- United Kingdom

- /

- Entertainment

- /

- AIM:ADF

Facilities by ADF (LON:ADF) shareholders are up 14% this past week, but still in the red over the last year

Facilities by ADF plc (LON:ADF) shareholders should be happy to see the share price up 14% in the last week. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 13% in the last year, significantly under-performing the market.

The recent uptick of 14% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Facilities by ADF

Given that Facilities by ADF only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last twelve months, Facilities by ADF increased its revenue by 62%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 13% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

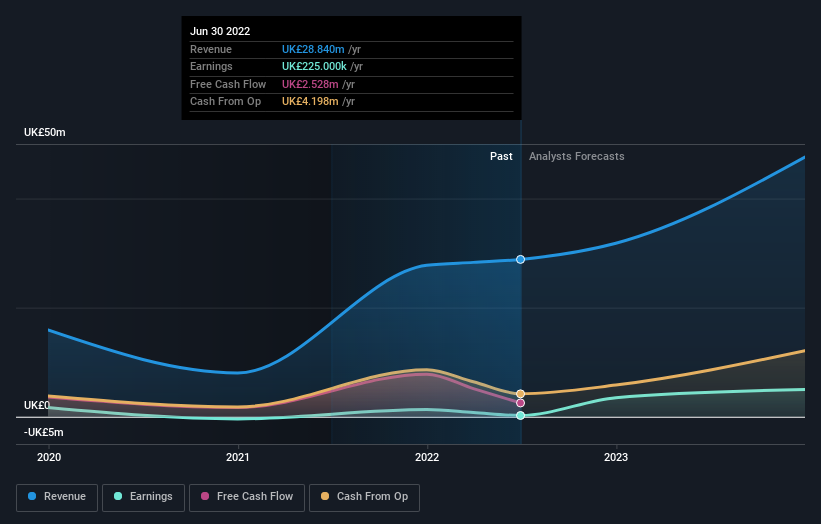

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Facilities by ADF has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Facilities by ADF in this interactive graph of future profit estimates.

A Different Perspective

We doubt Facilities by ADF shareholders are happy with the loss of 12% over twelve months (even including dividends). That falls short of the market, which lost 2.9%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 0.8%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 5 warning signs we've spotted with Facilities by ADF .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ADF

Facilities by ADF

Provides premium serviced production facilities, location, and equipment hire to the film and high-end television industry in the United Kingdom and Europe.

Good value with adequate balance sheet.

Market Insights

Community Narratives