Helios Towers (LON:HTWS) Shareholders Booked A 14% Gain In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Helios Towers plc (LON:HTWS) share price is 14% higher than it was a year ago, much better than the market decline of around 11% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Helios Towers

Given that Helios Towers didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Helios Towers saw its revenue grow by 8.8%. That's not great considering the company is losing money. In keeping with the revenue growth, the share price gained 14% in that time. That's not a standout result, but it is solid - much like the level of revenue growth. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

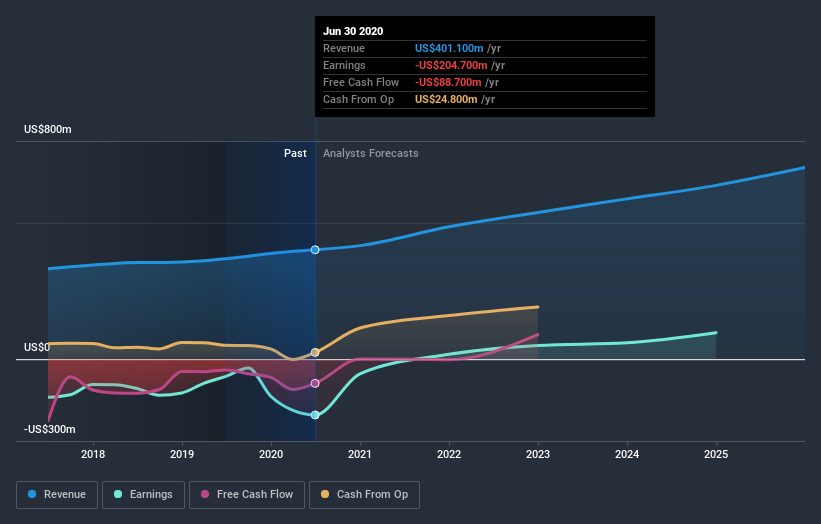

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Helios Towers boasts a total shareholder return of 14% for the last year. We regret to report that the share price is down 5.5% over ninety days. Shorter term share price moves often don't signify much about the business itself. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Helios Towers may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Helios Towers, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Helios Towers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:HTWS

Helios Towers

An independent tower company, acquires, builds, and operates telecommunications towers and passive infrastructure.

High growth potential with acceptable track record.