

Clarkson

Provides integrated shipping services in Europe, Middle East, Africa, Americas, and Asia-Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion